US-China Trade War Impact: Stock Market Analysis And Dow Futures Outlook

Table of Contents

The Initial Shock: How Tariffs Affected Stock Market Performance

The imposition of tariffs during the US-China trade war immediately impacted stock market performance, causing significant volatility and uncertainty. The effects weren't uniform; different sectors experienced disproportionately different levels of impact.

Sector-Specific Impacts

The technology, manufacturing, and agricultural sectors were particularly vulnerable to the trade war's tariffs.

- Technology: Companies heavily reliant on Chinese manufacturing or sales, like Apple and Qualcomm, saw stock prices fluctuate as tariffs increased costs and disrupted supply chains. Apple, for example, experienced a temporary dip in its stock price as consumer demand softened in response to higher prices on iPhones.

- Manufacturing: Companies in manufacturing, especially those involved in importing or exporting goods between the US and China, faced increased costs and reduced competitiveness. The impact varied greatly depending on the specific product and the extent of reliance on the affected supply chains. For example, some automakers experienced supply shortages due to increased tariffs on imported parts.

- Agriculture: The agricultural sector was severely impacted, with tariffs on soybeans and other agricultural products leading to significant price drops and financial hardship for many farmers. The impact was felt disproportionately in regions heavily reliant on exporting to China.

The mechanisms behind these impacts included reduced consumer demand due to higher prices, supply chain disruptions caused by delays and increased costs, and ultimately increased input costs for businesses, squeezing profit margins.

Volatility and Uncertainty

The trade war period was characterized by heightened stock market volatility.

- Significant Fluctuations: Periods of significant market fluctuations were directly correlated with announcements and escalations of trade disputes between the US and China. Uncertainty surrounding future trade policies contributed to increased market volatility.

- Investor Sentiment: Investor sentiment shifted dramatically, reflecting the uncertainty and fear surrounding the unpredictable nature of the trade war. This heightened uncertainty led to increased trading activity as investors reacted to news and speculation.

The constant uncertainty surrounding the future direction of trade policy created a climate of fear and unpredictability, making it difficult for investors to make informed decisions.

Long-Term Effects on Stock Market Growth

The US-China trade war had profound and lasting effects on stock market growth, extending beyond the initial shock.

Shifting Global Supply Chains

Many companies responded to the trade war by diversifying their supply chains, moving production away from China.

- Reshoring and Nearshoring: Numerous companies engaged in reshoring (returning production to the US) or nearshoring (moving production to nearby countries). This was driven by a desire to reduce reliance on China and mitigate future trade risks. Examples include companies in the apparel and electronics industries that shifted production to Vietnam, Mexico, or other Southeast Asian countries.

- Long-Term Implications: The long-term implications for global trade and economic growth are complex and still unfolding. While diversification reduces risk for individual companies, the overall shift in global supply chains has added complexities and costs to international trade.

This restructuring of global supply chains represents a significant and lasting consequence of the trade war, with far-reaching economic implications.

Inflationary Pressures

Tariffs contributed to inflationary pressures, impacting stock valuations.

- Inflationary Indicators: Increased import costs due to tariffs led to higher prices for consumers and businesses, reflected in various inflationary indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI).

- Inflation, Interest Rates, and Stock Prices: The resulting inflation led to central banks raising interest rates to combat rising prices. Higher interest rates typically negatively impact stock valuations, as they increase borrowing costs for companies and reduce investor demand for equities.

The interplay between tariffs, inflation, interest rates, and stock prices highlights the complex and interconnected nature of macroeconomic factors.

Dow Futures Outlook: Predicting Future Trends

Predicting future trends in Dow futures requires careful analysis of historical data and current geopolitical factors.

