Point72 Trader Exodus: The Closure Of Its Emerging Markets-Focused Pod

Table of Contents

The Closure of the Emerging Markets Pod: Reasons and Ramifications

Point72's decision to shutter its emerging markets trading pod was a shock to many. While the firm hasn't publicly detailed the specifics, several factors likely contributed to this drastic measure.

- Underperformance: The pod may have consistently underperformed relative to its benchmarks and internal targets, failing to meet Point72's stringent performance expectations. This underperformance could be attributed to various factors, including unforeseen geopolitical events or inaccurate market predictions.

- Strategic Shift: Point72 might be undergoing a strategic realignment of its investment portfolio, shifting focus away from emerging markets towards other asset classes deemed more promising in the current market climate. This reflects a common strategy among hedge funds to adapt to evolving market conditions.

- Adverse Market Conditions: Emerging markets are inherently volatile, susceptible to economic and political instability. A prolonged period of unfavorable market conditions could have made the pod's performance unsustainable. Factors like inflation, currency fluctuations, and geopolitical risks all play a significant role.

- Internal Restructuring: Point72, like many large financial institutions, periodically undertakes internal restructuring to optimize efficiency and resource allocation. The closure of the pod could be part of a broader internal restructuring aimed at streamlining operations and improving overall profitability.

The ramifications for Point72 are substantial. The short-term impact includes a loss of valuable expertise in emerging markets investment. Long-term, reputational damage could result from the perception that Point72 is less committed to this sector, potentially impacting its ability to attract top talent in the future. These events highlight the importance of effective Hedge Fund Restructuring and consistent Portfolio Performance for long-term success. The complexities of Emerging Markets Investment require robust strategies and adaptable Point72 Asset Management practices.

The Scale of the Trader Exodus: Who Left and Where Did They Go?

The closure of the emerging markets pod resulted in a significant Point72 Trader Exodus. While the exact number remains undisclosed, reports suggest a substantial number of traders, including senior portfolio managers and experienced quantitative analysts, have left the firm. Several high-profile individuals, if their departures are publicly known, should be mentioned here with appropriate context.

The departing traders are highly sought-after in the financial industry, possessing extensive expertise in emerging market trading and investment strategies. Their destinations are likely to include:

- Rival Hedge Funds: Many will likely find new roles at competing hedge funds eager to acquire their specialized knowledge and experience. This fuels intense Hedge Fund Talent Acquisition.

- Investment Banks: Investment banks often recruit experienced traders to bolster their trading desks and advise clients on emerging market investments. The demand for skilled Portfolio Managers and Quantitative Analysts remains high.

- Proprietary Trading Firms: Some traders may choose the entrepreneurial route, joining or founding proprietary trading firms to capitalize on their expertise.

This talent drain reflects the competitive landscape of Trader Recruitment within the hedge fund industry.

Impact on the Emerging Markets Investment Landscape

The Point72 Trader Exodus has notable implications for the broader emerging markets investment landscape. The departure of these experienced professionals represents a significant loss of both expertise and capital from this sector.

- Reduced Investment: Fewer experienced managers may lead to reduced investment in specific emerging markets, potentially hindering their economic growth.

- Shift in Investment Strategies: The overall investment strategies in emerging markets may shift as other firms adjust to the absence of these key players.

- Ripple Effects: The exodus could trigger a chain reaction, potentially influencing the strategies and hiring practices of other firms operating in emerging markets.

This situation underscores the interconnectedness of global financial markets and the importance of Emerging Market Investment Strategies for global economic stability. The intricacies of Global Macro Investing are heavily impacted by shifts in personnel and capital flow.

Lessons Learned and Future Implications for Point72

The Point72 Trader Exodus offers valuable lessons for the firm and the broader hedge fund industry. Point72 needs to carefully analyze the reasons behind the pod's closure and the subsequent exodus to prevent similar situations in the future. This includes:

- Refining Investment Strategies: A thorough review of their emerging markets investment strategy, risk assessment, and performance metrics is crucial.

- Improving Risk Management: Strengthening risk management procedures to better anticipate and mitigate potential losses is essential.

- Enhancing Talent Retention: Implementing robust talent retention policies, including competitive compensation and benefits, is necessary to attract and retain top-tier professionals.

This experience highlights the importance of proactive Risk Management and a well-defined Investment Strategy for sustainable success in Hedge Fund Management. Effective Talent Retention is crucial for maintaining a competitive edge. Further Hedge Fund Restructuring may be necessary to ensure future success.

Conclusion: Understanding the Point72 Trader Exodus and its Long-Term Effects

The Point72 Trader Exodus, triggered by the closure of its emerging markets trading pod, represents a significant event with far-reaching consequences. The reasons behind the closure are multifaceted, encompassing underperformance, strategic shifts, market conditions, and internal restructuring. The scale of the exodus highlights the high demand for experienced traders and the competitive landscape of the hedge fund industry. The impact extends beyond Point72, affecting the broader emerging markets investment landscape and potentially leading to shifts in investment strategies and capital allocation.

