The Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Its Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, the underlying assets are the stocks comprising the Dow Jones Industrial Average. The calculation is straightforward:

(Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV

The total asset value is determined by the market prices of the constituent stocks in the Dow Jones Industrial Average held by the ETF. The total liabilities include expenses associated with running the ETF. Therefore, the Amundi Dow Jones Industrial Average UCITS ETF NAV reflects the current market value of its holdings, adjusted for liabilities.

Several factors influence the daily fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF NAV:

- Market movements of the Dow Jones Industrial Average: Changes in the price of the underlying stocks directly impact the ETF's NAV. A rising Dow Jones Industrial Average generally leads to a higher NAV, and vice-versa.

- Currency fluctuations: If the ETF invests in companies outside your base currency, exchange rate variations can affect the NAV calculation.

- Dividend payments from underlying stocks: When underlying companies pay dividends, the ETF receives these payments, which are then reflected in the NAV.

- ETF expenses: Management fees and other operating expenses reduce the overall value available to investors, impacting the NAV.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV?

Accessing reliable and up-to-date Amundi Dow Jones Industrial Average UCITS ETF NAV data is essential for informed investment decisions. Several sources provide this information:

- Amundi's official website: The fund manager's website is the most authoritative source for official NAV figures.

- Financial news websites: Major financial news outlets like Bloomberg and Yahoo Finance often publish real-time and historical Amundi Dow Jones Industrial Average UCITS ETF NAV information.

- Brokerage platforms: If you hold the ETF through a brokerage account, the platform typically provides real-time NAV and historical data.

- ETF data providers: Specialized data providers offer comprehensive ETF information, including NAV, historical performance, and other relevant metrics.

Always verify the source's reliability to ensure accuracy. Inaccurate Amundi Dow Jones Industrial Average UCITS ETF NAV data can lead to flawed investment decisions.

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF NAV is a crucial tool for informed investment decisions. It helps investors:

- Track performance: By monitoring changes in the NAV over time, you can assess the ETF's performance relative to its benchmark (the Dow Jones Industrial Average).

- Compare investment options: NAV facilitates comparison with other ETFs or investment options, enabling you to make informed choices based on relative value.

- Make buying and selling decisions: While the market price might fluctuate slightly, the NAV provides a clearer picture of the ETF's intrinsic value.

It's important to understand that the NAV and the market price of the ETF might differ slightly due to trading volume and supply-demand dynamics. However, over the long term, these values tend to converge. Utilizing NAV in your investment strategy allows for:

- Performance analysis: Compare NAV changes over different periods to assess the ETF's historical performance.

- Investment portfolio diversification: Incorporate the ETF into your portfolio to diversify holdings and manage risk.

- Comparison with benchmark indices: Compare the ETF's NAV performance against the Dow Jones Industrial Average to evaluate its effectiveness as a tracking tool.

Understanding the Risks Associated with the Amundi Dow Jones Industrial Average UCITS ETF and its NAV

Investing in the Amundi Dow Jones Industrial Average UCITS ETF carries inherent market risks, primarily stemming from fluctuations in the Dow Jones Industrial Average. These market movements directly impact the ETF's NAV.

- Market risk: A downturn in the overall stock market will negatively affect the value of the underlying stocks and subsequently lower the NAV.

- Dow Jones specific risk: Even if the broader market performs well, a decline in specific Dow Jones components can drag down the ETF's NAV.

- Currency Risk (if applicable): If the ETF holds international stocks, changes in currency exchange rates can affect the NAV.

Diversification is crucial for mitigating these risks. By combining the Amundi Dow Jones Industrial Average UCITS ETF with other assets in a well-diversified portfolio, you can reduce the impact of market fluctuations on your overall investment returns.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for successful ETF investing. This guide highlighted the NAV's calculation, reliable data sources, its role in investment decisions, and the associated risks. Remember that consistently accessing accurate and reliable Amundi Dow Jones Industrial Average UCITS ETF NAV data is critical for informed decision-making. The NAV's relationship to the ETF's performance is direct and crucial for evaluating your investment strategy. Use this information to make better investment decisions with the Amundi Dow Jones Industrial Average UCITS ETF, and continue learning about its NAV and other key performance indicators through further research and consultation with financial professionals.

