Investment Opportunities In Hong Kong: Chinese Stocks' Recent Surge

Table of Contents

Understanding the Recent Surge in Chinese Stocks

The remarkable growth in Chinese stocks listed in Hong Kong is fueled by a confluence of economic factors and shifting investor sentiment.

Economic Factors Driving Growth

Several key economic indicators contribute to the surge:

- Government Policies: Supportive government policies aimed at stimulating economic growth, particularly in technology and renewable energy, have fostered a positive investment climate. Initiatives like the "Made in China 2025" plan and emphasis on technological self-reliance are key drivers.

- Technological Advancements: China's rapid technological progress, especially in areas like artificial intelligence, e-commerce, and fintech, has created numerous high-growth companies attracting significant investment.

- Consumer Spending: A burgeoning middle class with increasing disposable income fuels robust consumer spending, benefiting companies in the consumer goods and services sectors.

This growth is particularly evident in sectors like:

- Technology: Giants like Tencent, Alibaba, and Meituan have fueled significant index gains.

- Renewable Energy: Government support for green initiatives drives investment in solar, wind, and other renewable energy technologies.

- Consumer Goods: Companies catering to the growing middle class's demand for higher-quality goods and services experience substantial growth.

Indices like the Hang Seng Index and the CSI 300 reflect this positive trend, showcasing impressive year-on-year growth.

Geopolitical Implications and Investment Sentiment

Global events and geopolitical factors significantly impact Chinese stock performance. Recent shifts in global trade relations and easing geopolitical tensions have contributed to improved investor sentiment. However, regulatory changes, such as those impacting technology companies, can create market volatility. Understanding these nuances is crucial for successful investment.

Top Investment Opportunities in Hong Kong

Hong Kong offers a unique platform for accessing the Chinese market.

Accessing Chinese Stocks through Hong Kong

Investing in Chinese stocks listed in Hong Kong provides several advantages:

- Accessibility: Hong Kong's well-established and regulated stock market offers easier access compared to investing directly in mainland China.

- Regulatory Clarity: The Hong Kong Stock Exchange offers a more transparent and regulated environment.

- Diversification: Investing through Hong Kong allows for diversification within the Chinese market and across various sectors.

Investors can utilize different vehicles:

- ETFs: Exchange-Traded Funds provide diversified exposure to the Chinese market with relatively low expense ratios.

- Individual Stocks: Investing in individual companies allows for targeted exposure to specific sectors or companies with high growth potential.

Compared to direct investment in mainland China, Hong Kong offers greater accessibility, regulatory clarity, and often simpler trading processes.

Promising Sectors for Investment

Several sectors in Hong Kong, strongly tied to the Chinese mainland, present promising long-term growth opportunities:

- Fintech: Rapid growth in mobile payments, online lending, and other financial technologies creates exciting opportunities.

- Healthcare: An aging population and increasing healthcare spending drive demand for pharmaceutical companies, medical devices, and healthcare services.

- Consumer Discretionary: The burgeoning middle class fuels demand for luxury goods, travel, and entertainment.

Companies in these sectors, many listed on the Hong Kong Stock Exchange, offer significant growth potential, though careful risk assessment is necessary.

Diversification Strategies for Hong Kong Investments

Diversification is paramount in mitigating risk. Consider:

- Geographic Diversification: Don't limit investments solely to Hong Kong or China; include assets from other global markets.

- Sector Diversification: Spread investments across different sectors to reduce dependence on any single industry.

- Asset Class Diversification: Include various asset classes like bonds, real estate, and commodities to balance risk and reward.

Determining your risk tolerance and aligning your investment strategy accordingly is crucial.

Navigating the Risks of Investing in Chinese Stocks

While the potential rewards are significant, understanding the risks is equally crucial.

Geopolitical Risks and Regulatory Uncertainty

Geopolitical tensions and regulatory changes in both China and Hong Kong can significantly impact investment returns. Staying informed about political developments and regulatory shifts is essential.

