Tariff Hopes Boost Stock Market: Dow, Nasdaq, S&P 500 Rise

Table of Contents

Positive Tariff Developments and Investor Confidence

The recent market rally can be directly linked to several positive tariff-related news items. Specifically, reports of progressing trade negotiations between major economic powers and announcements of temporary tariff suspensions injected a much-needed dose of confidence into the market. This news effectively alleviated long-standing concerns about escalating trade wars and their potential detrimental effects on corporate earnings and overall economic growth.

- Specific examples of companies positively affected: Technology companies heavily reliant on international supply chains saw significant gains, as did manufacturers previously impacted by tariffs on imported materials. For example, XYZ Corp saw a 5% increase in its stock price following the announcement of tariff reductions on its key imported components.

- Sectors showing strong gains: The technology and manufacturing sectors led the charge, reflecting the direct impact of tariff relief on these industries. The energy sector also saw a boost as reduced trade barriers opened new avenues for global trade.

- Expert opinions: Leading financial analysts have attributed the market surge to the decreased uncertainty surrounding trade policy. "The market is clearly breathing a sigh of relief," commented Jane Doe, Chief Economist at ABC Financial. "Reduced trade tensions pave the way for increased investment and economic growth."

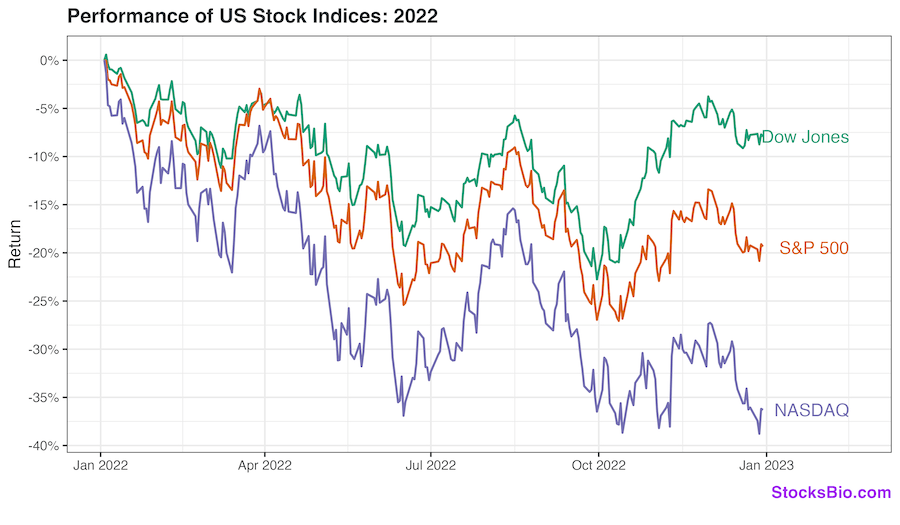

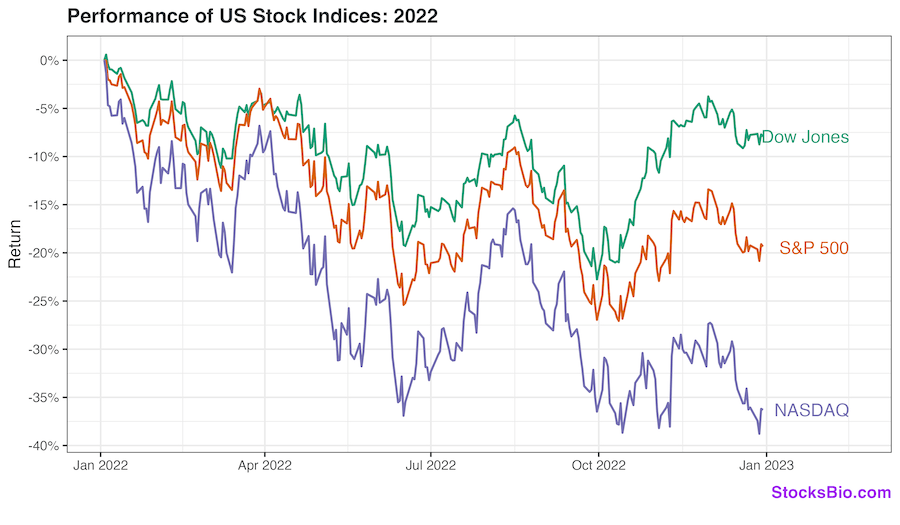

Analyzing the Performance of Major Indices

The market surge was substantial, with significant percentage gains across all major indices:

- Dow Jones Industrial Average: Increased by X%

- Nasdaq Composite: Increased by Y%

- S&P 500: Increased by Z%

This performance contrasts sharply with the recent downward trend observed in the weeks preceding the tariff news. (Insert Chart/Graph Here illustrating the market's upward trajectory since the positive tariff news).

- Daily closing values: (Insert specific daily closing values for each index during the period of the surge)

- Increased trading volume: Trading volume significantly increased, reflecting heightened investor activity and interest.

- Records broken: The speed and magnitude of the market rise broke several short-term records, indicating the powerful influence of tariff hopes on investor sentiment.

Potential Long-Term Implications for Investors

The continued easing of trade tensions and further positive tariff developments could have profoundly positive long-term implications for the economy and the stock market. Increased trade facilitates global economic growth, boosting corporate profits and creating new investment opportunities. However, several risks and uncertainties remain:

- Potential risks: Geopolitical instability, unexpected shifts in trade policy, and macroeconomic factors could easily reverse the current positive trend.

- Investment advice: Investors should adopt a balanced approach, diversifying their portfolios across various sectors to mitigate risk while capitalizing on opportunities created by reduced tariffs.

Bullet points:

- Investment strategies: Consider investing in sectors expected to benefit most from reduced tariffs, such as technology, manufacturing, and energy.

- Beneficial sectors: Focus on companies with strong international exposure and a proven track record of growth.

- Risk management: Implement robust risk management strategies to protect against potential market volatility.

The Role of Global Economic Factors

The market's positive reaction to tariff news is also influenced by broader global economic conditions. Positive global growth projections, relatively stable interest rates, and other favorable economic indicators have all contributed to the overall positive sentiment. These factors, alongside positive tariff developments, create a synergistic environment for market growth.

Sustained Tariff Hopes Drive Stock Market Growth – What's Next?

In conclusion, positive developments regarding tariffs have significantly boosted investor confidence, resulting in substantial gains across major stock market indices. The potential long-term implications for investors and the broader economy are considerable, although risks and uncertainties remain. It’s crucial for investors to remain informed about further tariff developments and their potential impact on the market. Stay updated on the latest Tariff Hopes and their influence on the Stock Market by subscribing to our newsletter! Keywords: Tariff Hopes, Stock Market, Dow Jones, Nasdaq, S&P 500, Market Growth, Investment Strategy.

