The SEC Vs. Ripple: What Does It Mean For XRP's Future?

Table of Contents

Keywords: SEC vs Ripple, Ripple lawsuit, XRP price prediction, XRP regulation, SEC cryptocurrency regulation, XRP future, cryptocurrency lawsuit, Ripple SEC case, implications of Ripple lawsuit

The SEC vs. Ripple lawsuit has cast a long shadow over the cryptocurrency market, particularly impacting XRP, Ripple's native token. The outcome of this high-stakes legal battle will significantly influence not only XRP's future but also the broader landscape of cryptocurrency regulation in the United States. This article delves into the intricacies of the case, exploring its potential outcomes and their far-reaching implications.

The SEC's Case Against Ripple: A Detailed Overview

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs in December 2020, alleging that Ripple illegally sold unregistered securities in the form of XRP. The SEC's central argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security.

-

The SEC's argument regarding the Howey Test and XRP: The SEC contends that XRP satisfies the Howey Test's criteria, arguing that investors purchased XRP with the expectation of profit generated by Ripple's efforts. They point to Ripple's sales of XRP to institutional investors and its active involvement in the XRP market as evidence of a common enterprise.

-

Ripple's counterarguments and defense strategy: Ripple vehemently denies these allegations, arguing that XRP is a decentralized digital asset, not a security. Their defense strategy emphasizes XRP's functionality as a medium of exchange and its independent operation outside Ripple's control. They highlight the significant decentralized nature of XRP and its vast network of exchanges and users.

-

Key figures involved in the case (e.g., Brad Garlinghouse): The case prominently features Brad Garlinghouse, CEO of Ripple, and Chris Larsen, Ripple's Executive Chairman, who are both named defendants. Their testimonies and actions significantly shape the case's narrative.

-

Timeline of significant events in the lawsuit: The lawsuit has seen numerous significant events, including various filings, motions, expert witness testimonies, and the recent partial summary judgment in favor of Ripple. Following these developments closely is crucial to understanding the evolving dynamics of the case.

Potential Outcomes of the Ripple Lawsuit and Their Impact on XRP

The Ripple lawsuit could result in several potential outcomes: an SEC win, a Ripple win, or a settlement. Each outcome carries drastically different implications for XRP.

-

Impact on XRP price if the SEC wins: An SEC victory could lead to a significant drop in XRP's price, potentially delisting it from major exchanges and severely impacting investor confidence. This outcome would likely set a precedent for stricter regulation of other cryptocurrencies.

-

Impact on XRP price if Ripple wins: A Ripple victory would likely result in a surge in XRP's price, driven by increased investor confidence and potentially attracting significant institutional investment. This would be a landmark decision for the crypto industry.

-

Impact on XRP trading volume and liquidity: Regardless of the outcome, the uncertainty surrounding the lawsuit has already impacted XRP's trading volume and liquidity. A clear resolution, however, could restore stability and potentially boost trading activity.

-

Potential legal precedents set by the case for other cryptocurrencies: The case’s outcome will create significant legal precedent, influencing how the SEC and other regulatory bodies approach the classification and regulation of other cryptocurrencies. This could lead to increased regulatory clarity or further uncertainty, depending on the ruling.

The Broader Implications for Cryptocurrency Regulation in the US

The SEC vs. Ripple case has significant implications for the broader regulatory landscape of cryptocurrencies in the US.

-

Uncertainty in the crypto market regarding regulatory clarity: The lawsuit highlights the existing regulatory uncertainty surrounding the crypto market, creating challenges for both investors and businesses operating in the space.

-

Potential for increased regulation or a more defined regulatory framework: The outcome could prompt either stricter regulation of cryptocurrencies or a more defined framework for classifying and overseeing digital assets.

-

The impact on investor confidence and market stability: Regulatory clarity, regardless of the outcome, will be crucial for restoring investor confidence and stabilizing the cryptocurrency market.

-

Comparison to other regulatory actions against crypto companies: The Ripple case should be considered alongside other regulatory actions by the SEC against crypto companies, painting a more comprehensive picture of regulatory approaches in the US.

The Impact on Institutional Investment in XRP

The lawsuit significantly influences institutional investors' perspectives on XRP.

-

Hesitation from institutional investors due to regulatory uncertainty: Regulatory uncertainty surrounding XRP has caused many institutional investors to adopt a wait-and-see approach, hindering significant investment.

-

Potential for increased investment if Ripple wins the case: A Ripple victory would likely lead to a surge in institutional investment, as the regulatory risk associated with XRP would be significantly reduced.

-

The role of institutional adoption in XRP's long-term price: Institutional adoption is vital for the long-term price stability and growth of XRP. A positive outcome for Ripple would likely accelerate this process.

Analyzing XRP's Price Performance in Relation to the Lawsuit

XRP's price has experienced significant fluctuations since the commencement of the lawsuit.

-

Price movements before, during, and after key legal developments: Analyzing XRP's price movements in relation to key developments in the lawsuit reveals a clear correlation between legal developments and market sentiment.

-

Correlation between news related to the lawsuit and XRP's price: Positive news tends to boost XRP's price, while negative news leads to price drops. This highlights the significant market sensitivity to the case's progress.

-

Technical analysis of XRP's charts: Technical analysis of XRP's price charts can provide additional insights into price trends and potential future movements.

-

Sentiment analysis of the crypto community regarding XRP's future: Analyzing the sentiment of the crypto community towards XRP through social media and online forums can offer further perspectives on investor confidence.