Analyzing Historical Data

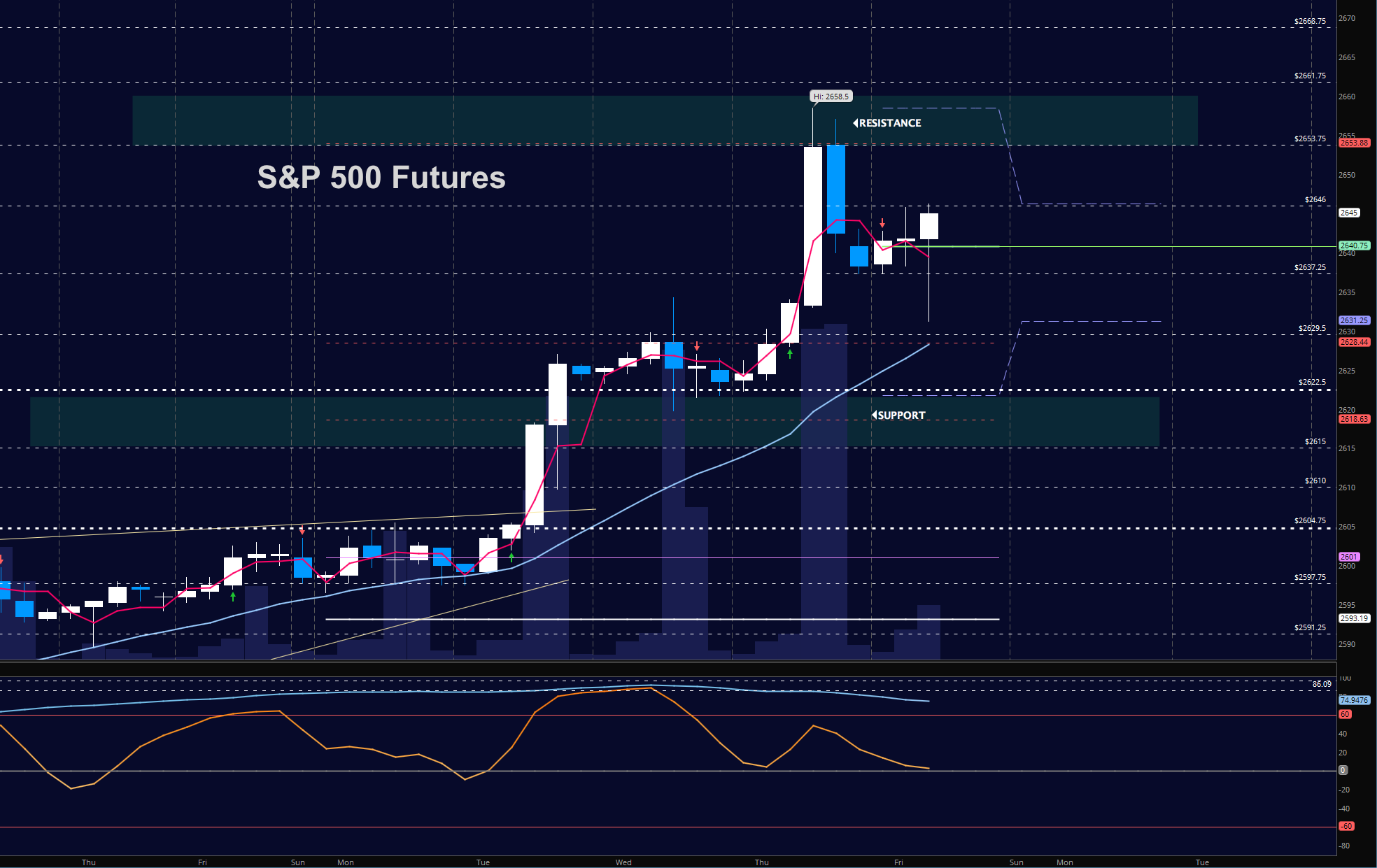

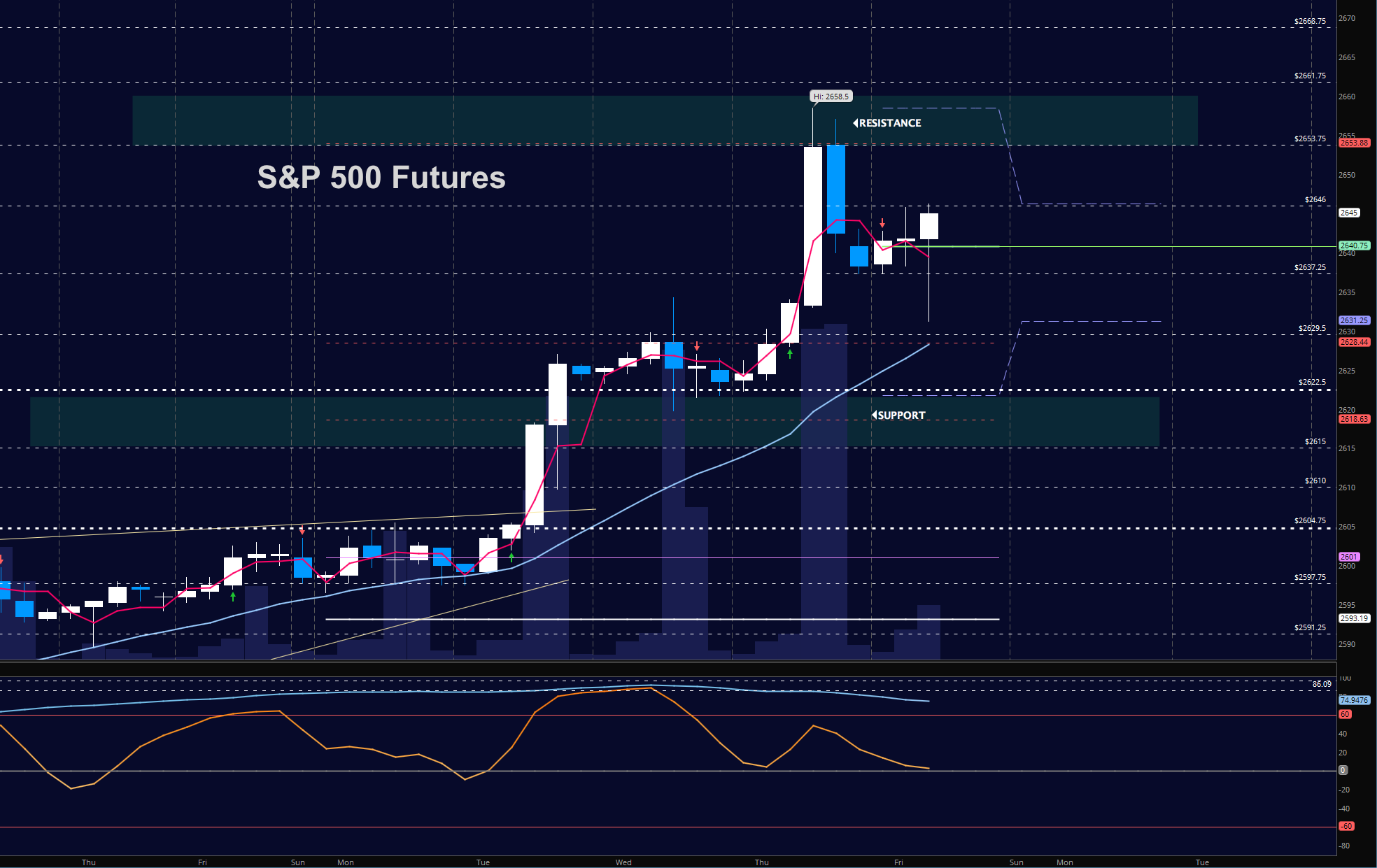

Examining the historical performance of Dow futures during and after the US-China trade war can provide valuable insights. [Insert chart/graph here visualizing Dow futures data during and after the trade war].

- Correlation Analysis: While a direct correlation between specific trade policy actions and Dow futures performance isn't always clear-cut, periods of heightened trade tensions generally coincided with increased volatility in Dow futures. However, other factors often played a more significant role in determining overall market direction.

- Market Reactions: The market's reaction to specific trade announcements and agreements can inform future predictions. Analyzing past reactions helps to understand how investors interpret future trade developments.

Analyzing historical data allows for a more informed assessment of how the market responds to trade-related events.

Geopolitical Factors and Market Sentiment

Ongoing geopolitical tensions and investor sentiment continue to influence Dow futures.

- Current Economic Indicators: Current economic indicators, such as inflation rates, unemployment levels, and consumer confidence, play a major role in shaping market sentiment and thus, Dow futures prices.

- Potential Future Trade Conflicts: The potential for future trade conflicts, whether between the US and China or involving other countries, remains a significant source of uncertainty that could impact Dow futures.

Understanding current geopolitical realities and investor sentiment is vital for developing a reasonable outlook on Dow futures. While predicting the future is always challenging, combining historical analysis with an understanding of current conditions allows for a more informed and nuanced prediction.

Conclusion: US-China Trade War's Lasting Impact on the Stock Market

The US-China trade war had a significant and lasting impact on stock market performance and Dow futures. The initial shock of tariffs caused sector-specific impacts and increased volatility. Long-term effects include shifts in global supply chains and inflationary pressures. Predicting future trends in Dow futures requires careful consideration of historical data and ongoing geopolitical factors. Understanding the lasting impact of the US-China trade war on stock market performance is essential for informed investment strategies. Continue your research on Dow futures and other market indicators to make well-informed decisions regarding your portfolio and Dow futures trading.

