How Tariffs Are Slowing Down Big Tech's Advertising Revenue

Table of Contents

A recent report showed a 5% decline in year-over-year growth for Big Tech advertising revenue in Q3 2023. The escalating trade war and subsequent tariffs are significantly impacting Big Tech's advertising revenue streams, creating a ripple effect across the digital advertising landscape. Tariffs, essentially taxes on imported goods, introduce a complex web of challenges that stifle growth and profitability within the tech sector's lucrative advertising ecosystem. This article will analyze the various ways tariffs are slowing down Big Tech's advertising revenue.

Increased Costs for Ad Tech Platforms & Services:

Higher Input Costs: Tariffs on imported components crucial for ad tech platforms dramatically increase operational costs. These tariffs directly impact the bottom line, squeezing profit margins and potentially forcing price increases for advertising services.

- Examples of affected components: Servers, microchips, specialized software licenses, and data center hardware.

- Quantifiable impact: A 10% tariff on imported servers, for example, could translate to a 2-5% increase in overall operational costs, depending on the reliance on imported components. This increase eats into profit margins and ultimately reduces the revenue available to Big Tech companies.

Supply Chain Disruptions: Tariffs don't just increase costs; they also disrupt the intricate supply chains upon which ad tech platforms rely. Delays in receiving essential components can lead to project delays, impacting the timely delivery of advertising services and harming client relationships.

- Examples of delays: Delays in server deliveries can postpone the launch of new ad tech features or upgrades, impacting campaign performance. Software updates might be delayed, impacting the effectiveness of targeted advertising campaigns.

- Ripple effect: These delays ripple through the advertising ecosystem, impacting both advertisers (who may miss crucial marketing windows) and publishers (who experience reduced ad revenue).

Reduced Consumer Spending & Advertising Budgets:

Economic Slowdown: Tariffs contribute to broader economic slowdowns. When import costs rise due to tariffs, the prices of consumer goods increase, reducing consumer disposable income. This directly impacts advertising budgets, as companies cut back on marketing expenses during periods of economic uncertainty.

- Affected industries: Retail, manufacturing, and consumer goods are especially sensitive to tariff-induced price hikes and subsequent drops in consumer spending. Consequently, advertising budgets in these sectors are often the first to be cut.

- Statistical data: Studies have shown a correlation between increased tariffs and decreased consumer spending, resulting in a contraction in advertising revenue across multiple sectors.

Shifting Consumer Behavior: Tariffs can subtly alter consumer behavior, impacting online shopping patterns and, by extension, digital advertising revenue. For example, consumers might switch to domestically produced goods, potentially affecting online advertising channels that focus on imported products.

- Changes in purchasing habits: Increased prices on imported goods may lead consumers to explore alternative brands or shopping channels, resulting in shifts in online advertising demand.

- Impact on advertising channels: Search engine advertising (SEA) and social media advertising (SMA) can be significantly affected as consumer preferences and purchasing behavior change.

Impact on Cross-Border Data Transfer and Privacy Regulations:

Increased Compliance Costs: Navigating the complexities of data privacy regulations in a tariff-affected environment increases compliance costs for Big Tech companies. These regulations, particularly regarding cross-border data transfers, become more expensive and time-consuming to adhere to.

- Examples of regulations: GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) are examples of regulations that impact data handling and cross-border data flows, leading to higher compliance costs.

- Impact on profitability: These increased compliance costs directly reduce the profitability of advertising activities, making targeted advertising and data-driven campaigns more expensive to execute.

Restrictions on Data Flow: While not directly caused by tariffs, they can indirectly lead to restrictions on cross-border data transfers, hampering targeted advertising. This can result from trade disputes causing governments to implement stricter data localization policies.

- Potential data transfer restrictions: Governments might impose restrictions on the transfer of user data across borders, hindering the ability of ad tech companies to analyze consumer behavior and tailor advertising effectively.

- Implications for personalized advertising: Restrictions on data flow can limit the effectiveness of personalized advertising and sophisticated targeting strategies, reducing ad campaign ROI for both advertisers and publishers.

Conclusion:

In summary, tariffs negatively impact Big Tech's advertising revenue through increased costs for ad tech platforms, reduced consumer spending and advertising budgets, and increased complexities surrounding cross-border data transfer and privacy regulations. The financial impact is significant, with potential long-term consequences for Big Tech companies and the broader digital advertising ecosystem. Understanding how tariffs are slowing down Big Tech's advertising revenue is crucial for navigating the evolving digital landscape. Stay informed about the latest developments in trade policy and their impact on the advertising industry.

