Musk's Political Ties Weigh On Tesla's Q1 Financial Performance

Table of Contents

Decreased Investor Confidence and Stock Market Volatility

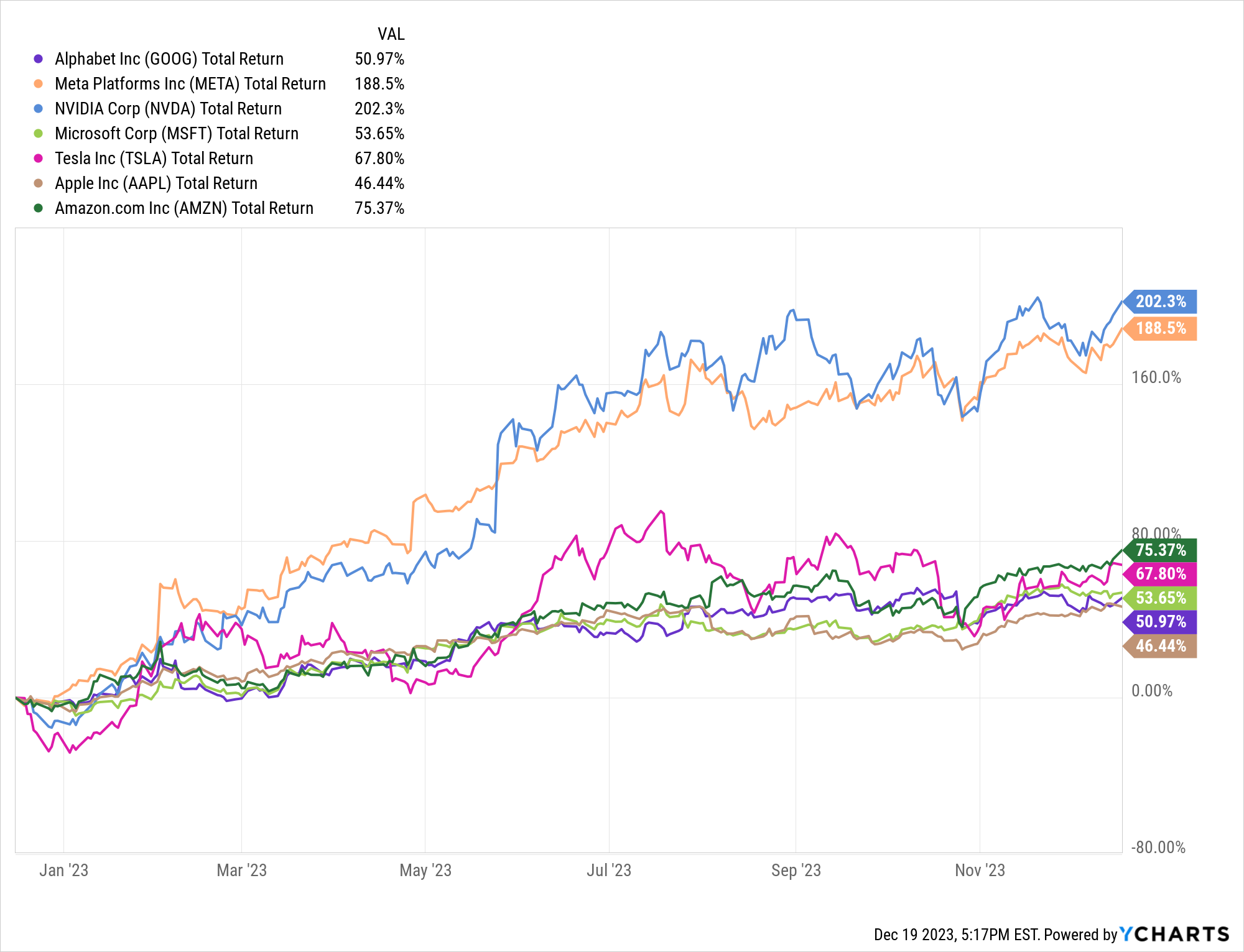

Tesla's stock price has experienced significant fluctuations following controversial political statements or actions by Elon Musk. These events create uncertainty and impact investor confidence, leading to stock market volatility and affecting Tesla's market capitalization. Keywords: Tesla stock, investor confidence, stock market volatility, market capitalization, share price, Musk controversies.

-

Fluctuating Stock Price: Analysis of Tesla's stock performance during Q1 reveals a correlation between negative news related to Musk's political activities and subsequent drops in share price. For example, [cite specific example of news event and stock reaction]. This volatility makes it difficult for investors to predict Tesla's future performance and creates a riskier investment environment.

-

Negative Media Coverage: Negative media coverage amplifies the impact of Musk's controversies. Articles highlighting the potential negative consequences of his political stances on Tesla’s operations contribute to a negative investor sentiment, thus discouraging investment and potentially triggering sell-offs. Increased media scrutiny directly impacts trading volume, reflecting the heightened uncertainty surrounding the company's future.

