Will A Wall Street Rebound Undermine The German DAX's Rise?

Table of Contents

H2: The Intertwined Nature of the DAX and Wall Street

The global financial markets are inextricably linked, forming a complex web of interconnectedness. The performance of the US economy significantly influences the German economy, and vice-versa, impacting both the DAX and Wall Street. A strong US economy generally benefits Germany through increased demand for German exports. Conversely, weakness in the US can negatively impact German businesses relying on US markets.

- Strong US dollar impact on German exports: A strengthening US dollar makes German goods more expensive for US buyers, potentially reducing export volumes and impacting DAX performance.

- Investor confidence shifts between US and European markets: Positive sentiment on Wall Street often attracts global investment, potentially diverting capital away from European markets, including the DAX.

- Impact of US interest rate hikes on German borrowing costs: US interest rate increases can influence global borrowing costs, potentially making it more expensive for German companies to borrow money, impacting investment and growth.

- Correlation analysis of historical DAX and S&P 500 performance: Historical data reveals a degree of correlation between the DAX index and the S&P 500, indicating that movements in one market often influence the other, though the strength of this correlation can vary over time.

H2: Analyzing the Potential for a Wall Street Rebound

Several factors could trigger a Wall Street rebound. Easing inflation, positive economic data releases (like strong employment figures or improved consumer confidence), and robust corporate earnings reports are all potential catalysts. The magnitude and duration of any rebound are, however, difficult to predict with certainty.

- Factors influencing US market performance: These include Federal Reserve monetary policy, geopolitical events, and overall investor sentiment.

- Analysis of current economic indicators in the US: Close monitoring of key indicators such as inflation rates, GDP growth, and unemployment figures is crucial in assessing the likelihood of a rebound.

- Expert opinions on the likelihood and extent of a rebound: Analyzing forecasts from leading economists and financial analysts provides valuable insights into the potential trajectory of the US stock market.

H2: Assessing the Impact on the German DAX

The impact of a Wall Street rebound on the German DAX will depend on its strength and duration.

-

Strong Wall Street rebound: This could lead to capital flight from Europe to the US, potentially putting downward pressure on the DAX. Investors might shift their portfolios towards perceived higher-return opportunities in the US.

-

Moderate Wall Street rebound: A moderate rebound might have a less pronounced impact on the DAX, although it could still affect investor sentiment and capital flows.

-

No Wall Street rebound: If Wall Street stagnates or declines, the DAX could continue its upward trend, or at least be less negatively affected.

-

DAX sector performance analysis: Specific sectors within the DAX, such as exporters, will be particularly vulnerable to a strong US dollar and reduced US demand.

-

Impact on German investor confidence: A Wall Street rebound could erode investor confidence in the German market if capital flows significantly shift towards the US.

-

Potential for capital flight from Germany to the US: The attractiveness of US investments relative to German investments will determine the extent of capital flight.

-

Effect on Euro/Dollar exchange rate: A strengthening US dollar could further dampen German export competitiveness and pressure the DAX.

H3: The Role of Geopolitical Factors

Geopolitical events, such as the ongoing war in Ukraine and the resulting energy crisis, significantly impact both the US and German economies, further complicating the relationship between the DAX and Wall Street.

- Energy price volatility and its impact on both economies: High energy prices negatively impact both economies, potentially dampening growth and investor sentiment.

- Supply chain disruptions and their influence on market sentiment: Global supply chain disruptions can exacerbate inflation and create uncertainty, affecting both markets.

- Uncertainty regarding geopolitical stability: Geopolitical instability increases market volatility and makes predicting market movements more challenging.

3. Conclusion

The relationship between the German DAX and Wall Street's performance is complex and multifaceted. A Wall Street rebound could potentially undermine the DAX's recent gains, particularly if it leads to significant capital flight and a stronger US dollar. However, the exact impact depends on various factors, including the magnitude and duration of the rebound, along with prevailing geopolitical conditions and economic indicators. Predicting market direction with certainty is inherently difficult.

To make informed investment decisions, continue monitoring the interplay between the German DAX and Wall Street. Conduct thorough market analysis, considering various economic and geopolitical factors. Diversified investment strategies that account for the potential for both gains and losses in these interconnected markets are crucial. Understanding the implications of a Wall Street rebound on the German DAX's future performance is vital for navigating the complexities of the global financial landscape. Thorough research into the DAX index and its relationship with Wall Street is essential for any investor.

