XRP Price Prediction: Will XRP Hold $2 Support? Reversal Or Fakeout?

Table of Contents

The price of XRP has been fluctuating recently, leaving many investors wondering about its future trajectory. A key area of focus is the $2 support level. Will it hold, signaling a potential price reversal, or is it merely a fakeout before a further decline? This article delves into the current market dynamics surrounding XRP, analyzing technical indicators and fundamental factors to offer a well-informed prediction of XRP's price movement. We'll explore the possibilities of a sustained recovery or a continued downward trend, helping you understand the potential for XRP to reach $2 or surpass it.

Technical Analysis of XRP Price Action

Chart Patterns and Indicators

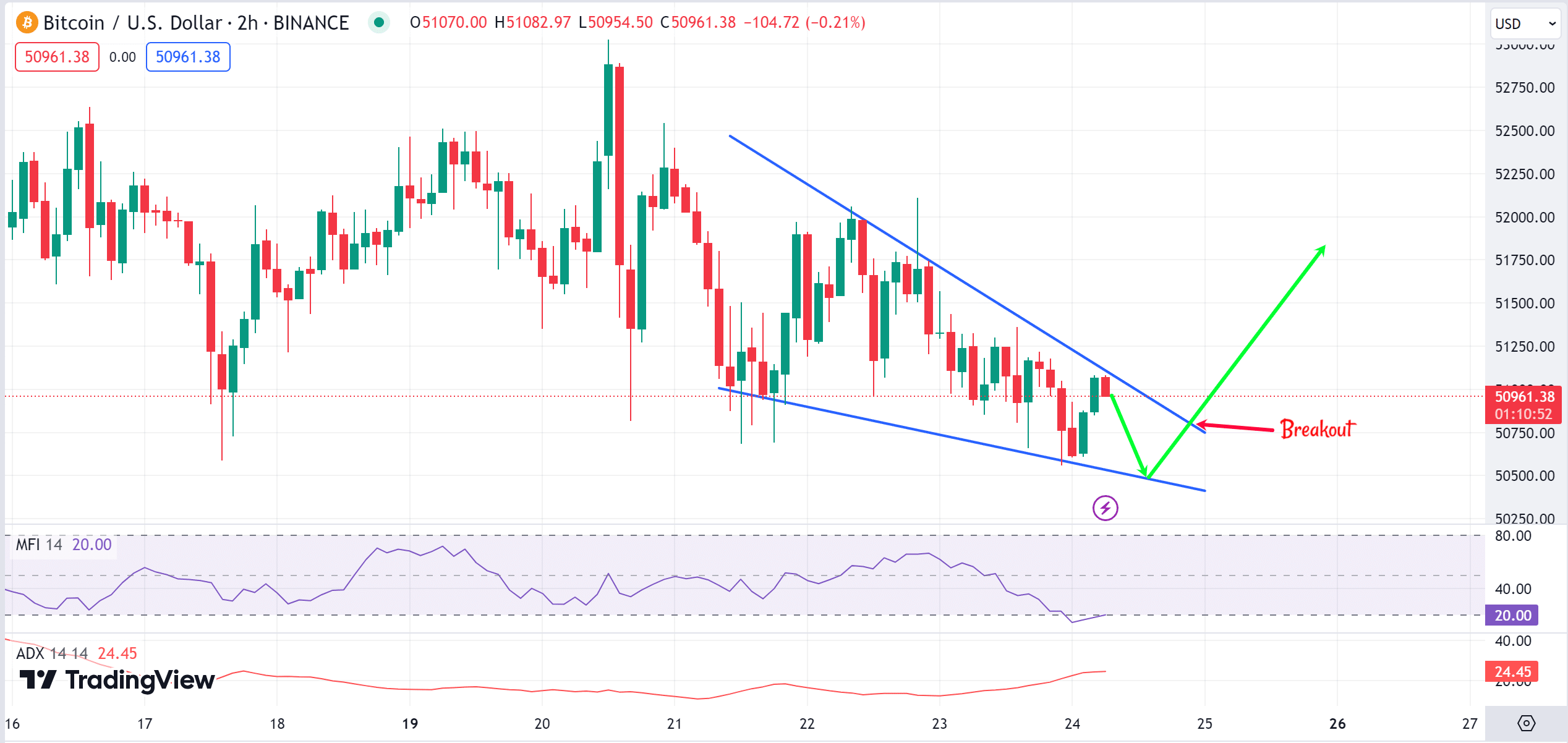

Analyzing XRP's recent price charts using key indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) is crucial for understanding potential trends and support/resistance levels.

- Chart Patterns: The presence of chart patterns like a head and shoulders pattern could suggest a bearish continuation, while a double bottom could indicate a potential reversal and a bounce back towards the $2 support or even higher. Identifying these patterns requires careful examination of the price action and volume.

- RSI & MACD Readings: An RSI reading below 30 often suggests oversold conditions, potentially indicating a bounce. Conversely, an RSI above 70 suggests overbought conditions, hinting at a potential correction. The MACD histogram can confirm these trends, providing insights into momentum changes. For example, a bullish crossover could precede a price increase. Monitoring these indicators around the $2 support level is key.

