Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The Impact of Tariffs on Apple's Bottom Line

The $900 million tariff hit directly affects Apple's profitability and operational efficiency in several key ways.

Increased Production Costs

Tariffs directly increase the cost of manufacturing Apple products, especially those assembled in China. This is because many components used in iPhones, iPads, and other Apple devices are imported, incurring tariff charges.

- Increased cost of components: Tariffs raise the price of essential components like processors, memory chips, and displays.

- Reduced profit margins: Higher input costs translate to lower profit margins for each unit sold, impacting Apple's overall revenue.

- Potential price increases for consumers: Apple may be forced to pass some of these increased costs onto consumers through higher product prices, potentially impacting sales volumes.

For example, the tariff on certain imported components might be 25%, significantly increasing the cost of goods sold. This directly affects Apple's bottom line and its ability to maintain its current pricing strategy.

Reduced Consumer Demand

Higher prices, a direct consequence of tariffs, can reduce consumer demand for Apple products.

- Price elasticity of demand for Apple products: While Apple products enjoy strong brand loyalty, higher prices may still affect sales, particularly in price-sensitive markets.

- Competition from other brands: Competitors offering similar products at lower prices might gain market share as consumers seek alternatives.

- Shifting consumer spending habits: Economic uncertainty exacerbated by tariff-related price increases could lead consumers to delay purchases or prioritize essential spending.

Data suggests a correlation between price increases and sales fluctuations in comparable markets affected by similar tariffs. A comprehensive analysis is needed to pinpoint the exact impact on Apple's sales figures and market share trends.

Supply Chain Disruptions

Tariffs and trade tensions can disrupt Apple's intricate global supply chain.

- Delays in production: Import restrictions and logistical challenges due to trade disputes could lead to delays in manufacturing and product delivery.

- Reliance on specific regions for component sourcing: Apple's reliance on specific regions, like China, for component manufacturing makes it particularly vulnerable to disruptions in those regions.

- Alternative sourcing strategies: Apple might need to explore alternative sourcing strategies to mitigate the risk of future disruptions, which can be time-consuming and costly.

Reports indicate certain key suppliers have experienced delays, and Apple has publicly acknowledged supply chain challenges, highlighting the vulnerability of its current model.

Investor Sentiment and Market Reaction

The tariff news has created significant volatility in Apple's stock price and investor sentiment.

Stock Price Volatility

Apple's stock price exhibited significant fluctuations following the tariff announcements.

- Day-to-day price changes: Investors reacted to news and updates about the tariffs with considerable volatility in trading.

- Investor confidence levels: The uncertainty surrounding the long-term effects of tariffs negatively impacted investor confidence.

- Impact on market capitalization: The stock price fluctuations directly impacted Apple's overall market capitalization, resulting in a considerable loss of value.

Charts clearly illustrate the sharp drops and subsequent recovery attempts in Apple's stock price following tariff announcements.

Analyst Predictions

Financial analysts offer varied predictions about Apple's future performance in light of the tariffs.

- Positive and negative outlooks: Some analysts remain optimistic about Apple's long-term prospects, while others express concerns about the impact of tariffs.

- Projected earnings: Analyst forecasts for Apple's earnings have been revised downward by several firms, reflecting the anticipated impact of the increased costs.

- Long-term implications: The long-term impact of these tariffs on Apple's growth trajectory remains uncertain and is a subject of ongoing debate.

Many reputable financial institutions have issued revised earnings projections and ratings downgrades for Apple, reflecting the concerns around the tariff implications.

Investor Strategies

Investors are responding to the stock slump with a variety of strategies.

- Buy, hold, or sell decisions: Investors are making diverse decisions depending on their risk tolerance and long-term outlook for Apple.

- Diversification strategies: Some investors are diversifying their portfolios to reduce exposure to the tech sector’s volatility.

- Hedging against risks: Others are employing hedging strategies to mitigate potential losses from further stock price declines.

Trading volume and investor sentiment indices have clearly shown a shift in response to the evolving situation.

Apple's Response and Mitigation Strategies

Apple has responded to the tariff situation through official statements and strategic adjustments.

Official Statements and Actions

Apple has issued public statements acknowledging the tariff impact and outlining its responses.

- Lobbying efforts: Apple is likely engaging in lobbying efforts to influence trade policies and mitigate the impact of tariffs.

- Diversification of supply chains: Apple may be actively exploring ways to diversify its supply chain to reduce reliance on any single region.

- Cost-cutting measures: The company will likely implement cost-cutting measures to offset the increased expenses from tariffs.

Public statements by Apple executives and news reports shed light on the company's strategic response.

Long-Term Implications

The tariff situation could significantly impact Apple's long-term strategy.

- Changes in manufacturing locations: Apple might consider shifting some of its manufacturing operations to regions with more favorable trade policies.

- Pricing strategies: The company may need to revise its pricing strategies to remain competitive while absorbing increased costs.

- Product development plans: Product development plans could be altered to incorporate more cost-effective components or design changes.

Apple's history demonstrates its ability to adapt to changing market dynamics, but this challenge is of significant scale.

Conclusion: Understanding the Apple Stock Slumps and Tariff Impacts

The Apple stock slump is multifaceted, with the $900 million tariff impact playing a significant role. Key factors contributing to the decline include increased production costs, reduced consumer demand, supply chain disruptions, and negative investor sentiment. Understanding these interconnected factors is crucial for investors and industry analysts alike. Increased production costs directly impacted profit margins, reduced consumer demand due to potential price increases, and supply chain disruptions created additional challenges. Investor response reflects this uncertainty.

Key Takeaways: The interplay between tariffs, Apple's financial health, and investor confidence reveals the complexities of global trade and its impact on leading tech companies.