Featured Posts

-

Analyzing The Glastonbury 2025 Lineup Charli Xcx Neil Young And Beyond

May 24, 2025

Analyzing The Glastonbury 2025 Lineup Charli Xcx Neil Young And Beyond

May 24, 2025 -

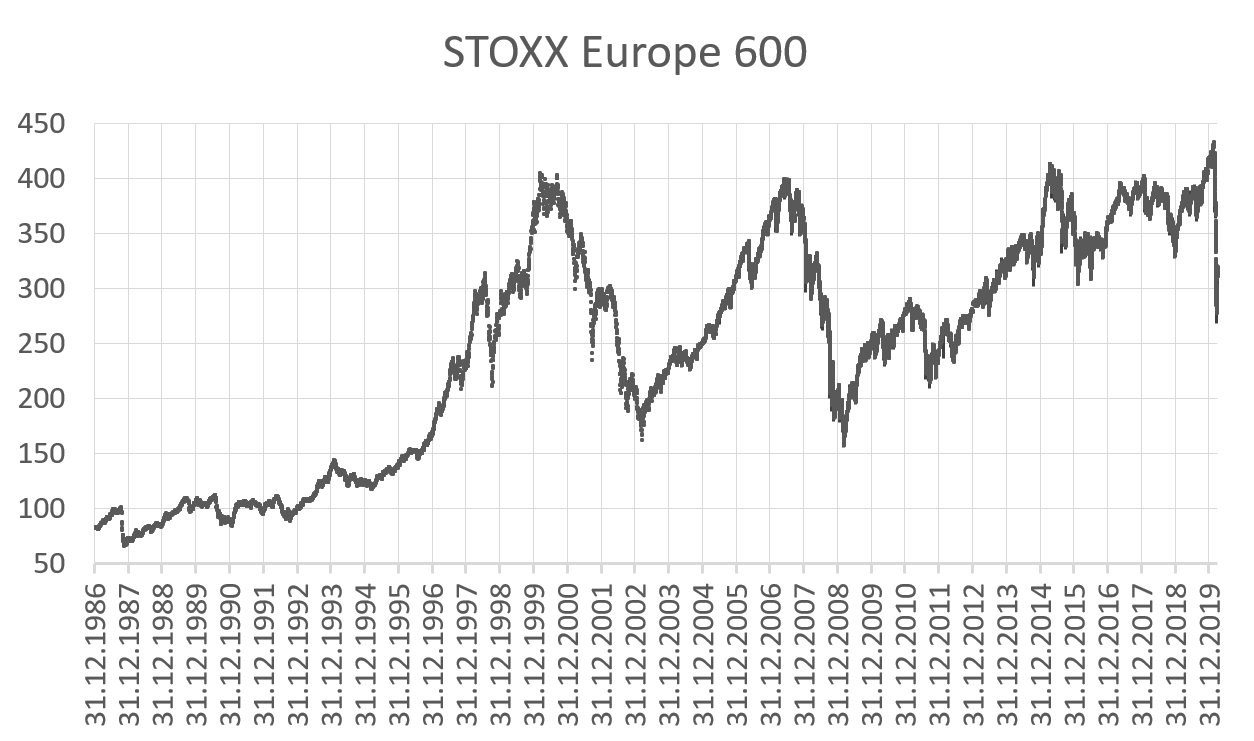

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 24, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 24, 2025 -

Lvmh Stock Takes A Hit 8 2 Decline After Q1 Sales Report

May 24, 2025

Lvmh Stock Takes A Hit 8 2 Decline After Q1 Sales Report

May 24, 2025 -

Us Band Announces Glastonbury Performance No Official Confirmation Yet

May 24, 2025

Us Band Announces Glastonbury Performance No Official Confirmation Yet

May 24, 2025

Latest Posts

-

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025 -

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025

Imcd N V Annual General Meeting Successful Vote On All Resolutions

May 24, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025