Featured Posts

-

Lyubovnye Gryozy Ili Ilicha Osveschenie V Gazete Trud

May 24, 2025

Lyubovnye Gryozy Ili Ilicha Osveschenie V Gazete Trud

May 24, 2025 -

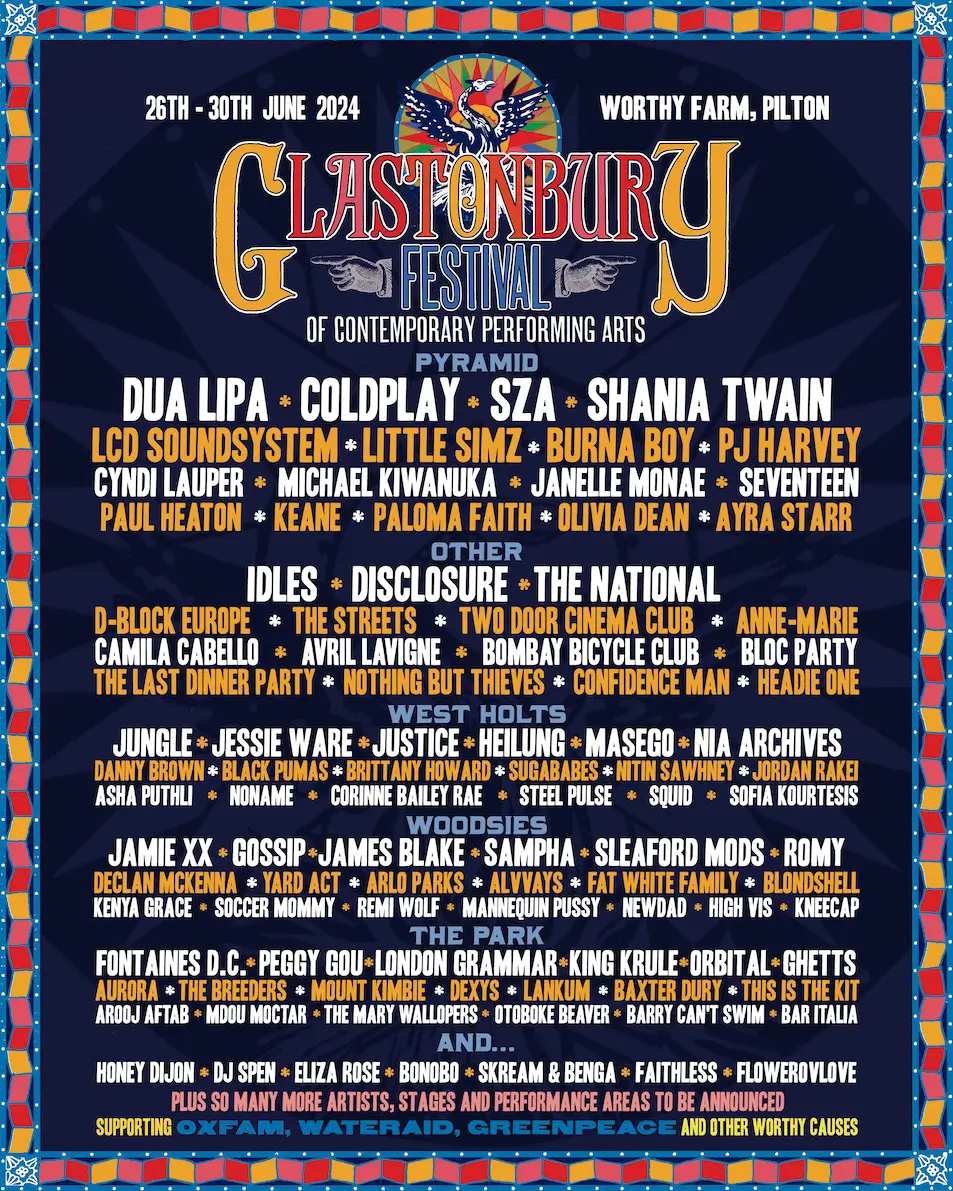

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025 -

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025

Stocks Surge 8 On Euronext Amsterdam Trumps Tariff Pause Fuels Rally

May 24, 2025 -

Garazh Ryazanova Plenum Tsenzura I Neozhidannaya Pomosch Brezhneva

May 24, 2025

Garazh Ryazanova Plenum Tsenzura I Neozhidannaya Pomosch Brezhneva

May 24, 2025 -

Buffetts Succession At Berkshire Hathaway What Happens To Apples Stock

May 24, 2025

Buffetts Succession At Berkshire Hathaway What Happens To Apples Stock

May 24, 2025

Latest Posts

-