Featured Posts

-

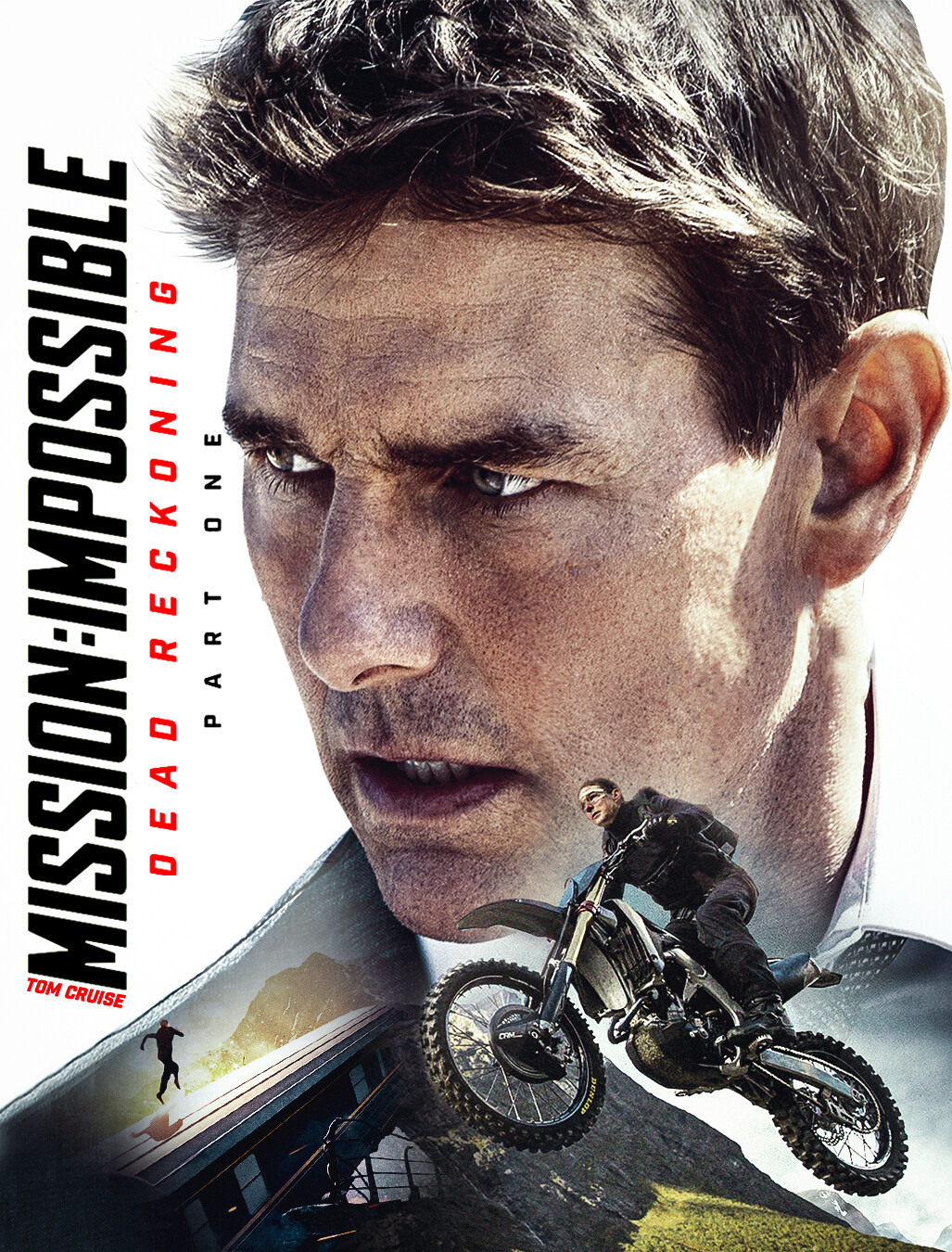

Mission Impossible Dead Reckoning Part Two Trailer Highlights And Speculation

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Trailer Highlights And Speculation

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Critical Analysis

Apr 26, 2025 -

Mission Impossible Tom Cruises Riskiest Stunt Yet

Apr 26, 2025

Mission Impossible Tom Cruises Riskiest Stunt Yet

Apr 26, 2025 -

Analysis 70 Million Impact Of Us Port Fees On Auto Carrier

Apr 26, 2025

Analysis 70 Million Impact Of Us Port Fees On Auto Carrier

Apr 26, 2025 -

A Conservative View Reforming Harvard University

Apr 26, 2025

A Conservative View Reforming Harvard University

Apr 26, 2025

Latest Posts

-

Financial Losses Of Tech Titans Musk Bezos And Zuckerberg Post 2017

May 10, 2025

Financial Losses Of Tech Titans Musk Bezos And Zuckerberg Post 2017

May 10, 2025 -

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025

The Impact Of Trumps Presidency On The Fortunes Of Musk Bezos And Zuckerberg

May 10, 2025 -

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 10, 2025

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 10, 2025 -

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025