Call to Action: Stay updated on further developments in Apple stock and the influence of tariffs on its performance and the tech industry as a whole. Follow our analysis for continuous updates on Apple's response to the $900 million tariff impact and its broader implications.

Featured Posts

-

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025

May 24, 2025

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025

May 24, 2025 -

Pokolenie Peremen Chto Udalos Izmenit

May 24, 2025

Pokolenie Peremen Chto Udalos Izmenit

May 24, 2025 -

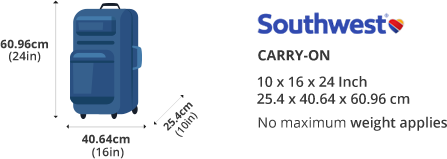

Southwest Airlines Changes To Carry On Baggage Policy Regarding Portable Chargers

May 24, 2025

Southwest Airlines Changes To Carry On Baggage Policy Regarding Portable Chargers

May 24, 2025 -

Analysis Open Ais Strategic Move To Acquire Jony Ives Ai Technology

May 24, 2025

Analysis Open Ais Strategic Move To Acquire Jony Ives Ai Technology

May 24, 2025

Latest Posts

-

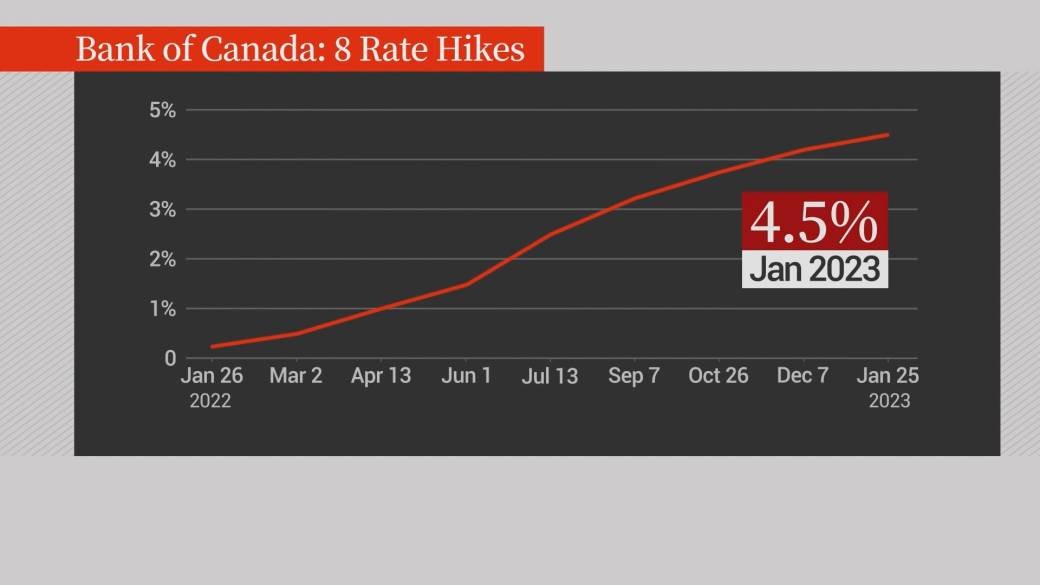

Bank Of Canada To Cut Rates Three More Times Desjardins Weighs In

May 24, 2025

Bank Of Canada To Cut Rates Three More Times Desjardins Weighs In

May 24, 2025 -

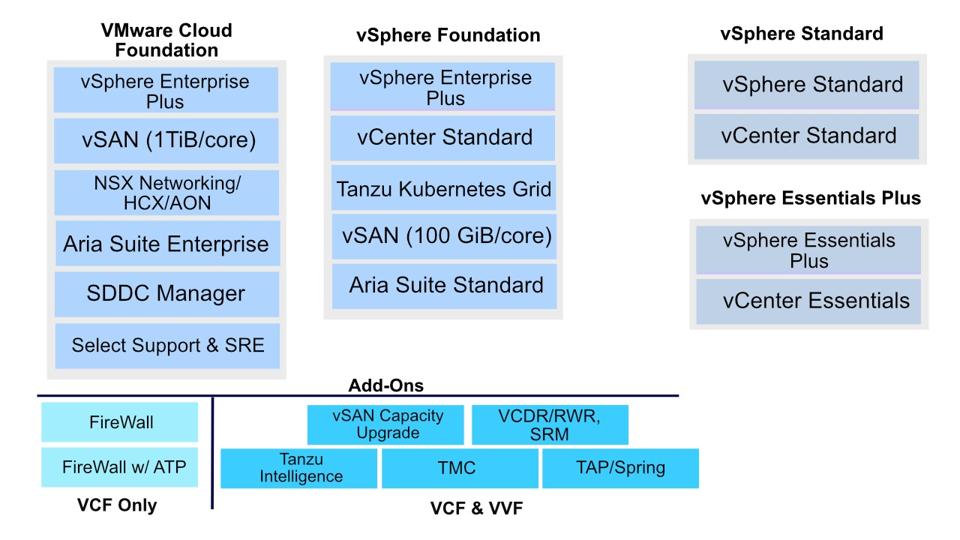

Extreme Price Hike At And T Details Broadcoms 1 050 V Mware Cost Increase

May 24, 2025

Extreme Price Hike At And T Details Broadcoms 1 050 V Mware Cost Increase

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Cuts

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Interest Rate Cuts

May 24, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A Staggering 1 050 Price Hike

May 24, 2025

Broadcoms V Mware Acquisition At And T Highlights A Staggering 1 050 Price Hike

May 24, 2025 -

Bank Of Canada Rate Cuts Desjardins Predicts Three More

May 24, 2025

Bank Of Canada Rate Cuts Desjardins Predicts Three More

May 24, 2025