Are La Landlords Price Gouging After The Recent Fires

May 24, 2025

Are La Landlords Price Gouging After The Recent Fires

May 24, 2025 -

Rising Rental Costs In La Following Fires Price Gouging Concerns

May 24, 2025

Rising Rental Costs In La Following Fires Price Gouging Concerns

May 24, 2025 -

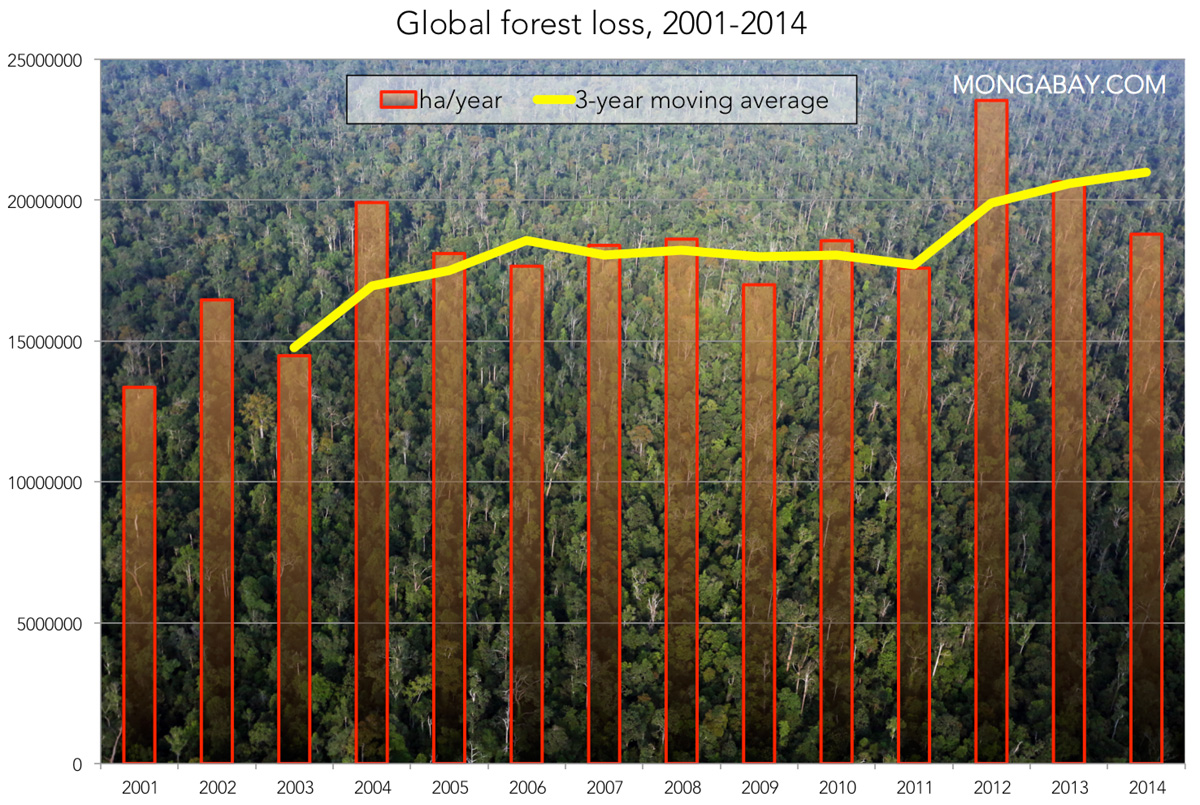

The Devastating Impact Of Wildfires Record High In Global Forest Loss

May 24, 2025

The Devastating Impact Of Wildfires Record High In Global Forest Loss

May 24, 2025 -

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025

Wildfires Drive Record Breaking Global Forest Loss

May 24, 2025 -

Navigating The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

May 24, 2025

Navigating The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

May 24, 2025