Tesla's Q1 Profit Decline: Impact Of Musk's Political Involvement

Table of Contents

Tesla's recent Q1 profit decline has sparked intense debate among investors and analysts. While several factors contributed to this downturn, the impact of Elon Musk's increasingly prominent political involvement is a key area of scrutiny. This article delves into the potential connections between Musk's political activities and Tesla's financial performance, exploring the complex relationship between corporate leadership, political engagement, and investor confidence. We will analyze the data and expert opinions to understand the extent to which Musk's political actions may have influenced Tesla's bottom line.

<h2>The Q1 Profit Decline: A Detailed Look</h2>

Tesla's Q1 2024 profit showed a significant decrease compared to previous quarters and market expectations. While the official figures will vary slightly depending on the reporting standards used, a substantial percentage drop in profit margin is widely acknowledged. This represents a notable deviation from the company's previously strong performance and has raised concerns amongst stakeholders.

- Specific numbers: Reports indicate a [Insert Percentage]% drop in profit compared to Q4 2023, and a [Insert Percentage]% shortfall compared to analyst predictions. Revenue figures also experienced a decline, dropping to approximately [Insert Revenue Figure] compared to [Insert Previous Quarter Revenue Figure].

- Comparison to previous quarters: This marks the sharpest quarterly decline in Tesla's profit in [Number] years, signifying a significant shift in the company's financial trajectory. The previous quarter showed [Brief description of previous quarter's performance].

- Analyst reactions and predictions: Analysts have expressed varied opinions, with some attributing the decline primarily to external factors, while others highlight the potential negative impact of Musk's political actions on investor sentiment and brand perception. Many are predicting [Insert Analyst Predictions for future performance].

<h2>Musk's Political Engagements: A Timeline of Controversies</h2>

Throughout Q1 2024, and in the period leading up to it, Elon Musk engaged in several high-profile political actions and statements that sparked significant controversy. These actions, often disseminated through his prolific Twitter account, generated considerable negative press and impacted public perception of both Musk and Tesla.

- Specific examples: This includes [Specific example 1, link to news article], [Specific example 2, link to news article], and [Specific example 3, link to news article]. These actions ranged from controversial endorsements to outspoken criticism of various political figures and policies.

- Resulting boycotts and negative press: The resulting negative publicity led to calls for boycotts of Tesla products from certain consumer groups, potentially impacting sales figures and brand loyalty. Numerous articles highlighted the negative impact of Musk's political stances on Tesla's image.

- Social Media Impact: The amplification of these controversies on social media platforms undoubtedly contributed to a decline in positive brand sentiment.

<h2>The Correlation: How Political Involvement Impacts Tesla's Stock</h2>

A clear correlation appears to exist between Musk's politically charged pronouncements and fluctuations in Tesla's stock price during Q1 2024. While causality cannot be definitively established, the timing of significant stock drops often coincided with periods of intense political controversy surrounding Musk.

- Stock price changes: For example, following [Specific political event], Tesla's stock price experienced a [Percentage]% drop within [Timeframe]. Similar patterns emerged following other controversial statements and actions.

- Expert opinions: Financial analysts have expressed concerns that Musk's actions are eroding investor confidence in Tesla. Some experts argue that this uncertainty is driving investors to divest from Tesla stock.

- Sell-offs and drops: The combination of negative publicity and investor uncertainty likely contributed to significant sell-offs, further impacting Tesla's overall financial performance.

<h2>Other Contributing Factors to Tesla's Q1 Performance</h2>

It's crucial to acknowledge that factors beyond Musk's political involvement contributed to Tesla's Q1 profit decline. Presenting a balanced perspective requires recognizing these external pressures on the company's performance.

- Increased competition: The electric vehicle (EV) market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This intensified competition puts pressure on Tesla's pricing strategies and sales volume.

- Global economic slowdown: The global economic climate, marked by inflation and potential recessionary concerns, has impacted consumer spending on discretionary items like luxury vehicles.

- Supply chain disruptions: Ongoing supply chain challenges and increased material costs also contributed to Tesla's reduced profitability during the quarter.

<h2>The Future of Tesla and Musk's Political Influence</h2>

The long-term consequences of Musk's political engagement for Tesla's success remain uncertain. However, the risks are significant and require careful consideration by the company.

- Brand reputation: Continued political controversies could further damage Tesla's brand reputation, potentially alienating customers and investors.