-

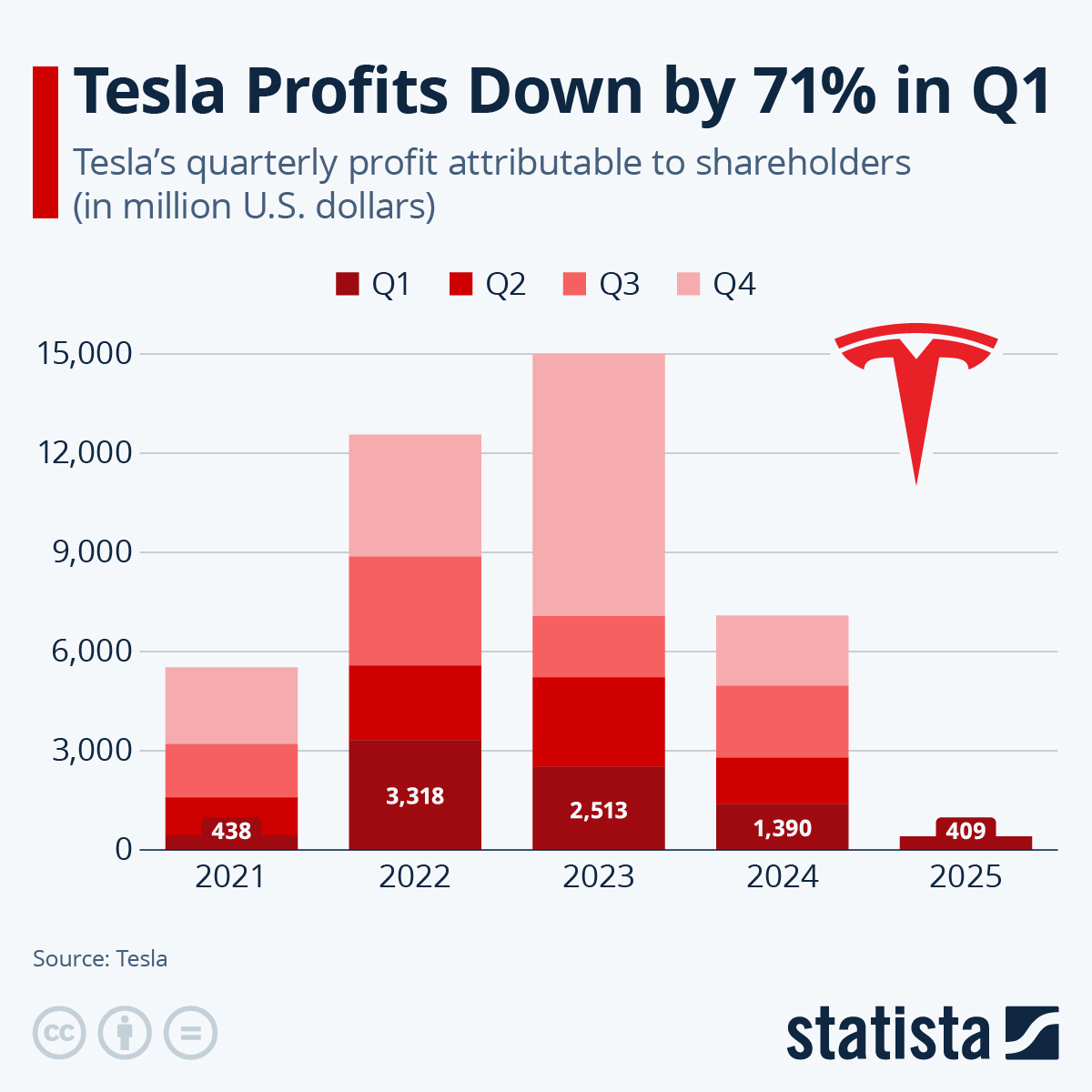

Q1 Performance Compared to Benchmarks: Comparing Tesla's Q1 2024 performance to previous quarters and industry benchmarks reveals underperformance relative to expectations. The decline can be partly attributed to the negative investor sentiment fueled by Musk’s political entanglements.

-

Potential Sell-offs: Concerns over Musk's political influence on Tesla’s operations and decision-making have likely triggered sell-offs by investors seeking to minimize risk. This outflow of investment further contributes to the volatility of Tesla's stock.

Impact on Brand Perception and Consumer Sentiment

Musk's political positions have the potential to alienate significant portions of the consumer market, posing a direct threat to Tesla's sales figures. Keywords: Brand image, consumer sentiment, brand reputation, public perception, Tesla brand, marketing challenges.

