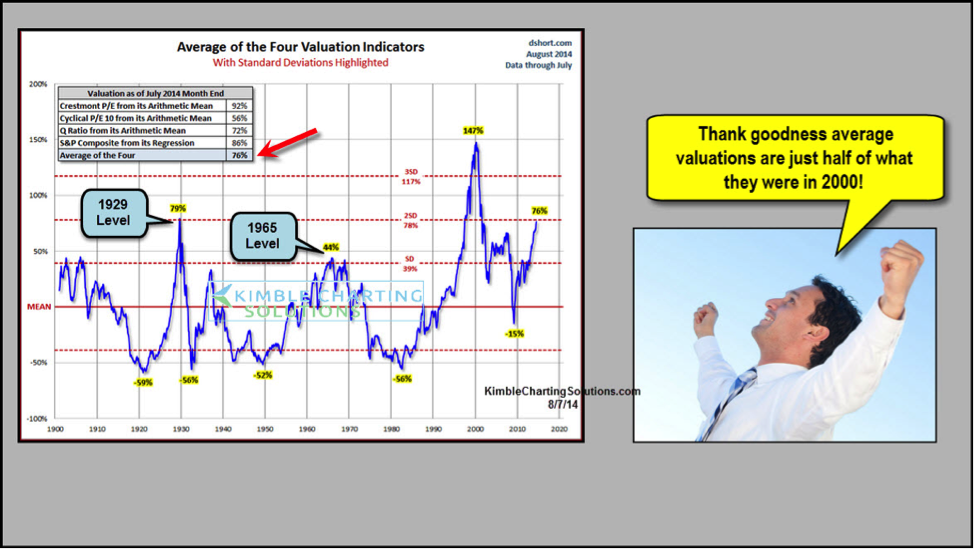

Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Key Arguments for a Moderate Valuation

BofA's reassuring outlook rests on several key pillars supporting current stock market valuations. Their analysis provides a more nuanced perspective than simply looking at headline P/E ratios.

Emphasis on Earnings Growth

BofA highlights the potential for robust corporate earnings growth as a primary factor justifying current valuations. This isn't just blind optimism; their analysis is grounded in specific sectors and trends.

- Focus on high-growth sectors: BofA points to sectors like technology and healthcare as poised for significant earnings expansion. These sectors are driving innovation and benefiting from long-term demographic trends. The potential for disruptive technologies and advancements in healthcare continues to fuel significant growth opportunities.

- Profit margin analysis: Their assessment includes a detailed analysis of profit margins and their potential impact on valuations. Even with inflationary pressures, many companies are demonstrating resilience in maintaining or improving their profit margins through operational efficiency and pricing power.

- Innovation as a driver: The role of innovation and technological advancements in driving future earnings is a significant part of BofA's argument. Companies that successfully adapt and innovate are expected to outperform, leading to overall market growth.

Considering Interest Rate Impacts

The analysis acknowledges the impact of rising interest rates on stock valuations, a crucial element of any market assessment. However, BofA argues that current valuations already reflect much of this anticipated increase.

- Historical context: BofA's analysis compares current interest rates to historical levels, providing perspective on the current environment. While rates are rising, they are still relatively low compared to past periods of economic expansion.

- Discount rate implications: The relationship between interest rates and discount rates used in valuation models is central to their argument. While higher interest rates increase the discount rate, making future earnings less valuable, BofA contends the market has already adjusted to a large extent.

- Impact on different asset classes: The impact of rising rates is assessed across different asset classes. While bonds might be more sensitive, BofA suggests equities, particularly those with strong earnings growth prospects, are better positioned to weather the storm.

Long-Term Perspective

BofA strongly advocates for a long-term investment perspective. They emphasize that short-term market fluctuations should not dictate long-term investment decisions. This is a key element of their investor outlook.

- Diversification is key: Maintaining a well-diversified investment portfolio is crucial to mitigating risk and weathering market volatility. This is vital for long-term success.

- Dollar-cost averaging: BofA recommends dollar-cost averaging as a risk-mitigation strategy. This involves investing a fixed amount regularly, regardless of market fluctuations, helping to reduce the impact of short-term volatility.

- Navigating market volatility: The report outlines strategies for navigating market volatility, emphasizing the importance of patience and disciplined investing. Avoiding panic selling and sticking to a long-term plan is crucial.

