Tesla Board Grilled By State Treasurers On Musk's Shifting Priorities

Table of Contents

Concerns Regarding Musk's Diversification and Focus

Keywords: Elon Musk, Twitter, SpaceX, Diversification, Management Focus, Tesla Stock Performance, Shareholder Value

State treasurers voiced significant concerns over Elon Musk's substantial time commitment to Twitter and its potential detriment to Tesla. This raises critical questions about his ability to effectively lead Tesla while simultaneously managing other large enterprises like SpaceX.

- Diversion of Focus: Treasurers expressed worry that Musk's involvement in Twitter significantly diverts his attention from Tesla's core business, potentially hindering innovation and strategic decision-making.

- Conflicts of Interest: Questions were raised about potential conflicts of interest arising from Musk's leadership roles across Tesla, SpaceX, and Twitter, particularly concerning resource allocation and the use of Tesla’s intellectual property or resources for other ventures.

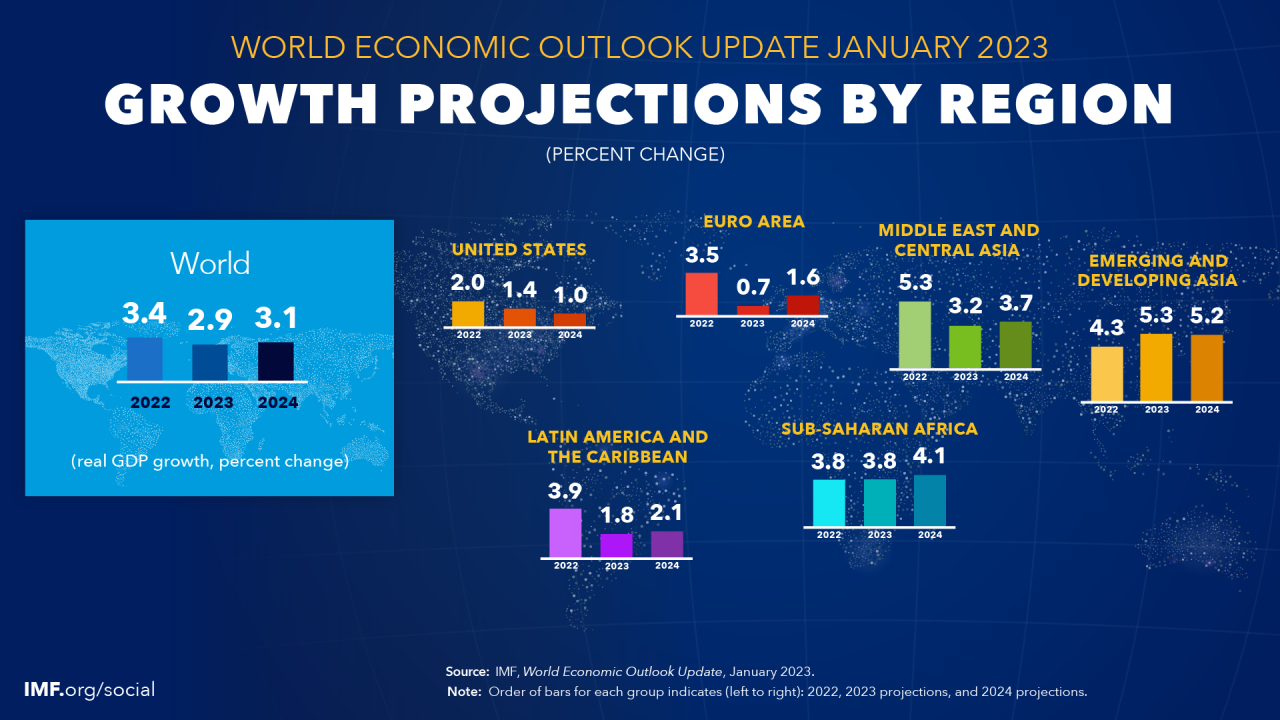

- Impact on Tesla's Growth: The treasurers questioned whether Musk's focus on other ventures negatively impacts Tesla's growth strategies, its ability to compete effectively in the rapidly expanding electric vehicle market, and the development of new technologies.

- Stock Performance Analysis: Tesla's stock performance has been closely scrutinized in light of Musk's shifting priorities. Some analysts suggest a correlation between Musk's increased involvement in Twitter and periods of market volatility for Tesla shares. The impact on shareholder value remains a central concern.

The treasurers' concerns center on the perceived dilution of Musk's attention to Tesla's core business, jeopardizing its competitive edge. They questioned whether his involvement in other high-profile companies is detrimental to Tesla's long-term sustainability and shareholder returns, impacting the overall value of Tesla stock.

ESG (Environmental, Social, and Governance) Concerns

Keywords: ESG Investing, Sustainability, Corporate Governance, Tesla ESG Score, Environmental Responsibility, Social Impact

Beyond financial performance, the state treasurers highlighted significant concerns regarding Tesla's ESG profile. Musk's often controversial public statements and actions have raised questions about the company's commitment to environmental sustainability and responsible corporate governance.

- Impact on ESG Ratings: Musk's actions have undoubtedly impacted Tesla's ESG ratings and investor perception. A lower ESG score can deter investors prioritizing environmental and social responsibility.

