Cantor Fitzgerald In Talks For $3 Billion Crypto SPAC With Tether And SoftBank

Table of Contents

The Potential of a Cantor Fitzgerald-Led Crypto SPAC

Cantor Fitzgerald's Role

Cantor Fitzgerald, a veteran player in the financial markets with extensive experience in mergers and acquisitions (M&A), is uniquely positioned to lead a major crypto SPAC. Their established reputation and strong network of investors are crucial elements in attracting substantial capital and legitimizing crypto projects for mainstream investors.

- Expertise in mergers and acquisitions: Cantor Fitzgerald possesses a deep understanding of complex financial transactions, crucial for navigating the intricacies of a crypto SPAC.

- Established reputation: Their long-standing presence and credibility in the financial world lend significant weight and trust to this ambitious venture.

- Strong network of investors: Access to a vast network of high-net-worth individuals and institutional investors is essential for securing the funding necessary for a $3 billion SPAC.

Their established reputation can significantly reduce the risk perception associated with crypto investments, attracting institutional investors who might otherwise be hesitant. This influx of capital could provide a much-needed boost to the cryptocurrency sector.

Attracting Crypto Projects

The combined power of Cantor Fitzgerald, Tether, and SoftBank creates a compelling proposition for high-quality crypto projects seeking funding and strategic partnerships. This consortium brings together financial expertise, substantial capital, and industry influence.

- Access to substantial capital: A $3 billion SPAC offers unprecedented access to funding for promising crypto projects.

- Credibility boost: Association with established financial institutions like Cantor Fitzgerald and SoftBank immediately enhances the credibility of participating crypto projects.

- Potential for strategic partnerships: The network and expertise offered by the partners could open doors to valuable collaborations and strategic alliances.

This combination of financial resources and industry clout could attract projects that would otherwise be hesitant to enter the SPAC market, leading to a higher quality pool of investable companies.

Market Impact

This potential deal could significantly impact both the cryptocurrency market and the broader financial landscape. The influx of institutional capital could usher in a new era of maturity and stability for the crypto sector.

- Increased institutional investment in crypto: The deal could signal a major shift towards wider institutional acceptance and investment in cryptocurrencies.

- Potential for new regulatory frameworks: The increased involvement of established financial players might accelerate the development of clearer and more comprehensive regulatory frameworks for the crypto market.

- Increased market capitalization: The successful launch and investment activity of this SPAC could dramatically increase the overall market capitalization of the cryptocurrency market.

The deal might significantly influence investor sentiment, potentially leading to a more positive outlook and further institutional adoption of cryptocurrencies, thus driving market growth.

The Involvement of Tether and SoftBank

Tether's Strategic Position

Tether's participation is a double-edged sword. While its USDT stablecoin boasts a massive market capitalization, its controversial history regarding reserve transparency introduces significant risks.

- Massive market capitalization of USDT: Tether's involvement brings significant market influence and potential for liquidity.

- Controversies surrounding its reserves: Concerns about the backing and transparency of Tether's reserves could negatively impact investor confidence.

- Potential for conflict of interest: The close relationship between Tether and the SPAC might raise concerns about potential conflicts of interest.

The potential benefits of Tether's involvement must be carefully weighed against the associated reputational and regulatory risks.

SoftBank's Investment Strategy

SoftBank's involvement reflects their well-known appetite for large-scale investments in disruptive technologies. Their participation brings substantial financial backing and strategic guidance.

- History of large-scale tech investments: SoftBank has a track record of investing in high-growth tech companies, including many in the fintech space.

- Focus on disruptive technologies: Cryptocurrency fits squarely within SoftBank's investment strategy focused on innovative and transformative technologies.

- Potential for high returns: The potential for high returns from a successful crypto SPAC is a significant incentive for SoftBank's involvement.

SoftBank's expertise in navigating complex tech investments and their considerable financial resources could be pivotal in the success of this ambitious venture.

Risks and Challenges of the Deal

Regulatory Uncertainty

The cryptocurrency market faces significant regulatory uncertainty, posing a substantial challenge to the proposed SPAC.

- Varying regulatory landscapes across different jurisdictions: Navigating the diverse and often inconsistent regulatory landscapes globally is a major hurdle.

- Potential for increased scrutiny: The scale of this deal could attract heightened scrutiny from regulators, potentially leading to delays or complications.

- Legal complexities: The legal framework surrounding cryptocurrencies is still evolving, creating numerous potential legal complexities.

Understanding and proactively addressing potential regulatory challenges will be crucial to the success of the SPAC.

Market Volatility

The inherent volatility of the cryptocurrency market is a significant risk factor for the SPAC’s performance.

- Price fluctuations: Cryptocurrency prices are notoriously volatile, posing significant risks to investment returns.

- Market downturns: A downturn in the cryptocurrency market could severely impact the value of investments held by the SPAC.

- Potential for significant losses: The high volatility of the market makes significant losses a very real possibility.

Implementing effective risk management strategies to mitigate the impact of market volatility is paramount.