The Point72 Trader Exodus serves as a compelling case study in hedge fund dynamics and talent management, emphasizing the importance of proactive risk management, adaptive investment strategies, and robust talent retention policies. The long-term effects on Point72 and the emerging markets investment landscape remain to be seen.

To stay informed about further developments in the Point72 Trader Exodus story and the evolving landscape of emerging markets investment, subscribe to our newsletter [link to newsletter] or follow us on [link to social media]. Share your thoughts on the situation in the comments below!

Featured Posts

-

Spring Into Action Learn Lente And Embrace The Season

Apr 26, 2025

Spring Into Action Learn Lente And Embrace The Season

Apr 26, 2025 -

New Mission Impossible Dead Reckoning Part Two Trailer Key Moments

Apr 26, 2025

New Mission Impossible Dead Reckoning Part Two Trailer Key Moments

Apr 26, 2025 -

The Countrys Top Business Locations A Detailed Geographic Overview

Apr 26, 2025

The Countrys Top Business Locations A Detailed Geographic Overview

Apr 26, 2025 -

18 Projets De Bois Et De Bois D Uvre Canadiens Francais Honores Aux Prix D Excellence Cecobois 2025

Apr 26, 2025

18 Projets De Bois Et De Bois D Uvre Canadiens Francais Honores Aux Prix D Excellence Cecobois 2025

Apr 26, 2025 -

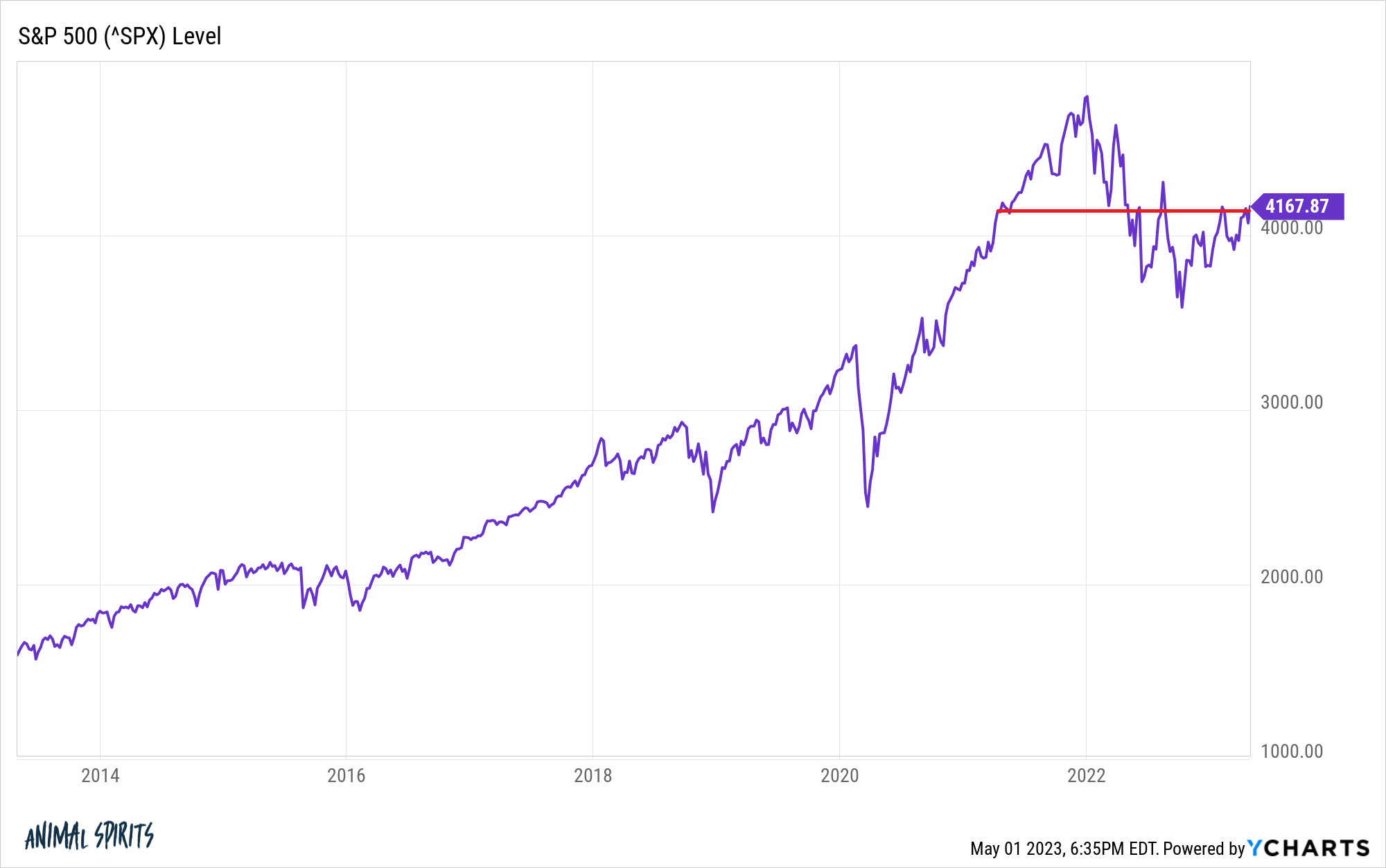

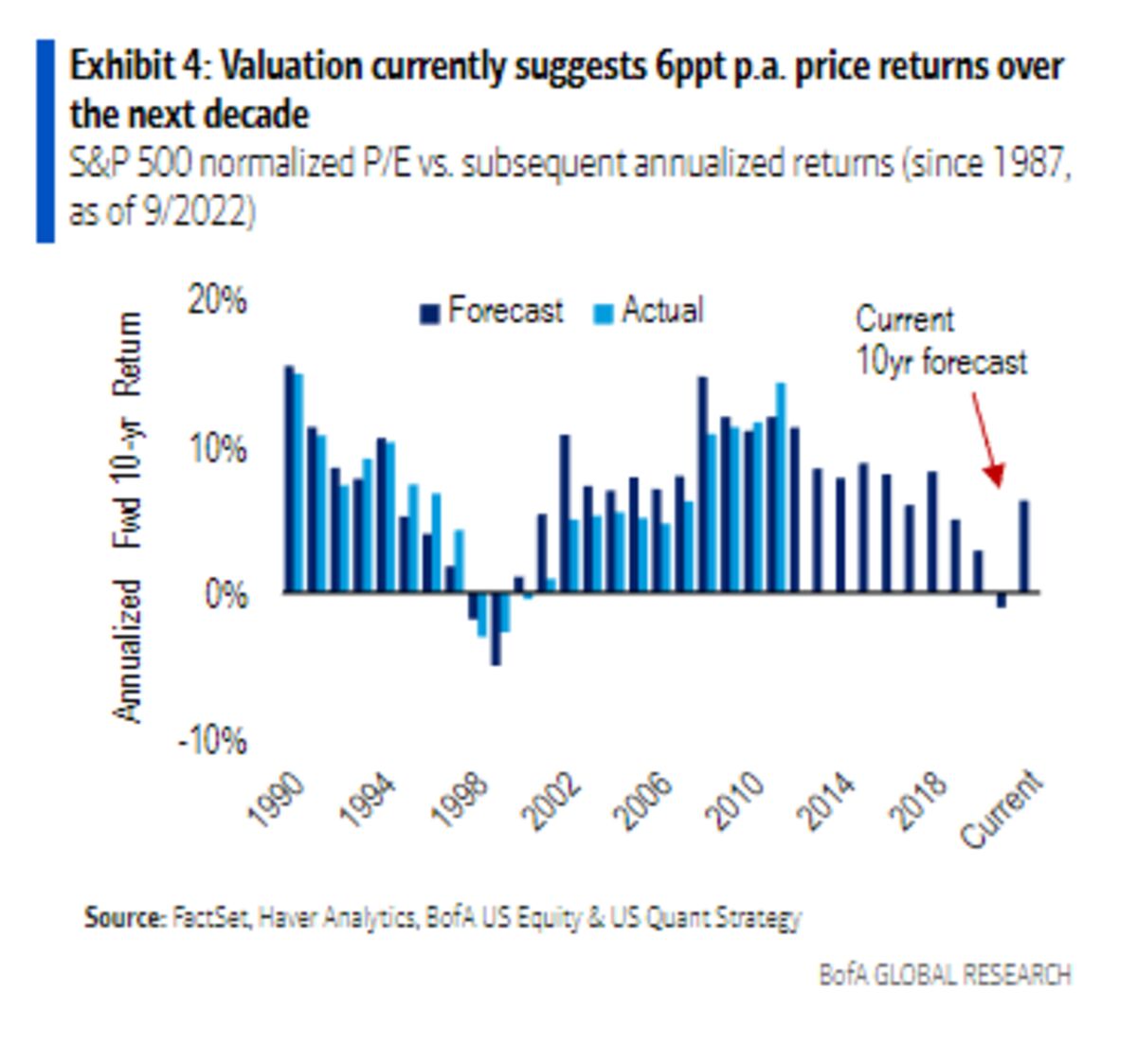

Stock Market Valuations Bof As Case For Continued Investment

Apr 26, 2025

Stock Market Valuations Bof As Case For Continued Investment

Apr 26, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025