Featured Posts

-

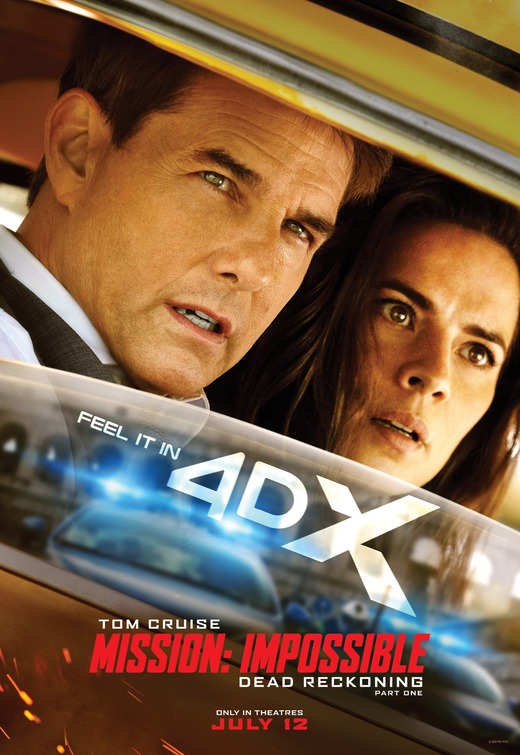

Behind The Scenes Mission Impossible Dead Reckonings Epic Plane Sequence

Apr 26, 2025

Behind The Scenes Mission Impossible Dead Reckonings Epic Plane Sequence

Apr 26, 2025 -

The Jennifer Aniston Chelsea Handler Friendship Split What Happened

Apr 26, 2025

The Jennifer Aniston Chelsea Handler Friendship Split What Happened

Apr 26, 2025 -

Anchor Brewing Companys Closure Whats Next For San Francisco Beer

Apr 26, 2025

Anchor Brewing Companys Closure Whats Next For San Francisco Beer

