Hong Kong Monetary Authority Intervention: Impact On HKD/USD And Interest Rates

Table of Contents

The Hong Kong Dollar's Linked Exchange Rate System

Hong Kong operates under a linked exchange rate system, pegging the HKD to the USD within a narrow band. This system, managed by the HKMA, aims to provide currency stability and foster economic confidence.

- Definition of the HKD/USD peg and its implications for currency stability: The HKD is pegged to the USD at a rate of 7.75-7.85 HKD per USD. This relatively stable exchange rate minimizes exchange rate risk for businesses and investors, promoting international trade and investment.

- Explanation of the exchange rate band and its fluctuations: While pegged, the HKD can fluctuate within a narrow band. Small deviations within this range are allowed, reflecting market forces. Significant deviations, however, trigger HKMA intervention.

- The role of the HKMA in managing the currency board system: The HKMA acts as the manager of the currency board system. It maintains sufficient foreign currency reserves to back the HKD, ensuring the peg's credibility. This involves careful monitoring of the market and strategic interventions.

- Importance of maintaining confidence in the peg for Hong Kong's economy: Maintaining confidence in the peg is paramount. Any perceived weakness in the peg can lead to capital flight and economic instability. The HKMA's actions are geared towards preserving this confidence.

Mechanisms of HKMA Intervention

The HKMA employs several mechanisms to manage the HKD/USD exchange rate, primarily through buying and selling US dollars in the foreign exchange market.

- Buying US dollars to strengthen the HKD when it weakens: When the HKD weakens towards the weak end of the band (7.85 HKD/USD), the HKMA buys US dollars, increasing demand for HKD and pushing its value upwards.

- Selling US dollars to weaken the HKD when it strengthens: Conversely, if the HKD strengthens towards the strong end of the band (7.75 HKD/USD), the HKMA sells US dollars, increasing the supply of HKD and lowering its value.

- The use of the Exchange Fund to manage interventions: The HKMA utilizes its substantial Exchange Fund reserves to finance these interventions. This fund acts as a crucial buffer against speculative attacks and market fluctuations.

- Impact of the intervention on the money supply: These interventions directly impact Hong Kong's money supply. Buying US dollars reduces the money supply, while selling US dollars increases it. This is a key aspect of monetary policy in Hong Kong.

- Potential use of other monetary policy tools: While buying and selling US dollars is the primary method, the HKMA may also use other tools, such as adjusting interest rates, to manage liquidity and maintain the peg.

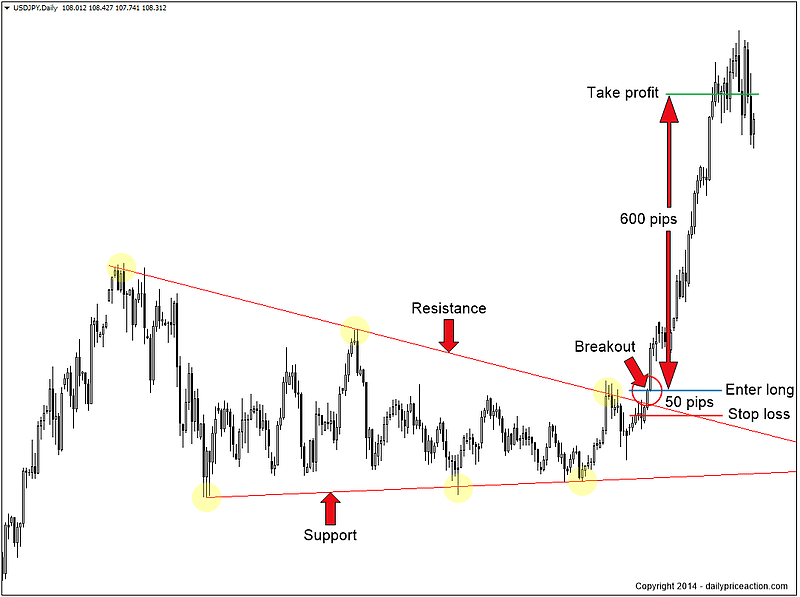

Impact on HKD/USD Exchange Rate

HKMA interventions have generally been effective in maintaining the HKD/USD peg within the allowed band. However, the effectiveness varies depending on the intensity and nature of market pressures.

