Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to today's sharp decline in the DAX, impacting the German Stock Market significantly.

Global Economic Uncertainty

Global economic uncertainty is a major driver of the current market volatility. Rising inflation rates across the globe, coupled with aggressive interest rate hikes by central banks like the US Federal Reserve, are dampening investor confidence. Geopolitical instability, particularly the ongoing war in Ukraine and its impact on energy supplies, further exacerbates these concerns.

- Weakening Euro: The Euro's weakening against the US dollar increases import costs for German businesses, impacting profitability and potentially slowing economic growth.

- US Federal Reserve Policy: The Federal Reserve's aggressive interest rate hikes aim to curb inflation but also risk triggering a global recession, impacting investment flows into Germany and Europe.

- Ongoing War in Ukraine: The conflict continues to disrupt global supply chains, increasing energy prices and creating uncertainty for businesses reliant on imports from the region.

- Energy Crisis: Europe's dependence on Russian energy has been severely disrupted, leading to soaring energy prices and impacting industrial production across the continent. Germany, as a major industrial power, is particularly vulnerable. For example, the recent inflation rate in Germany (insert current data if available) highlights the severity of this energy crisis impact.

Concerns within the German Economy

Beyond global headwinds, the German economy faces its own set of challenges that contribute to the DAX decline. Supply chain disruptions, high energy costs, and weakening export demand are all significant factors impacting investor sentiment towards the Frankfurt Stock Exchange.

- Automotive Sector Slowdown: The German automotive industry, a cornerstone of the economy, is experiencing a slowdown due to supply chain issues and decreased global demand.

- Inflation Impacting Consumer Spending: High inflation is eroding consumer purchasing power, leading to reduced spending and impacting the growth of domestic-focused businesses.

- Energy Dependence on Russia: Germany's significant reliance on Russian energy has left its economy vulnerable to disruptions and price volatility, further dampening investor confidence in the German Stock Market and the Frankfurt Stock Exchange. Statistics showing the percentage of German energy sourced from Russia (insert relevant data if available) illustrate the scale of this challenge.

Sector-Specific Performance

The DAX decline isn't uniform across all sectors. Some sectors have been hit harder than others, reflecting the specific challenges they face.

- Energy Sector Performance: The energy sector, already under pressure due to the global energy crisis, has seen significant losses, reflecting the uncertainty in the market. (Mention specific companies and their performance data if available, e.g., "RWE experienced a X% decline").

- Technology Sector Losses: The technology sector, sensitive to interest rate changes and global economic uncertainty, has also experienced considerable losses. (Mention specific companies and their performance data if available).

- Financial Sector Stability: While the financial sector has shown some resilience, it remains exposed to the broader economic headwinds and the potential for further market volatility impacting the Frankfurt Stock Exchange.

Investor Sentiment and Market Volatility

The DAX decline reflects a significant shift in investor sentiment. The increased market volatility has led to cautious investor behavior, with many adopting a "wait-and-see" approach. A flight to safety is evident, with investors seeking refuge in safer assets like gold and government bonds.

- Increased Market Volatility: The DAX has seen increased daily fluctuations, indicating heightened uncertainty and risk aversion among investors.

- Cautious Investor Behavior: Investors are holding back from making significant new investments, preferring to wait for clearer signs of economic recovery.

- Flight to Safety Investments: The demand for safe-haven assets, such as gold and government bonds, has increased, reflecting investors' concerns about the overall economic outlook and the instability in the Frankfurt Stock Exchange.

- Trading Volume: Increased trading volume during the decline shows heightened activity as investors react to the changing market conditions and the drop in the DAX. (Include data on trading volume if available).

Potential Implications and Future Outlook

The DAX decline carries significant implications for the German economy and the broader European market. The short-term outlook remains uncertain, with the potential for further declines depending on the evolution of global and domestic economic factors.

- Impact on Consumer Confidence: Continued economic uncertainty and market volatility could negatively impact consumer confidence and spending, further slowing economic growth.

- Potential for Further Decline: The DAX could experience further declines depending on the resolution (or lack thereof) of several key factors contributing to the current volatility.

- Government Intervention Possibilities: The German government may consider implementing measures to mitigate the economic impact and support businesses and consumers.