Apr 26, 2025 -

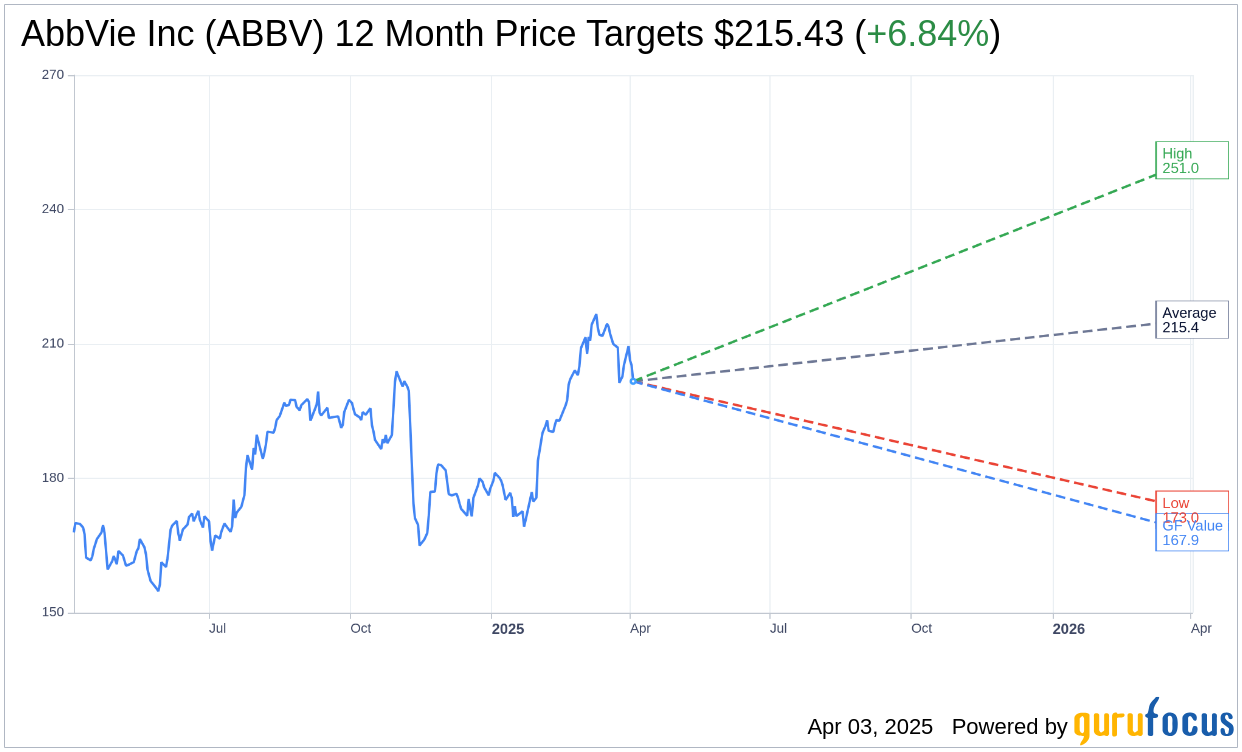

Abb Vie Abbv Raises Profit Outlook Strong Sales Growth From Newer Drugs

Apr 26, 2025

Abb Vie Abbv Raises Profit Outlook Strong Sales Growth From Newer Drugs

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Full Trailer Review

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Full Trailer Review

Apr 26, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

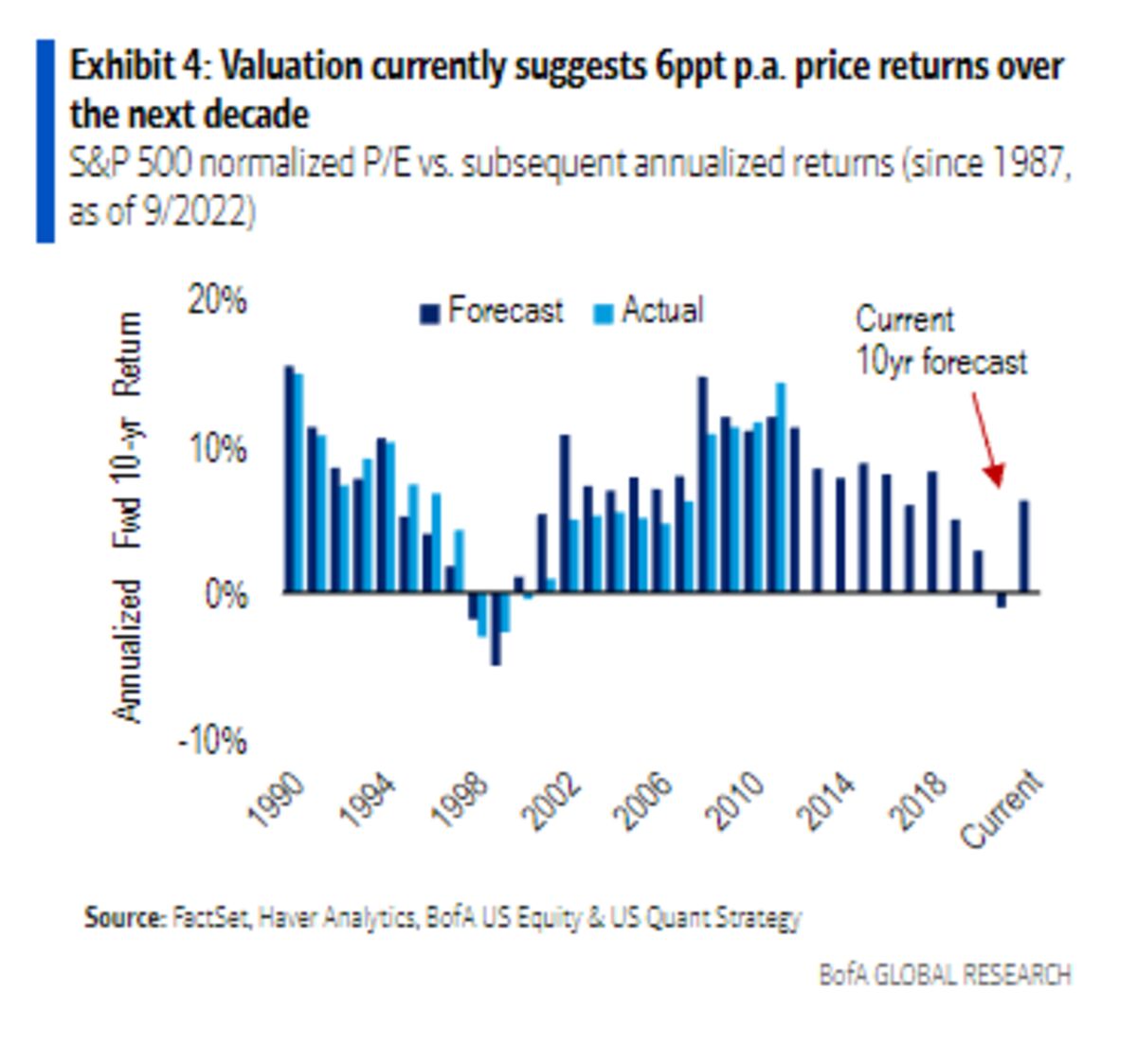

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025