Voice Recognition Technology: Revolutionising HMRC Call Handling

Table of Contents

Enhanced Efficiency and Reduced Wait Times with Voice Recognition

Automated voice recognition systems are capable of handling a significant portion of incoming calls, dramatically reducing wait times and freeing up human agents to focus on more complex issues. These systems can quickly understand and respond to simple queries, such as checking tax return statuses, confirming payment details, or scheduling appointments. This immediate response significantly improves the overall efficiency of the call handling process.

For example, studies have shown that implementing voice recognition can reduce average call handling times by up to 40%. This translates to:

- Faster initial query resolution: Taxpayers receive answers more quickly.

- Improved agent productivity: Agents can handle a larger volume of complex cases.

- Reduced call queue lengths: Wait times are significantly shortened.

- Increased call volume capacity: The system can manage a higher volume of calls without compromising service quality.

Specific applications already seeing success include automated appointment scheduling for tax consultations, instant balance inquiries for self-assessment taxpayers, and provision of simple, pre-recorded tax advice.

Improved Accuracy and Reduced Errors with Speech-to-Text Capabilities

Human error is a significant factor in any data-intensive operation. Voice recognition systems with advanced speech-to-text capabilities drastically reduce this risk. By accurately transcribing taxpayer information, these systems minimise data entry errors, leading to improved data quality within HMRC records. This improvement extends to several key areas:

- Minimized data entry errors: Reduces the likelihood of incorrect information being recorded.

- Improved data quality for analysis and reporting: Enables more accurate insights and informed decision-making.

- Enhanced compliance and audit capabilities: Provides a more reliable audit trail for regulatory compliance.

- Reduced manual data verification: Frees up valuable time for agents.

The security implications of accurate data capture are also significant. Accurate transcription ensures the correct information is recorded, reducing the risk of fraud and identity theft. This enhances data security and compliance with regulations like GDPR.

Enhanced Customer Experience Through Self-Service Options

Voice recognition empowers taxpayers with 24/7 access to information and self-service options, significantly enhancing the overall customer experience. The ability to access information and resolve simple queries at any time, without waiting on hold, leads to increased customer satisfaction. Key benefits include:

- Increased customer satisfaction scores: Reduced frustration translates to happier taxpayers.

- Improved accessibility for taxpayers: Services are available 24/7, accommodating diverse schedules.

- Reduced need for human intervention for simple queries: Frees up agents to deal with complex cases.

- 24/7 availability for information and service: Increased convenience for taxpayers.

Furthermore, the technology allows for the potential development of personalized interactions. By recognizing the voice of a returning taxpayer, the system can provide tailored information and quicker access to their specific details.

Challenges and Considerations of Implementing Voice Recognition in HMRC

While the benefits are numerous, implementing voice recognition technology within HMRC also presents some challenges. Careful consideration must be given to several factors:

- Data security and encryption protocols: Robust security measures are crucial to protect sensitive taxpayer data.

- Integration complexities with existing HMRC infrastructure: Seamless integration with existing systems is essential for optimal performance.

- Addressing potential biases in speech recognition algorithms: Algorithms must be trained on diverse datasets to avoid bias and ensure accuracy across different accents and dialects.

- Ongoing maintenance and updates for optimal performance: Regular updates and maintenance are essential to maintain accuracy and adapt to evolving language patterns.

Addressing concerns about data privacy and compliance with regulations like GDPR is paramount. Transparency with taxpayers about how their data is collected and used is vital to build trust and maintain confidence in the system.

The Future of HMRC Call Handling with Voice Recognition Technology

The implementation of voice recognition technology offers HMRC a significant opportunity to improve efficiency, accuracy, and the overall taxpayer experience. The benefits for both HMRC agents, who gain more time to deal with complex cases, and taxpayers, who benefit from quicker resolution times and 24/7 access to information, are undeniable. Voice recognition is not just a technological upgrade; it is a transformative solution that can redefine how HMRC interacts with taxpayers.