Conclusion

The SEC vs. Ripple case holds profound implications for XRP's future, significantly impacting its price, regulatory standing, and institutional adoption. The outcome will not only affect XRP but will also shape the broader cryptocurrency regulatory landscape in the US. The uncertainty surrounding the case underscores the need for clearer regulatory frameworks within the crypto industry.

Call to Action: Stay informed about the ongoing SEC vs. Ripple case and its potential impact on XRP’s future. Follow the developments closely to make informed decisions about your XRP investments. Continue to research the latest news and analysis on the SEC vs. Ripple and XRP. Understanding the complexities of this case is crucial for navigating the evolving world of cryptocurrency investment.

Featured Posts

-

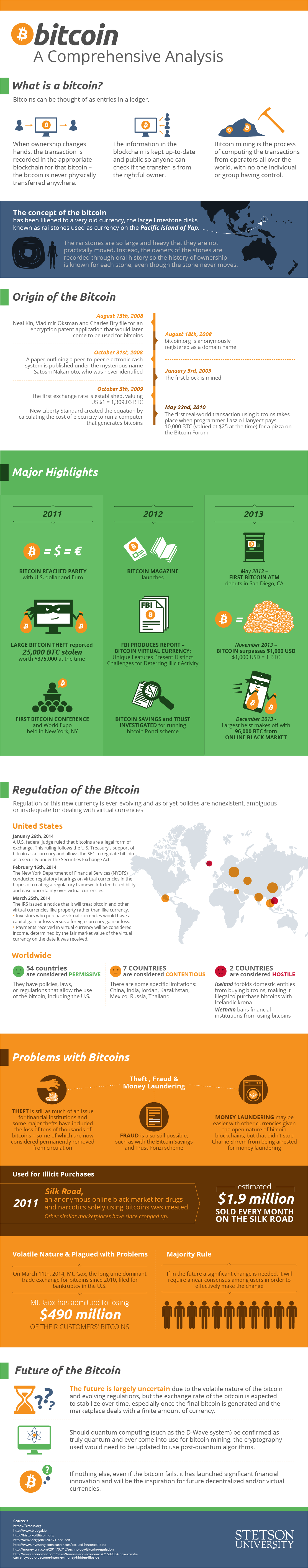

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

Taiwans Strengthening Currency A Call For Economic Restructuring

May 08, 2025

Taiwans Strengthening Currency A Call For Economic Restructuring

May 08, 2025 -

Subscription Plans For Uber Drivers A New Era In Commission Structures

May 08, 2025

Subscription Plans For Uber Drivers A New Era In Commission Structures

May 08, 2025 -

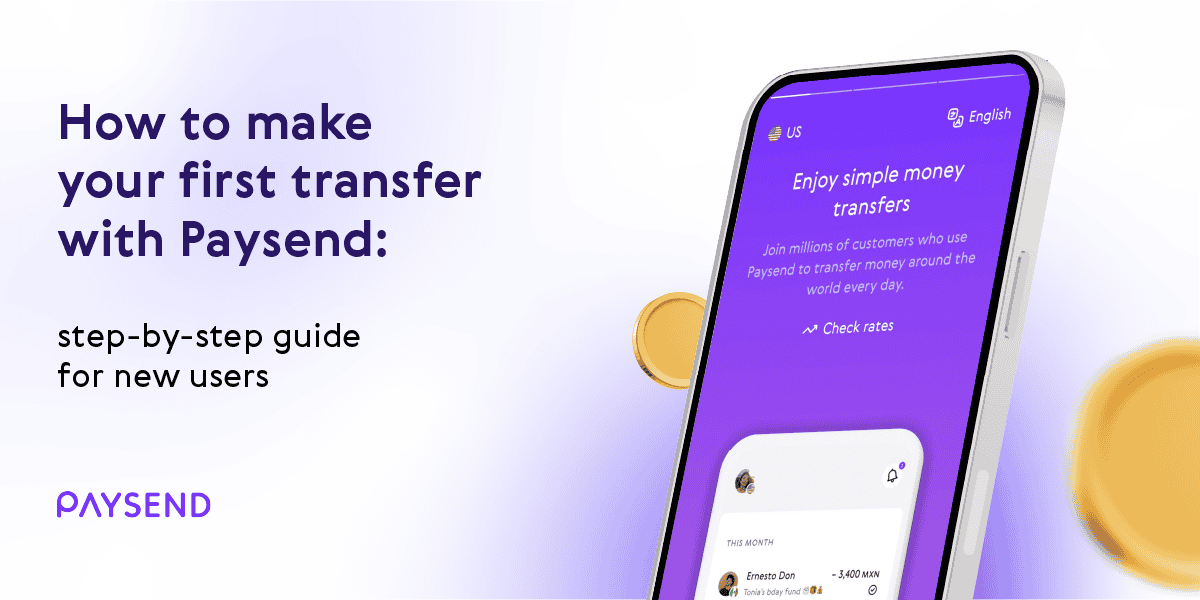

The Process Of Data Transfer A Step By Step Guide

May 08, 2025

The Process Of Data Transfer A Step By Step Guide

May 08, 2025 -

Wildfire Speculation Analyzing The Market For Los Angeles Disaster Bets

May 08, 2025

Wildfire Speculation Analyzing The Market For Los Angeles Disaster Bets

May 08, 2025