Market Volatility and Currency Fluctuations

The Chinese stock market is inherently volatile. Currency fluctuations between the USD, HKD, and CNY can further influence returns. Strategies to mitigate these risks include hedging and careful portfolio management.

Due Diligence and Investment Research

Thorough due diligence and independent research are paramount. Utilize reputable financial news sources, analyst reports, and company filings to make informed investment decisions.

Conclusion: Unlocking Investment Opportunities in Hong Kong

The recent surge in Chinese stocks presents compelling investment opportunities in Hong Kong. While the potential for significant returns is undeniable, understanding and managing the inherent risks through diversification and thorough research is crucial. Start your journey to unlock the exciting investment opportunities in Hong Kong's dynamic market today. Conduct thorough research and consider consulting a financial advisor before making any investment decisions. Remember, successful investment in Hong Kong investment opportunities requires careful planning and due diligence.

Featured Posts

-

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025 -

Tesla Space X And The Epa The Impact Of Elon Musks Actions

Apr 24, 2025

Tesla Space X And The Epa The Impact Of Elon Musks Actions

Apr 24, 2025 -

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025

Oblivion Remastered Now Available From Bethesda

Apr 24, 2025 -

Ice Blocks Columbia Student Mahmoud Khalil From Attending Sons Birth

Apr 24, 2025

Ice Blocks Columbia Student Mahmoud Khalil From Attending Sons Birth

Apr 24, 2025 -

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

Apr 24, 2025

High Stock Market Valuations Why Bof A Thinks Investors Shouldnt Panic

Apr 24, 2025

Latest Posts

-

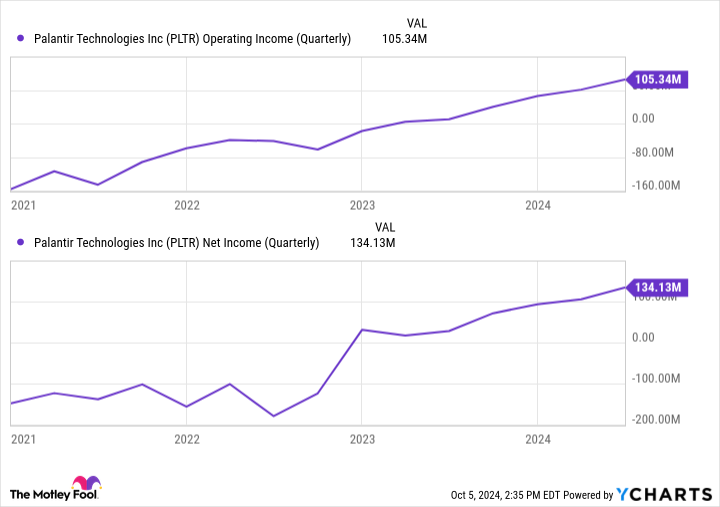

Is Now The Right Time To Invest In Palantir Technologies Stock Pltr

May 10, 2025

Is Now The Right Time To Invest In Palantir Technologies Stock Pltr

May 10, 2025 -

Palantir Technologies Stock Buy Or Sell Evaluating The Investment Potential

May 10, 2025

Palantir Technologies Stock Buy Or Sell Evaluating The Investment Potential

May 10, 2025 -

Will Palantir Hit A 1 Trillion Valuation Analyzing The Potential By 2030

May 10, 2025

Will Palantir Hit A 1 Trillion Valuation Analyzing The Potential By 2030

May 10, 2025 -

The Palantir Stock Rally New Forecasts And Market Implications

May 10, 2025

The Palantir Stock Rally New Forecasts And Market Implications

May 10, 2025 -

Revised Palantir Predictions Analyzing The Factors Behind The Stock Rally

May 10, 2025

Revised Palantir Predictions Analyzing The Factors Behind The Stock Rally

May 10, 2025