-

Alienating Consumer Segments: Musk's outspoken views on various political issues may alienate potential customers who disagree with his stances, leading to a decline in sales. This is particularly true in markets with strong social and political sensitivities.

-

Boycotts and Negative Social Media Campaigns: Several instances of consumer boycotts and negative social media campaigns targeting Tesla have emerged directly in response to Musk’s controversial political actions. This negative publicity directly impacts brand reputation and sales.

-

Marketing and PR Challenges: Tesla’s marketing and public relations strategies have struggled to effectively counter the negative impact of Musk’s political controversies during Q1. The company's attempts to separate Musk's personal brand from the Tesla brand have been largely unsuccessful.

-

Shifting Consumer Preferences: Negative publicity surrounding Musk’s actions may be driving some consumers to consider competing EV brands, further impacting Tesla’s market share and future sales.

Regulatory Scrutiny and Potential Legal Ramifications

Musk's political activities have increased the risk of regulatory scrutiny and potential legal ramifications for Tesla. Keywords: Regulatory scrutiny, legal ramifications, SEC investigations, government regulations, compliance risks, political pressure.

-

SEC Investigations and Lawsuits: Past SEC investigations and potential future lawsuits related to Musk's tweets and actions could result in significant financial penalties for Tesla. This uncertainty creates additional risk for investors.

-

Financial Implications of Penalties: Any fines or penalties levied against Tesla as a result of Musk’s actions would directly impact the company's financial performance, potentially leading to decreased profitability and reduced shareholder value.

-

Increased Regulatory Scrutiny: Tesla may face increased regulatory scrutiny due to its association with Musk’s politically controversial behavior, potentially leading to stricter compliance requirements and impacting the company's operational flexibility.

Diversion of Resources and Management Focus

Musk's extensive involvement in political matters may divert his attention and resources away from Tesla’s core business operations. Keywords: Resource allocation, management focus, operational efficiency, strategic priorities, business priorities, time management.

-

Distraction from Core Business: Musk's involvement in other ventures and political activities potentially detracts from his focus on Tesla's strategic priorities, potentially hindering decision-making and operational efficiency.

-

Impact on Strategic Decision-Making: A diluted focus from Musk could lead to suboptimal strategic decisions for Tesla, negatively affecting product development, market positioning, and overall growth.

-

Negative Effects on Innovation: A shift in management priorities toward non-core activities might reduce resources dedicated to Tesla’s research and development, potentially hindering innovation and competitiveness in the rapidly evolving EV market.

Conclusion

This article explored the potential links between Elon Musk’s political ties and Tesla’s Q1 2024 financial performance. We examined how decreased investor confidence, brand image challenges, regulatory risks, and potential management distractions may have negatively influenced the company’s results. Understanding the interplay between Musk's political activities and Tesla's financial health is crucial for investors and stakeholders alike. Stay informed on further developments regarding Musk's political ties and their potential impact on Tesla's future performance. Continue to monitor the evolving situation concerning Musk's political influence on Tesla's financial future.

Featured Posts

-

Liams Secrecy Steffys Rage A Bold And The Beautiful Recap April 9

Apr 24, 2025

Liams Secrecy Steffys Rage A Bold And The Beautiful Recap April 9

Apr 24, 2025 -

The Critical Role Of Middle Managers In Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Critical Role Of Middle Managers In Bridging The Gap Between Leadership And Employees

Apr 24, 2025 -

Teslas Q1 2024 Financial Performance Significant Net Income Decline

Apr 24, 2025

Teslas Q1 2024 Financial Performance Significant Net Income Decline

Apr 24, 2025 -

Zuckerberg And Trump A New Era For Tech And Politics

Apr 24, 2025

Zuckerberg And Trump A New Era For Tech And Politics

Apr 24, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

Apr 24, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

Apr 24, 2025

Latest Posts

-

Gods Mercy In 1889 A Diverse Religious Landscape And Divine Compassion

May 10, 2025

Gods Mercy In 1889 A Diverse Religious Landscape And Divine Compassion

May 10, 2025 -

Palantir Stock Prediction Identifying 2 Superior Investments In 3 Years

May 10, 2025

Palantir Stock Prediction Identifying 2 Superior Investments In 3 Years

May 10, 2025 -

3 Year Stock Prediction Two Potential Winners Over Palantir

May 10, 2025

3 Year Stock Prediction Two Potential Winners Over Palantir

May 10, 2025 -

Stock Market Prediction 2 Potential Winners Over Palantir 3 Year Outlook

May 10, 2025

Stock Market Prediction 2 Potential Winners Over Palantir 3 Year Outlook

May 10, 2025 -

Predicting Future Stock Performance Will These 2 Stocks Beat Palantir In 3 Years

May 10, 2025

Predicting Future Stock Performance Will These 2 Stocks Beat Palantir In 3 Years

May 10, 2025