Counterarguments and Potential Risks

While BofA's outlook is generally reassuring, it's crucial to acknowledge potential counterarguments and risks. No market assessment is without its limitations.

Inflationary Pressures

Persistent inflationary pressures remain a significant threat to stock market valuations. While BofA acknowledges this, their analysis suggests the market has partially priced in expected inflation.

- Potential for higher-than-expected inflation: The risk of inflation exceeding expectations remains. Unforeseen supply chain disruptions or further geopolitical instability could exacerbate this risk.

- Impact on corporate profits and consumer spending: High inflation erodes consumer purchasing power and can squeeze corporate profit margins, potentially impacting future earnings growth.

- Inflation risk mitigation: The report suggests strategies for mitigating inflation risk in an investment portfolio, such as investing in inflation-protected securities or companies with pricing power.

Geopolitical Uncertainty

Global geopolitical instability is another significant risk factor impacting stock market valuations. Unpredictable events can dramatically shift market sentiment.

- Geopolitical events and market sentiment: The report provides examples of geopolitical events that can influence market sentiment, highlighting the need for careful monitoring of global events.

- Managing geopolitical risk: Strategies for managing geopolitical risk in investment strategies are discussed, including diversification across geographies and sectors.

- Geographic diversification: Diversification across geographies is crucial for reducing the impact of localized geopolitical events.

Practical Implications for Investors

BofA's assessment provides valuable insights that can inform your investment strategies. However, remember to conduct your own due diligence.

Adjusting Investment Strategies

Based on BofA's assessment, investors should consider adjusting their portfolios to reflect the current market conditions and opportunities.

- Portfolio rebalancing: Rebalancing portfolios to reflect the relative valuations of different asset classes, based on BofA's analysis, can be a prudent step.

- Identifying undervalued sectors: Investors can identify potentially undervalued sectors based on BofA's analysis and consider increasing their allocation to these areas.

- Considering alternative investment options: Diversification into alternative investment options can further enhance portfolio resilience.

The Importance of Due Diligence

Despite BofA's reassuring outlook, it's imperative that investors conduct thorough due diligence before making any investment decisions.

- Understanding company fundamentals: Investors should focus on understanding the fundamentals of individual companies before investing.

- Seeking professional advice: Consulting with a financial advisor for personalized guidance tailored to your risk tolerance and financial goals is highly recommended.

- Staying informed: Staying informed about market trends and news is essential for making sound investment decisions.

Conclusion

BofA's analysis provides a reassuring perspective on current stock market valuations, suggesting that despite existing challenges like inflation and geopolitical uncertainty, the market isn't excessively overvalued. Their emphasis on potential earnings growth and a long-term outlook offers a degree of comfort. However, thorough due diligence and a well-diversified strategy remain crucial. Don't hesitate to adjust your approach based on your risk tolerance and financial goals. Understanding current stock market valuations is key to successful investing, so stay informed and make informed decisions about your investment portfolio. Continue researching stock market valuations to optimize your investment strategy.