- Potential Recovery Scenarios: A stabilization of the global economy, a resolution to the energy crisis, and improved investor confidence could contribute to a potential recovery in the DAX. (Include expert opinions and forecasts from reputable sources).

Conclusion

The Frankfurt Stock Market's decline, with the DAX closing below 24,000 points, is a result of several converging factors, including global economic uncertainty, challenges within the German economy, and sector-specific weaknesses. The resulting market volatility and cautious investor sentiment highlight the importance of careful monitoring and informed decision-making.

Call to Action: Stay informed about the fluctuating Frankfurt Stock Market and the DAX index. Regularly monitor market news and analysis to make informed investment decisions. Understanding the factors influencing the DAX is crucial for navigating the complexities of the German stock market and mitigating risks. Continue to follow our updates on the Frankfurt Stock Exchange and DAX performance to stay ahead of the curve.

Featured Posts

-

M6 Closure Latest News And Travel Disruptions Due To Accident

May 24, 2025

M6 Closure Latest News And Travel Disruptions Due To Accident

May 24, 2025 -

Memorial Day 2025 Air Travel When To Book For The Best Prices And Avoid Crowds

May 24, 2025

Memorial Day 2025 Air Travel When To Book For The Best Prices And Avoid Crowds

May 24, 2025 -

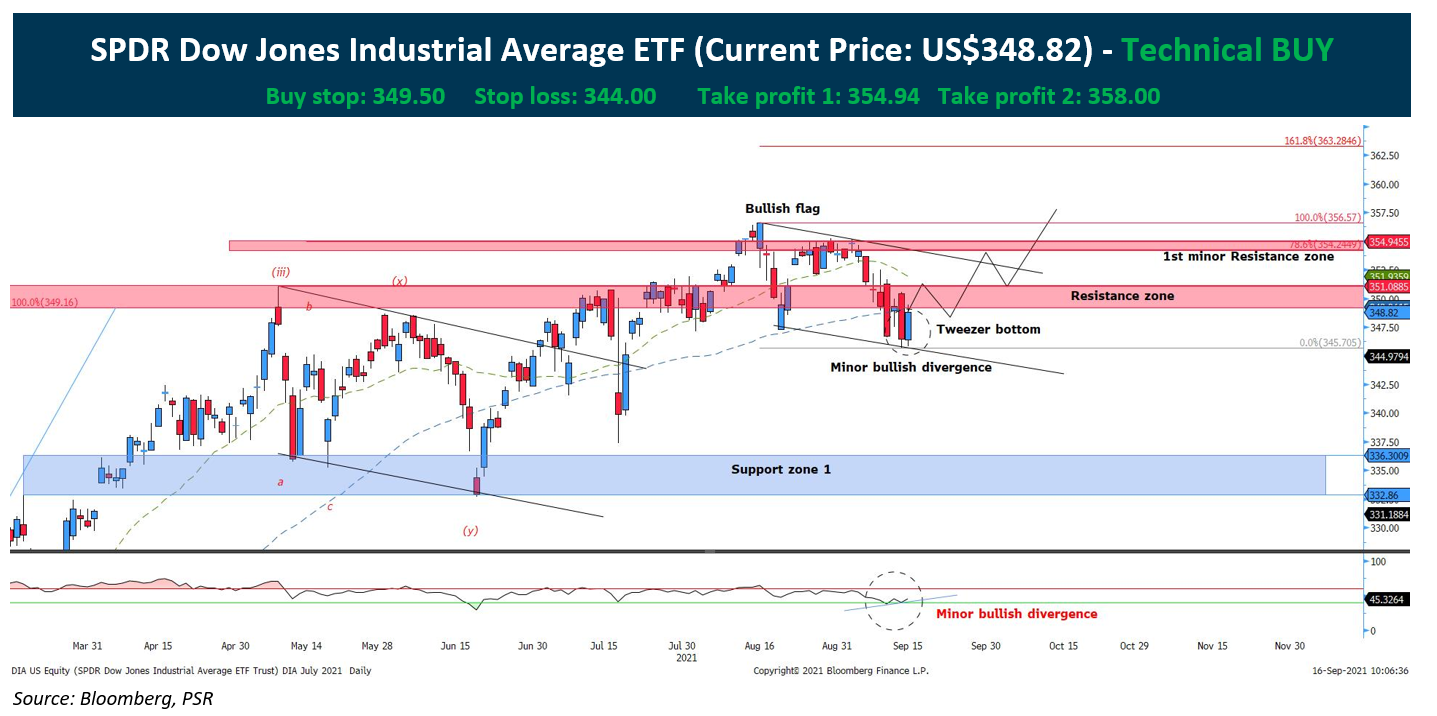

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 24, 2025 -

Joy Crookes Unveils Haunting New Track I Know You D Kill Details Inside

May 24, 2025

Joy Crookes Unveils Haunting New Track I Know You D Kill Details Inside

May 24, 2025 -

Planning Your Memorial Day Trip Smart Flight Dates For 2025

May 24, 2025

Planning Your Memorial Day Trip Smart Flight Dates For 2025

May 24, 2025

Latest Posts

-

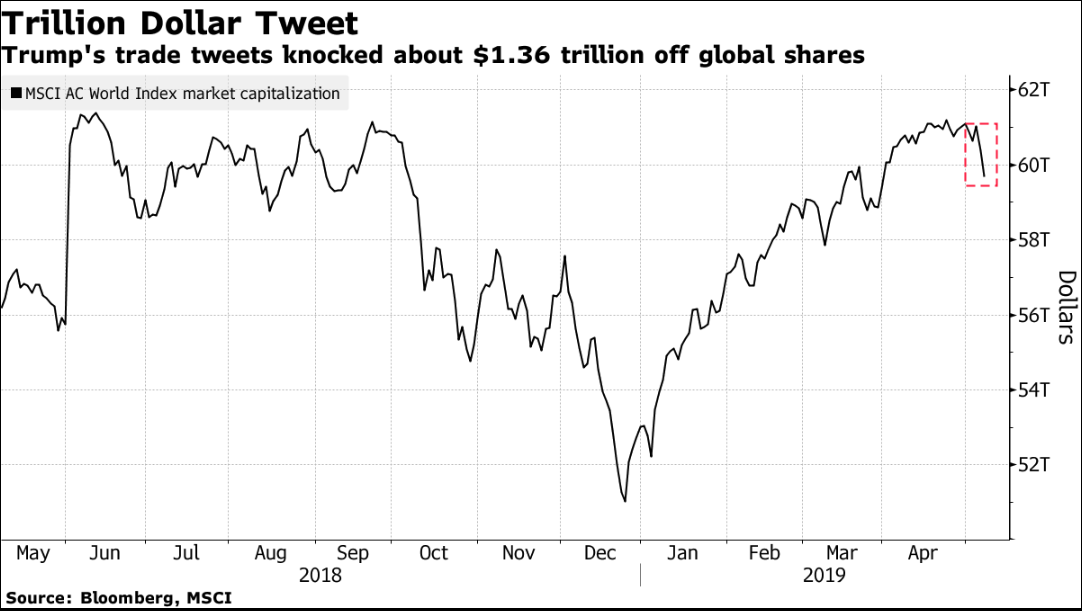

Trump E I Dazi Analisi Dell Effetto Negativo Sul Mercato Della Moda

May 24, 2025

Trump E I Dazi Analisi Dell Effetto Negativo Sul Mercato Della Moda

May 24, 2025 -

European Stock Market Reaction To Trumps Auto Tariff Comments

May 24, 2025

European Stock Market Reaction To Trumps Auto Tariff Comments

May 24, 2025 -

Dazi Trump 20 Impatto Sul Settore Moda Europeo Nike E Lululemon In Calo

May 24, 2025

Dazi Trump 20 Impatto Sul Settore Moda Europeo Nike E Lululemon In Calo

May 24, 2025 -

Trumps Tariff Relief Hint Boosts European Stocks Lvmh Shares Fall

May 24, 2025

Trumps Tariff Relief Hint Boosts European Stocks Lvmh Shares Fall

May 24, 2025 -

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025

European Shares Rise On Trump Tariff Hint Lvmh Dips

May 24, 2025