Conclusion

The potential $3 billion crypto SPAC spearheaded by Cantor Fitzgerald, in collaboration with Tether and SoftBank, represents a significant development at the intersection of traditional finance and the cryptocurrency market. While significant risks and challenges remain, the deal's potential to accelerate institutional adoption of cryptocurrencies and unlock new investment opportunities is undeniable. This partnership could fundamentally reshape the landscape for cryptocurrency startups seeking funding and market access. To stay updated on the latest developments in this groundbreaking deal and other significant events shaping the crypto space, continue to follow news related to Cantor Fitzgerald and crypto SPAC ventures.

Featured Posts

-

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025 -

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

Extreme V Mware Price Hike At And T Highlights 1 050 Increase Proposed By Broadcom

Apr 24, 2025

Extreme V Mware Price Hike At And T Highlights 1 050 Increase Proposed By Broadcom

Apr 24, 2025 -

65 Hudsons Bay Properties Generate High Leasing Interest

Apr 24, 2025

65 Hudsons Bay Properties Generate High Leasing Interest

Apr 24, 2025 -

V Mware Costs To Skyrocket At And T Details A 1 050 Price Hike From Broadcom

Apr 24, 2025

V Mware Costs To Skyrocket At And T Details A 1 050 Price Hike From Broadcom

Apr 24, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

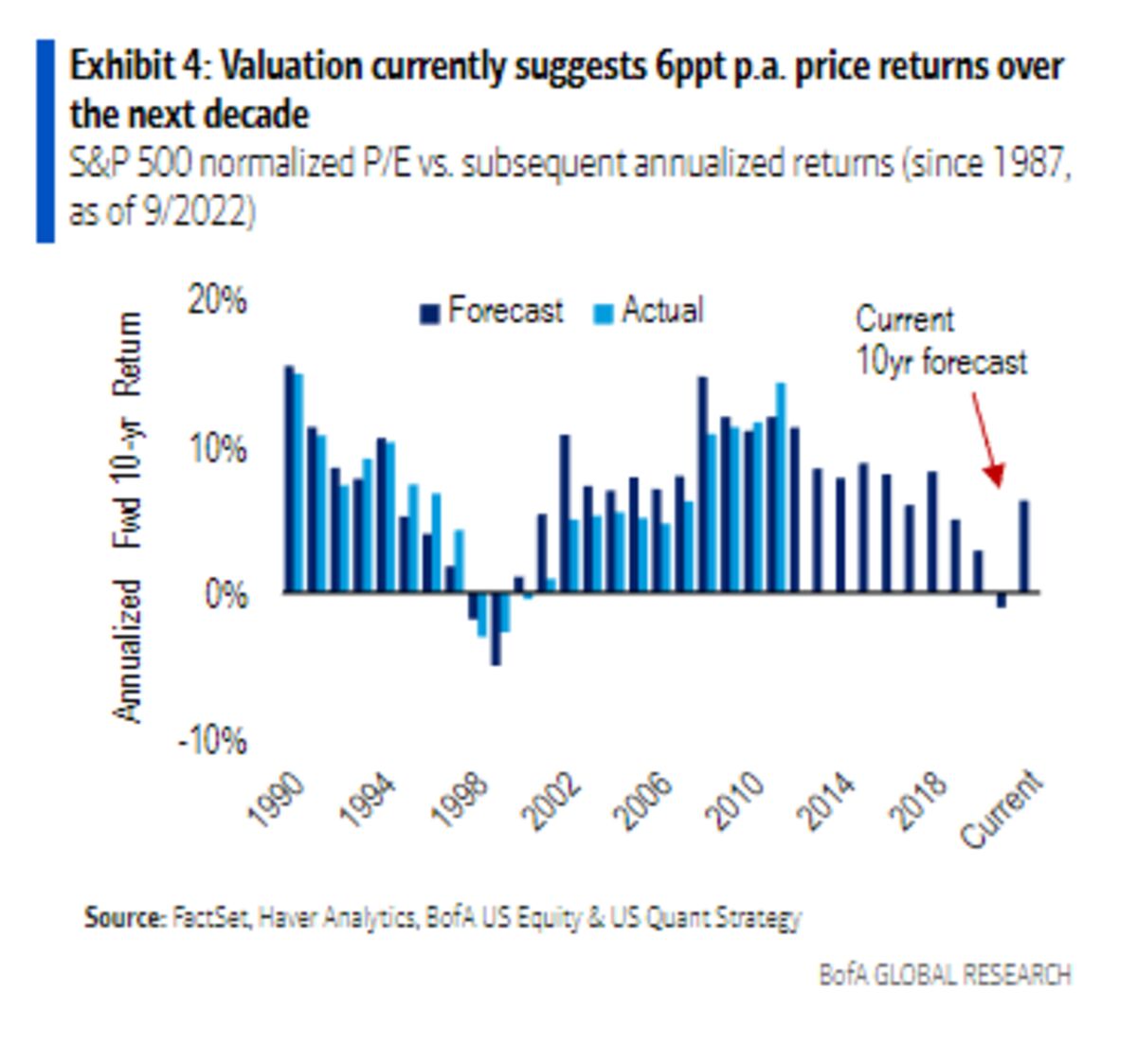

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025