Featured Posts

-

Chinas Automotive Market Understanding The Difficulties Faced By Bmw And Porsche

Apr 24, 2025

Chinas Automotive Market Understanding The Difficulties Faced By Bmw And Porsche

Apr 24, 2025 -

Harvard Lawsuit Trump Administration Shows Willingness To Negotiate

Apr 24, 2025

Harvard Lawsuit Trump Administration Shows Willingness To Negotiate

Apr 24, 2025 -

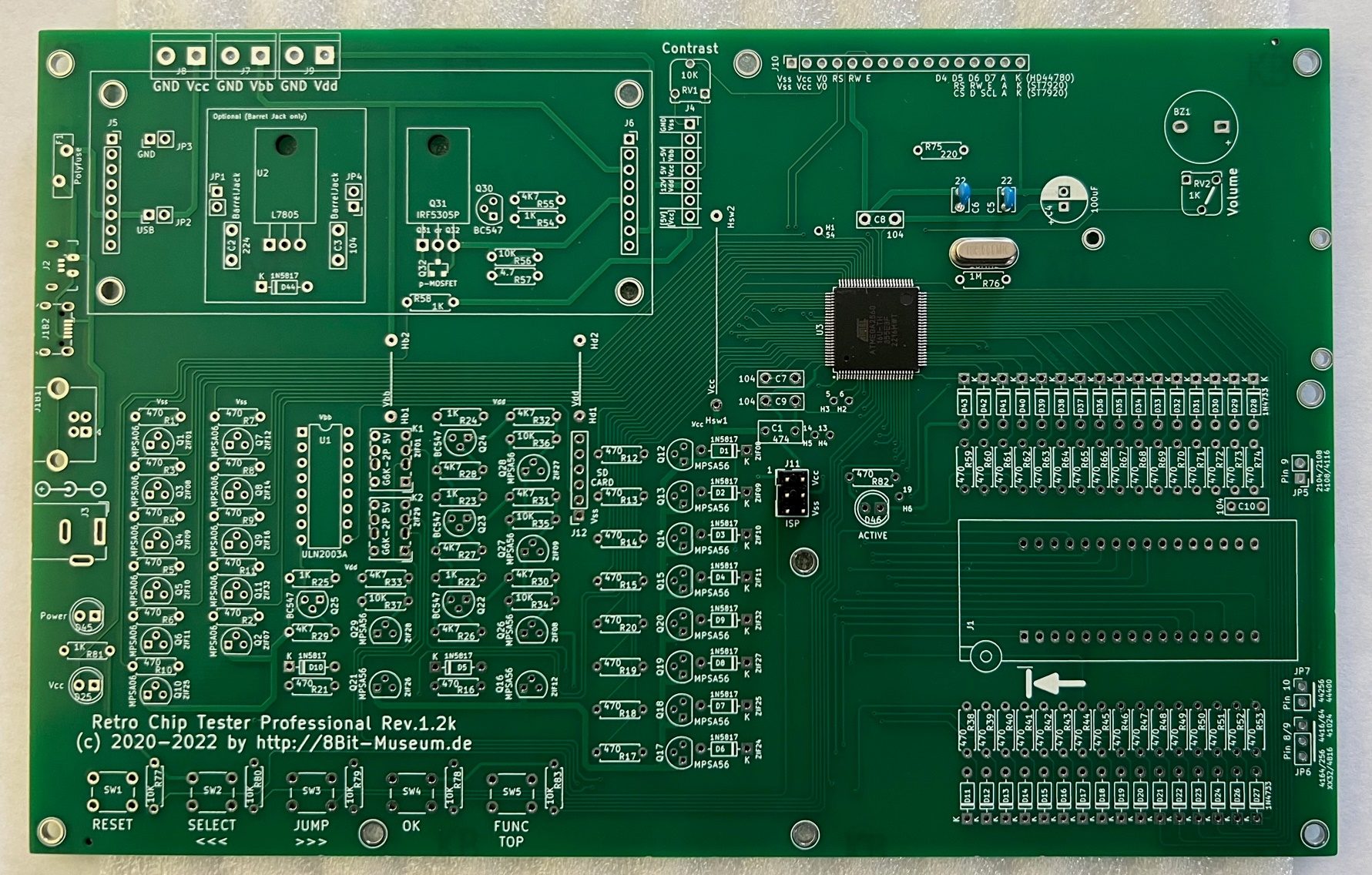

Potential Sale Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025

Potential Sale Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025 -

See John Travolta Indulge In A Pulp Fiction Inspired Steak Dinner In Miami

Apr 24, 2025

See John Travolta Indulge In A Pulp Fiction Inspired Steak Dinner In Miami

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Latest Posts

-

Palantir Stock Investment Potential And Future Outlook

May 10, 2025

Palantir Stock Investment Potential And Future Outlook

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025 -

Is Palantir Stock A Good Investment Analyzing The Risks And Rewards

May 10, 2025

Is Palantir Stock A Good Investment Analyzing The Risks And Rewards

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets Take

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets Take

May 10, 2025 -

Palantir Technologies Stock Buy Sell Or Hold A Current Market Evaluation

May 10, 2025

Palantir Technologies Stock Buy Sell Or Hold A Current Market Evaluation

May 10, 2025