Featured Posts

-

China Diversifies Lpg Supply From Us To Middle East

Apr 24, 2025

China Diversifies Lpg Supply From Us To Middle East

Apr 24, 2025 -

Significant Drop In Teslas Q1 Profit The Musk Administration Backlash

Apr 24, 2025

Significant Drop In Teslas Q1 Profit The Musk Administration Backlash

Apr 24, 2025 -

Open Ai To Acquire Google Chrome Chat Gpt Ceos Surprise Statement

Apr 24, 2025

Open Ai To Acquire Google Chrome Chat Gpt Ceos Surprise Statement

Apr 24, 2025 -

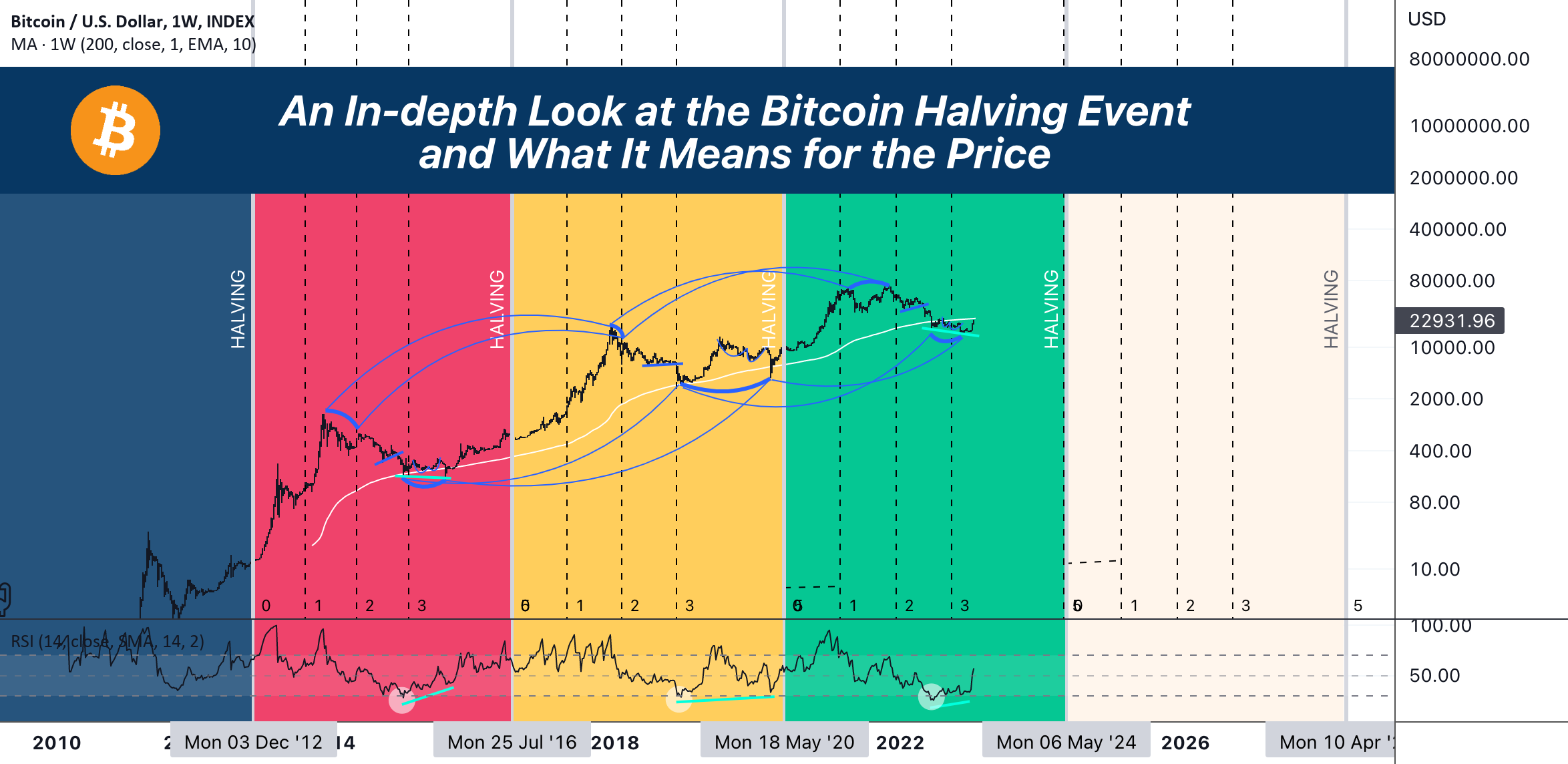

Recent Bitcoin Btc Gains A Look At Trade And Monetary Policy Factors

Apr 24, 2025

Recent Bitcoin Btc Gains A Look At Trade And Monetary Policy Factors

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025

Latest Posts

-

Dogecoins Price Volatility The Impact Of Elon Musk And Tesla Stock Fluctuations