- Strategies for improvement: Tesla needs to develop robust strategies to manage negative publicity and rebuild investor trust. Improved communication and a more measured approach to political commentary could be beneficial.

- Future predictions: The future performance of Tesla will heavily depend on its ability to mitigate the negative impacts of Musk's political actions and navigate the challenges within the broader EV market.

<h2>Conclusion</h2>

Tesla's Q1 profit decline is a complex issue with multiple contributing factors. While external market forces certainly played a role, Elon Musk's political involvement appears to have had a significant negative impact on investor confidence and Tesla's stock performance. The correlation between his controversial actions and the company's financial results warrants further investigation. Understanding the interplay between corporate leadership's political stances and a company's financial health is crucial for investors. Stay informed about Tesla's performance and Elon Musk's political activities to make informed investment decisions. Continue following our coverage of Tesla's performance and the impact of Musk's political involvement to stay ahead of the curve.

Featured Posts

-

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025

Bethesdas Oblivion Remastered Officially Released Today

Apr 24, 2025 -

Strategic Energy Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025

Strategic Energy Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025 -

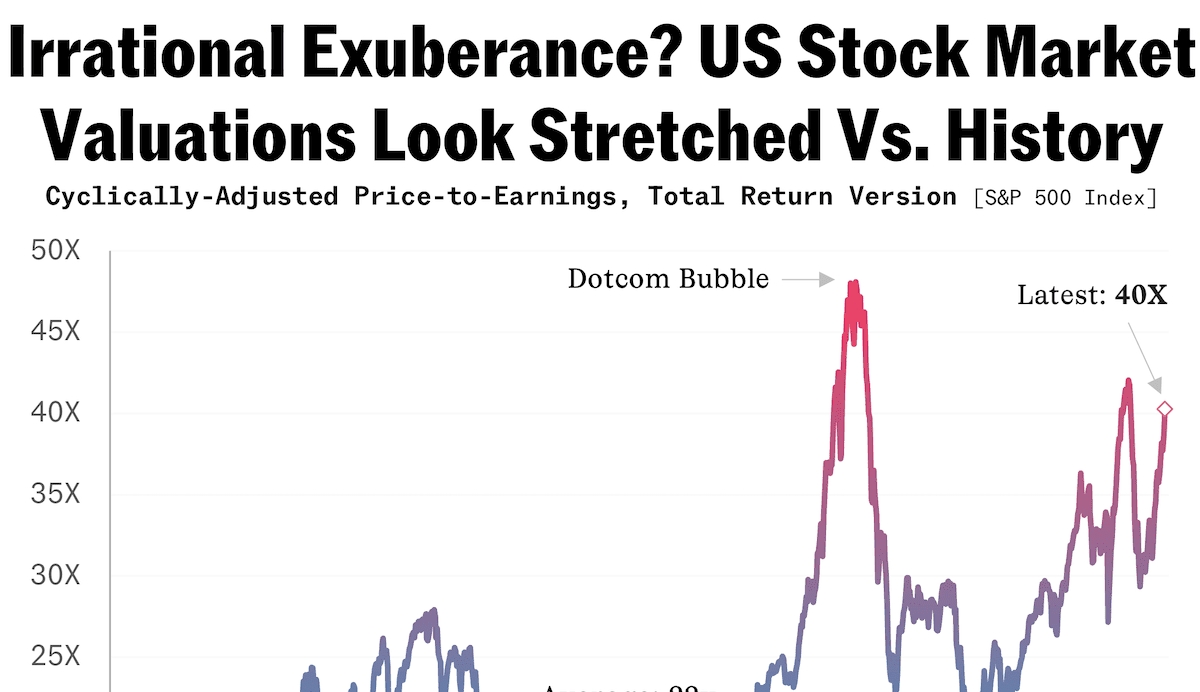

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 24, 2025

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Latest Posts

-

When To Watch The Next High Potential Episode On Abc

May 10, 2025

When To Watch The Next High Potential Episode On Abc

May 10, 2025 -

High Potential Abc Air Date For The Next Episode

May 10, 2025

High Potential Abc Air Date For The Next Episode

May 10, 2025 -

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025

Madhyamik 2025 Result How To Check Merit List And Your Score

May 10, 2025 -

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 10, 2025

West Bengal Madhyamik Exam 2025 Merit List And Result Date

May 10, 2025 -

High Potential Season 1 And 2 Analyzing The Underrated Characters Arc

May 10, 2025

High Potential Season 1 And 2 Analyzing The Underrated Characters Arc

May 10, 2025