- Case studies of successful HKMA interventions: Numerous instances demonstrate the HKMA's successful interventions in stabilizing the HKD during periods of market volatility, preventing significant deviations from the peg.

- Analysis of periods where the HKD experienced significant pressure: While the peg has generally held, there have been periods of significant pressure, particularly during times of global financial turmoil. These periods highlight the challenges of maintaining a fixed exchange rate in a volatile global environment.

- The role of speculation and market sentiment in influencing the exchange rate: Speculative attacks and shifts in market sentiment can put pressure on the peg. The HKMA's ability to counter these forces is crucial.

- Long-term trends in the HKD/USD exchange rate: Despite short-term fluctuations, the long-term trend shows remarkable stability, a testament to the effectiveness of the HKMA's interventions and the strength of the linked exchange rate system.

Speculative Attacks and their Mitigation

The HKD peg has faced speculative attacks in the past, testing the resilience of the system.

- Examples of past speculative attacks on the Hong Kong dollar: The Asian Financial Crisis of 1997-98 saw significant attacks on the HKD, highlighting the vulnerability of a fixed exchange rate system to speculative pressures.

- The HKMA's strategies for deterring and mitigating speculative attacks: The HKMA employs various strategies, including maintaining substantial foreign reserves, actively intervening in the market, and communicating transparently with market participants.

- The importance of transparency and communication in maintaining market confidence: Open communication about the HKMA's actions and strategies helps to maintain market confidence and deter speculative attacks.

Impact on Interest Rates in Hong Kong

HKMA interventions directly influence Hong Kong's interest rates, largely mirroring US interest rate movements.

- The relationship between the HKD/USD exchange rate and Hong Kong interest rates: To maintain the peg, the HKMA often adjusts interest rates in line with US rates. Higher US interest rates usually lead to higher Hong Kong interest rates.

- How interest rate adjustments are used to maintain the currency peg: Interest rate adjustments help control capital flows and maintain the HKD/USD exchange rate within the band.

- The impact of US interest rate changes on Hong Kong interest rates: Changes in US interest rates significantly impact Hong Kong interest rates due to the linked exchange rate system.

- The implications for borrowing costs and investment decisions in Hong Kong: These interest rate movements affect borrowing costs for businesses and individuals, influencing investment decisions and economic activity.

Conclusion

The Hong Kong Monetary Authority Intervention plays a vital role in maintaining the stability of the HKD/USD exchange rate and influencing interest rates in Hong Kong. The HKMA's interventions, primarily through buying and selling US dollars, effectively manage fluctuations within the allowed band and mitigate speculative attacks. Understanding the mechanisms of these interventions and their impact on the Hong Kong economy is crucial. The interplay between the HKD/USD exchange rate, Hong Kong interest rates, and the overall economic health of Hong Kong is complex but fundamentally linked to the effectiveness of HKMA interventions. For further insights into the complexities of Hong Kong Monetary Authority Intervention and its impact on the HKD/USD exchange rate and interest rates, continue researching the topic using reliable financial news sources and the HKMA's official website. Understanding Hong Kong Monetary Authority interventions is crucial for anyone involved in the Hong Kong financial market.

Featured Posts

-

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Heart Of The Lawsuit

May 08, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Heart Of The Lawsuit

May 08, 2025 -

Is Uber Technologies Uber A Smart Investment

May 08, 2025

Is Uber Technologies Uber A Smart Investment

May 08, 2025 -

Recent Ethereum Price Action Resilience And Breakout Potential

May 08, 2025

Recent Ethereum Price Action Resilience And Breakout Potential

May 08, 2025 -

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 08, 2025

Spac Stock Surge Should You Invest In This Micro Strategy Competitor

May 08, 2025 -

The Ps 5 Pro A Less Successful Launch Than Its Predecessor

May 08, 2025

The Ps 5 Pro A Less Successful Launch Than Its Predecessor

May 08, 2025