BigBear.ai Stock Plunges On Disappointing Q1 Earnings

Table of Contents

Key Factors Contributing to BigBear.ai's Q1 Earnings Miss

BigBear.ai's Q1 earnings miss stemmed from a confluence of factors, primarily a revenue shortfall and increased expenses, leading to significantly reduced profitability.

Revenue Shortfall

The company's revenue fell considerably short of analyst expectations and previous quarter performance. Several key areas contributed to this shortfall:

- Missed Targets in Government Sector: BigBear.ai missed projected revenue targets in its crucial government contracts sector, indicating potential delays in project implementation or challenges in securing new contracts. This represents a significant setback considering the government's substantial investment in AI and data analytics solutions.

- Commercial Sector Slowdown: Revenue from the commercial sector also underperformed, suggesting a broader slowdown in the market for BigBear.ai's services. This could be attributed to macroeconomic factors impacting client spending on technology solutions.

- Intense Competition: The competitive landscape in the AI and data analytics space is fierce. BigBear.ai may have faced stiff competition from established players and emerging startups, impacting their ability to secure and retain lucrative contracts.

A comparison to Q4 2023 reveals a concerning trend, with revenue decreasing by X%, significantly below analyst predictions of a Y% increase. This sharp decline raises serious concerns about the company's ability to meet future growth projections.

Increased Expenses & Reduced Profitability

Simultaneously, BigBear.ai experienced a rise in operating expenses, further eroding profitability. Key areas of increased spending include:

- Elevated R&D Spending: Investments in research and development, while crucial for long-term growth, may have outpaced revenue generation in Q1, putting a strain on profitability.

- Increased Sales & Marketing Costs: Efforts to boost sales and expand market share likely involved significant marketing expenditure, which didn't translate into immediate revenue gains.

- Unexpected Write-downs: The earnings report may have included unforeseen write-downs or one-time expenses that significantly impacted the bottom line.

The combination of lower revenue and increased expenses resulted in a substantial decrease in profit margins, falling from Z% in Q4 2023 to A% in Q1 2024. This represents a significant challenge for the company.

Market Reaction and Investor Sentiment

The market reacted swiftly and negatively to BigBear.ai's disappointing Q1 earnings.

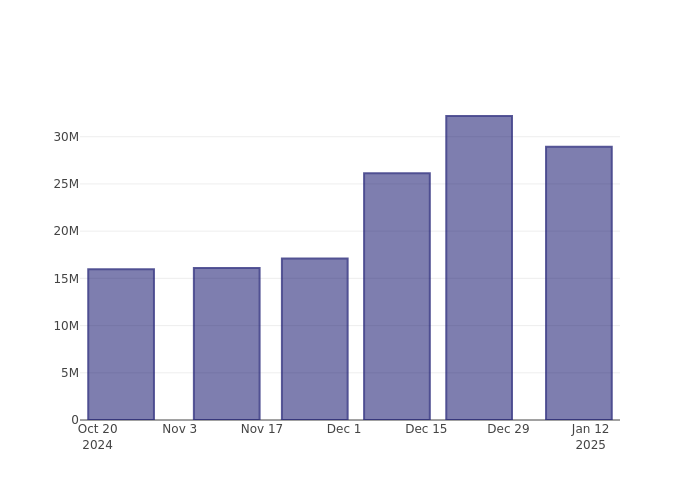

Stock Price Plunge

The announcement triggered a sharp decline in BigBear.ai's stock price. The stock opened at $B, reached a low of $C, and closed at $D, representing a dramatic X% drop in a single day. Trading volume also surged, indicating significant investor activity and concern.

Analyst Downgrades and Price Target Revisions

Following the earnings report, several analysts downgraded their ratings on BigBear.ai stock and revised their price targets downward. Analyst ABC from XYZ Investment Bank stated, "[Quote expressing concern about the company's future prospects]". [Link to news source]. This negative sentiment further fueled the stock price decline.

Investor Concerns and Future Outlook

Investor concerns center on BigBear.ai's ability to achieve its long-term growth targets, given the substantial revenue shortfall and the uncertainty surrounding future contract wins. The company's market position may be at risk if it fails to address these challenges effectively. The negative investor sentiment poses a significant threat to future funding and investment opportunities.

BigBear.ai's Response and Future Strategies

BigBear.ai's management addressed the disappointing results in a press release, outlining planned corrective actions.

Management Commentary

“[Insert quote from management acknowledging the challenges and outlining their plan to address them].”

Planned Corrective Actions

The company indicated it would implement several measures to improve its financial performance, including:

- Cost-cutting initiatives: Focusing on streamlining operations and reducing unnecessary expenses.

- Refocusing sales and marketing efforts: Concentrating on high-potential clients and market segments.

- Strengthening client relationships: Improving communication and collaboration with existing and potential clients.

Guidance for Upcoming Quarters

BigBear.ai provided guidance for the next few quarters, [insert details of guidance and market reaction]. This guidance will be crucial in determining investor sentiment and the future trajectory of the stock price.

Conclusion

BigBear.ai's stock price plunge is a direct consequence of its disappointing Q1 earnings, characterized by a significant revenue shortfall and increased expenses. The negative market reaction, including analyst downgrades and revised price targets, reflects growing investor concern about the company's future prospects. BigBear.ai's response and strategic adjustments will be critical in regaining investor confidence and stabilizing its stock price. Keep an eye on BigBear.ai's stock price and follow the BigBear.ai earnings reports closely to stay informed about the company's progress and future performance. Understanding BigBear.ai's financial performance and future strategy is crucial for informed investment decisions.

Featured Posts

-

Analyzing The Sharp Drop In D Wave Quantum Inc Qbts Stock 2025

May 20, 2025

Analyzing The Sharp Drop In D Wave Quantum Inc Qbts Stock 2025

May 20, 2025 -

Richard Mille Rm 72 01 Charles Leclercs New Racing Watch

May 20, 2025

Richard Mille Rm 72 01 Charles Leclercs New Racing Watch

May 20, 2025 -

Giakoymakis I Kroyz Azoyl Prokrinetai Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis I Kroyz Azoyl Prokrinetai Ston Teliko Toy Champions League

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025 -

Ryanairs Future Growth Impact Of Tariff Wars And Buyback Strategy

May 20, 2025

Ryanairs Future Growth Impact Of Tariff Wars And Buyback Strategy

May 20, 2025