- Scrutiny of Sustainability Practices: The treasurers scrutinized Tesla's environmental initiatives and sustainability practices under Musk's leadership. Questions were raised about the transparency and effectiveness of these initiatives.

- Investment Appeal: A lower ESG score can significantly affect Tesla's investment appeal, especially among ESG-focused investors who represent a growing segment of the market. This could lead to decreased investment and a lower valuation of Tesla stock.

- Corporate Governance Implications: The situation highlights concerns about the effectiveness of Tesla's corporate governance structures and their ability to hold Musk accountable for his actions and their impact on the company's reputation and long-term sustainability.

This aspect of the criticism goes beyond the purely financial; it challenges Tesla's standing as a leader in sustainable technology and responsible business practices, impacting its brand image and market attractiveness.

The Board's Response and Future Implications

Keywords: Tesla Board of Directors, Corporate Accountability, Investor Relations, Future of Tesla, Strategic Direction

The Tesla board's response to the state treasurers' concerns is crucial for restoring investor confidence. Their ability to address these issues and maintain a clear strategic direction will be instrumental in determining Tesla's future trajectory.

- Board's Response: The board's official response and the measures they are taking to address the concerns are yet to be fully determined, but their actions will be closely scrutinized by investors and the public.

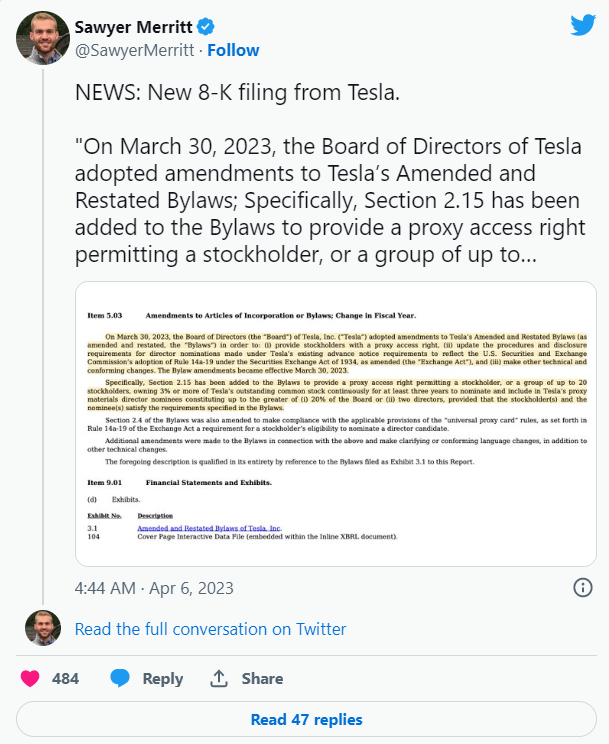

- Accountability Mechanisms: The board's ability to hold Musk accountable for his actions and their impact on Tesla's performance and reputation is critical for maintaining investor trust. The effectiveness of corporate governance will be under intense scrutiny.

- Strategic Direction Changes: Potential changes in Tesla's strategy or leadership structure might be necessary to address the concerns raised. This could involve restructuring the management team or clarifying leadership responsibilities.

- Long-Term Implications: The long-term implications will depend on the board's response, the market's reaction, and Tesla's ability to maintain its competitive edge in the increasingly crowded electric vehicle market.

The board's ability to effectively manage this crisis, ensure strong corporate governance, and maintain a compelling vision for Tesla's future will be pivotal for its continued success.

Conclusion

The grilling of the Tesla board by state treasurers underscores growing unease about Elon Musk's influence and its potential negative impact on the company's future. Concerns about his shifting priorities, their effect on Tesla's stock performance, and the company's ESG profile necessitate a strong and decisive response from the board. The outcome of this situation will likely shape Tesla's trajectory for years to come.

Call to Action: Stay informed about the evolving situation with Tesla and the ongoing scrutiny of Elon Musk's leadership. Understanding the complexities of Tesla Board concerns and the implications for the electric vehicle industry is critical for any serious investor. Continue reading our in-depth analysis to stay abreast of developments on this crucial issue impacting the future of Tesla and the broader electric vehicle sector.

Featured Posts

-

Smaller Qe A More Targeted Approach For The Bank Of England

Apr 23, 2025

Smaller Qe A More Targeted Approach For The Bank Of England

Apr 23, 2025 -

Despite Trade Disputes Canadian Investment In Us Stocks Hits Peak

Apr 23, 2025

Despite Trade Disputes Canadian Investment In Us Stocks Hits Peak

Apr 23, 2025 -

Dinamo Obolon 18 Kvitnya Rezultat Matchu Upl

Apr 23, 2025

Dinamo Obolon 18 Kvitnya Rezultat Matchu Upl

Apr 23, 2025 -

On Refait La Seance Fdj Schneider Electric Et Les Publications Parisiennes De La Semaine Du 17 Fevrier

Apr 23, 2025

On Refait La Seance Fdj Schneider Electric Et Les Publications Parisiennes De La Semaine Du 17 Fevrier

Apr 23, 2025 -

Global Financial Risk The Imf On Trumps Trade Policies

Apr 23, 2025

Global Financial Risk The Imf On Trumps Trade Policies

Apr 23, 2025