- Support and Resistance Levels: The $2 level acts as significant support. A break below this level could trigger further selling pressure, while a successful defense of this level could signal a potential reversal. Identifying other resistance levels above $2 is also vital for predicting the potential upside.

Volume Analysis

Analyzing trading volume alongside price movements provides crucial context.

- Volume and Price Correlation: High volume accompanying price increases confirms strong buying pressure, while low volume during price rallies suggests weak momentum and potential weakness. Conversely, high volume during price drops confirms significant selling pressure.

- Accumulation/Distribution: By analyzing volume relative to price changes, we can identify potential accumulation (buying pressure outweighing selling) or distribution (selling outweighing buying) phases, providing further insight into the future price direction of XRP. High volume near the $2 support, coupled with a price bounce, could indicate accumulation and a potential bullish reversal.

Fundamental Factors Affecting XRP Price

Ripple's Legal Battle

The ongoing legal battle between Ripple and the SEC significantly influences XRP's price.

- Positive Scenarios: A favorable court ruling could significantly boost XRP's price, potentially leading to a sustained rally. Positive developments during the legal proceedings can generate positive investor sentiment and fuel price increases.

- Negative Scenarios: An unfavorable ruling could trigger further price declines. Negative news related to the case may suppress investor confidence and exert downward pressure on the price.

Adoption and Partnerships

Increased adoption and strategic partnerships are crucial for long-term XRP price growth.

- Positive Developments: New partnerships with financial institutions or technology companies integrating XRP into their payment systems could boost investor confidence and drive demand, pushing the price higher. Increased usage and adoption are crucial factors for long-term price appreciation.

- Adoption Hurdles: Regulatory uncertainty and competition from other cryptocurrencies remain potential hurdles to broader adoption and could limit price appreciation. Overcoming these obstacles is essential for sustained growth.

Overall Cryptocurrency Market Sentiment

The general sentiment in the cryptocurrency market heavily influences XRP's price.

- Correlation with Bitcoin: XRP often correlates with Bitcoin's price movements. A bullish Bitcoin market generally benefits altcoins like XRP, while a bearish Bitcoin market can lead to widespread sell-offs.

- Regulatory News and Volatility: Regulatory announcements and overall market volatility can impact XRP, resulting in both price increases and decreases. Macroeconomic factors and regulatory news heavily influence the overall cryptocurrency market sentiment, impacting XRP.

Potential Scenarios: Reversal or Fakeout?

Bullish Scenario (Reversal)

The $2 support could hold, leading to a price increase under certain conditions.

- Positive Catalysts: A positive resolution in the Ripple lawsuit, increased adoption by financial institutions, and a generally bullish cryptocurrency market sentiment could combine to propel XRP beyond the $2 support level.

- Technical Confirmation: Technical indicators like a bullish crossover in the MACD and an RSI rebound above 30 would confirm the reversal, bolstering confidence in a price increase.

Bearish Scenario (Fakeout)

The $2 support could break, resulting in a further price decline.

- Negative Catalysts: A negative court ruling in the Ripple case, slower-than-expected adoption, a broader cryptocurrency market downturn, or a lack of positive technical signals could all contribute to a break below $2.

- Technical Indicators: A failure to bounce back from the $2 support level, coupled with bearish technical signals like a continued downtrend in the moving averages and an RSI remaining below 30, would reinforce the bearish outlook.

Conclusion

This article analyzed XRP's current state, examining technical indicators, fundamental factors, and potential scenarios around the critical $2 support level. Both bullish and bearish outcomes are possible, depending on the Ripple lawsuit outcome, adoption rates, and broader market conditions. The $2 support is crucial; a break below it could signal further declines, while holding it could suggest a potential reversal. Understanding these factors will help you navigate the complexities of XRP price prediction.

Call to Action: Stay informed about the latest XRP market developments and continue monitoring the price action around the crucial $2 support level. Conduct thorough research before making investment decisions regarding XRP. Remember, this is not financial advice; your investment choices should be based on your risk tolerance and due diligence. Learn more about XRP price predictions and analysis by following our blog and subscribing to our newsletter.

Featured Posts

-

Uber Technologies Uber Investment Potential And Risks

May 08, 2025

Uber Technologies Uber Investment Potential And Risks

May 08, 2025 -

Record Ethereum Liquidations A Sign Of Further Price Drops

May 08, 2025

Record Ethereum Liquidations A Sign Of Further Price Drops

May 08, 2025 -

Will Trumps Policies Push Bitcoin Above 100 000 A Price Prediction Analysis

May 08, 2025

Will Trumps Policies Push Bitcoin Above 100 000 A Price Prediction Analysis

May 08, 2025 -

Rogue The Savage Land 2 Preview Ka Zars Perilous Situation

May 08, 2025

Rogue The Savage Land 2 Preview Ka Zars Perilous Situation

May 08, 2025 -

Carney Defends Canadian Sovereignty In Trump Meeting

May 08, 2025

Carney Defends Canadian Sovereignty In Trump Meeting

May 08, 2025