May 10, 2025

Dogecoins Price Volatility The Impact Of Elon Musk And Tesla Stock Fluctuations

May 10, 2025 -

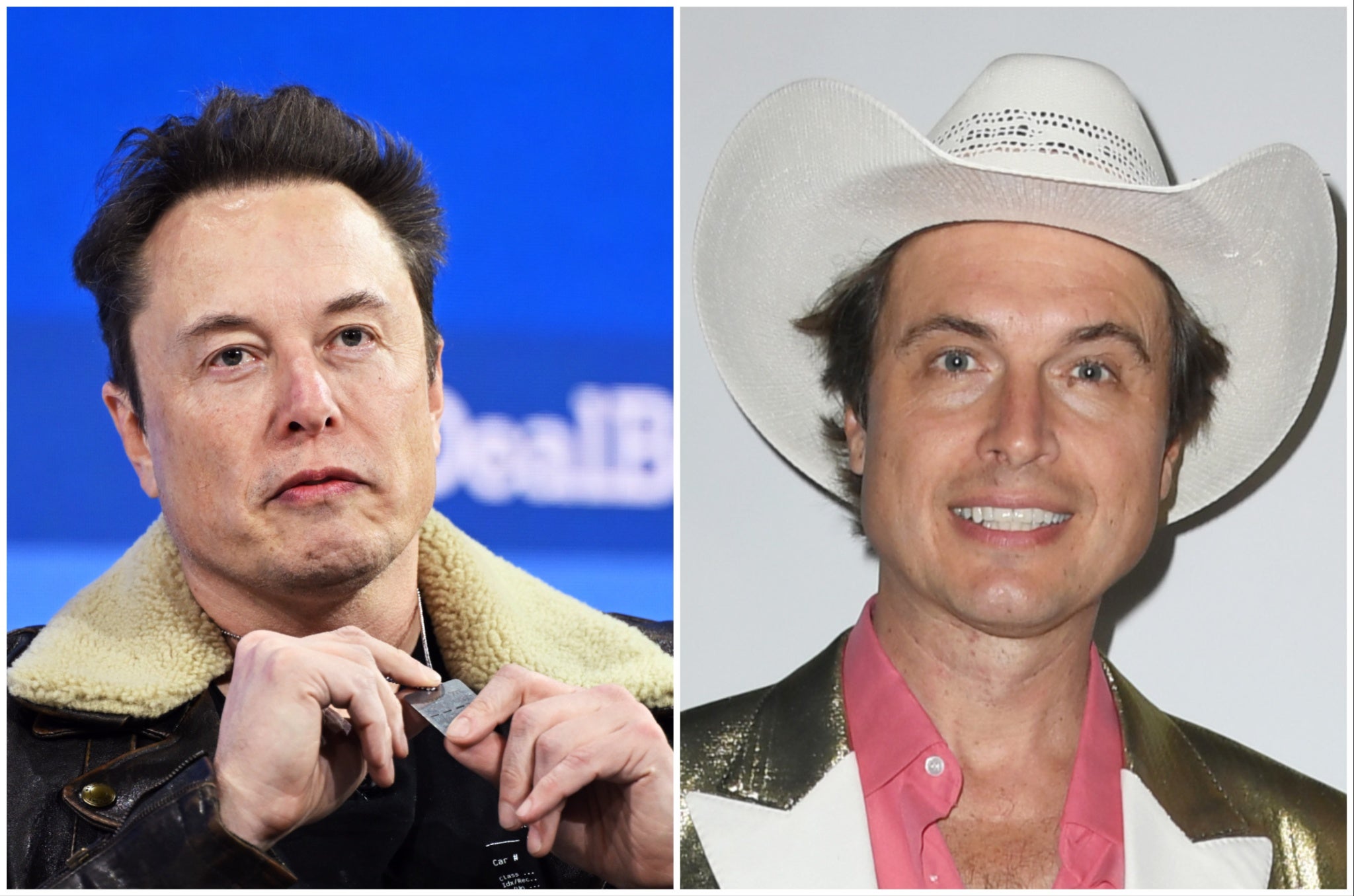

Elon Musks Brother Kimbal Musk A Profile

May 10, 2025

Elon Musks Brother Kimbal Musk A Profile

May 10, 2025 -

Elon Musk And Dogecoin A Look At Teslas Stock Performance And Doges Price

May 10, 2025

Elon Musk And Dogecoin A Look At Teslas Stock Performance And Doges Price

May 10, 2025 -

Kimbal Musk Exploring The Life And Work Of Elon Musks Brother

May 10, 2025

Kimbal Musk Exploring The Life And Work Of Elon Musks Brother

May 10, 2025 -

The Implications Of Pam Bondis Comments On The Deaths Of American Citizens

May 10, 2025

The Implications Of Pam Bondis Comments On The Deaths Of American Citizens

May 10, 2025