Learn more about how voice recognition technology is transforming HMRC call handling and explore its potential for your organization. Contact us today to discuss how voice recognition can optimize your HMRC call center operations.

Featured Posts

-

Wayne Gretzky Fast Facts For Hockey Fans

May 20, 2025

Wayne Gretzky Fast Facts For Hockey Fans

May 20, 2025 -

Sasol Sol Investor Concerns Following 2023 Strategy Presentation

May 20, 2025

Sasol Sol Investor Concerns Following 2023 Strategy Presentation

May 20, 2025 -

Hl Syueyd Aldhkae Alastnaey Ktabt Rwayat Aghatha Krysty

May 20, 2025

Hl Syueyd Aldhkae Alastnaey Ktabt Rwayat Aghatha Krysty

May 20, 2025 -

Significant Hmrc Tax Return Rule Changes Impact And Implications

May 20, 2025

Significant Hmrc Tax Return Rule Changes Impact And Implications

May 20, 2025 -

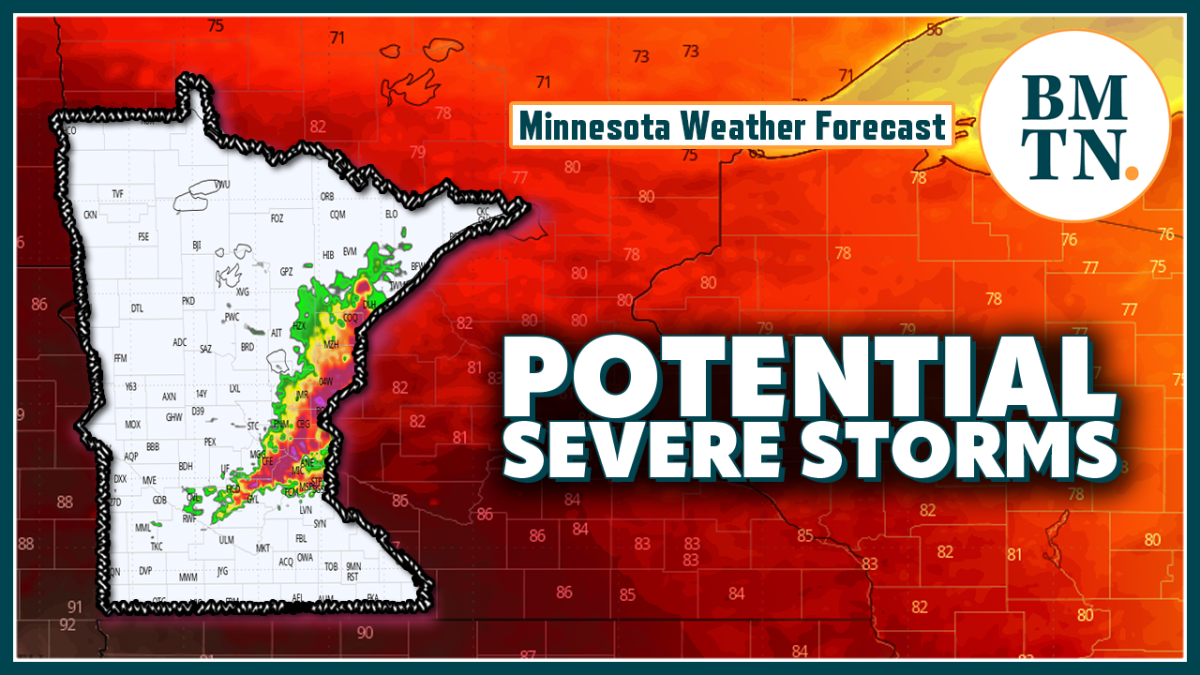

Increased Storm Potential Overnight Severe Weather Monday

May 20, 2025

Increased Storm Potential Overnight Severe Weather Monday

May 20, 2025