Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Key Arguments for Moderate Valuations

BofA's recent reports offer a more nuanced view of current stock market valuations than the headline-grabbing volatility might suggest. Their analysis rests on three key pillars: a considered macroeconomic context, a detailed examination of Price-to-Earnings (P/E) ratios, and a forward-looking perspective on corporate earnings.

Considering the Macroeconomic Context

BofA's assessment acknowledges the impact of inflation and rising interest rates but tempers the immediate concerns. They don't ignore the challenges; instead, they incorporate them into their projections.

- BofA's forecast for inflation easing in [Let's assume] the next 12-18 months: This prediction suggests that inflationary pressures, a major driver of market uncertainty, may soon abate, potentially easing pressure on the Federal Reserve to continue aggressive interest rate hikes.

- Impact of interest rate increases on corporate borrowing costs: While higher interest rates increase borrowing costs for companies, BofA’s analysis likely accounts for this, assessing the capacity of healthy businesses to manage these increased expenses and the impact on future profit margins.

- BofA's assessment of the resilience of the US economy: The underlying strength of the US economy, despite challenges, plays a crucial role in BofA’s overall positive outlook. They likely factor in resilience factors like a robust labor market and continued consumer spending (though possibly moderating).

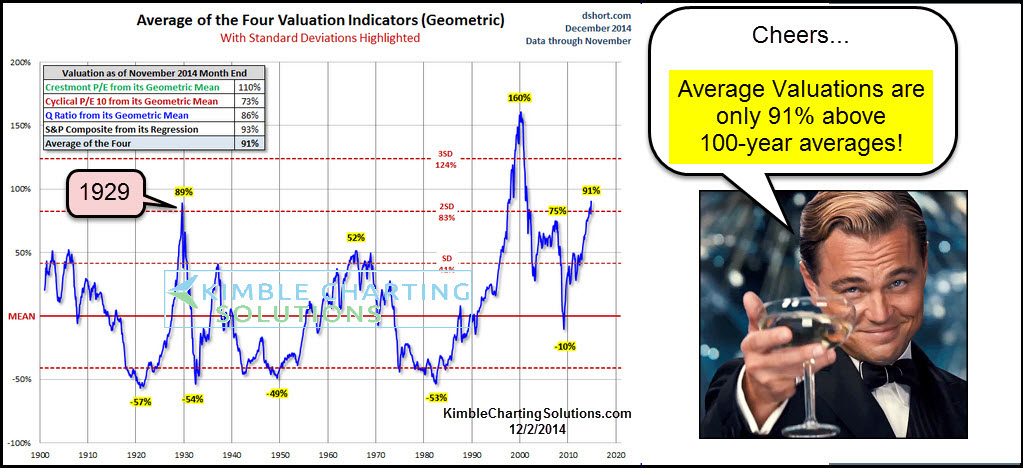

Analyzing Price-to-Earnings (P/E) Ratios

BofA’s analysis likely involves a careful examination of current P/E ratios relative to historical averages, adjusted for factors like earnings growth expectations.

- Comparison of current P/E ratios to historical data: By comparing current P/E ratios to long-term averages, BofA can determine whether current valuations are significantly above or below historical norms. This provides context and helps to determine whether the market is overvalued or undervalued.

- Mention specific sectors BofA highlights as potentially attractive: BofA's analysis may identify specific sectors showing relative undervaluation, offering potential investment opportunities. These could be sectors less sensitive to interest rate hikes or those poised for future growth.

- Explanation of how BofA adjusts for earnings growth expectations: Simply looking at the P/E ratio is insufficient. BofA likely adjusts for projected future earnings growth. A higher expected earnings growth can justify a higher P/E ratio.

The Role of Corporate Earnings

BofA’s valuation assessment isn’t solely based on current market prices. It deeply considers future corporate earnings growth.

- BofA’s forecast for earnings growth across different sectors: This forecast likely provides sector-specific insights, helping investors identify potentially outperforming sectors.

- Factors driving BofA's earnings projections (e.g., consumer spending, technological advancements): BofA likely considers various factors influencing future corporate earnings, including macroeconomic trends, technological innovations, and industry-specific dynamics.

- Potential risks to BofA's earnings forecast: Transparency about potential risks to their earnings projections, such as unexpected economic downturns or geopolitical events, strengthens the credibility of their analysis.

Implications for Investors

BofA's analysis provides a valuable framework for investors to make informed decisions, but it's not a crystal ball.

Strategies Based on BofA's Analysis

Investors can use BofA’s findings to refine their investment strategies.

- Recommendation for investors with a long-term investment horizon: BofA's relatively positive outlook might encourage long-term investors to maintain their position, perhaps selectively adding to positions in undervalued sectors.

- Suggestions for diversification strategies: Diversification remains crucial. BofA's analysis can help investors optimize their portfolio allocation across different sectors and asset classes based on their risk tolerance.

- Advice on sector-specific investments based on BofA's assessment: Investors can use BofA's sector-specific insights to identify potential investment opportunities in undervalued or high-growth sectors.

Managing Risk in a Volatile Market

Even with a positive outlook, market volatility persists. Risk management is paramount.

- Importance of diversification to mitigate risk: Diversification across various asset classes and sectors remains a cornerstone of effective risk management.

- Strategies for managing portfolio risk during periods of uncertainty: Investors may consider strategies like dollar-cost averaging or adjusting their asset allocation to reduce portfolio volatility.

- The role of asset allocation in managing risk: Careful asset allocation, aligning investments with individual risk tolerance and time horizon, is crucial for navigating market fluctuations.

Conclusion

Bank of America's analysis offers a tempered but reassuring perspective on current stock market valuations. While acknowledging ongoing market volatility driven by inflation and interest rates, their assessment suggests that current prices aren't excessively inflated, offering potential opportunities for informed investors. By considering BofA's insights on macroeconomic factors, P/E ratios, and corporate earnings, and by implementing sound risk management strategies, investors can navigate the market more effectively. Don't hesitate to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions based on stock market valuations. Remember, understanding stock market valuations is crucial for long-term investment success.

Featured Posts

-

Red Sox Vs Blue Jays Lineups Walker Buehler Starts Outfielder Returns

Apr 28, 2025

Red Sox Vs Blue Jays Lineups Walker Buehler Starts Outfielder Returns

Apr 28, 2025 -

Where To Invest Mapping The Countrys Top Business Hot Spots

Apr 28, 2025

Where To Invest Mapping The Countrys Top Business Hot Spots

Apr 28, 2025 -

Red Sox Blue Jays Game Lineups Buehlers Start And Outfielders Return

Apr 28, 2025

Red Sox Blue Jays Game Lineups Buehlers Start And Outfielders Return

Apr 28, 2025 -

Times Trump Interview 9 Key Takeaways On Annexing Canada Xis Calls And Third Term Loopholes

Apr 28, 2025

Times Trump Interview 9 Key Takeaways On Annexing Canada Xis Calls And Third Term Loopholes

Apr 28, 2025 -

Auto Industry Pushback Against Electric Vehicle Regulations Grows

Apr 28, 2025

Auto Industry Pushback Against Electric Vehicle Regulations Grows

Apr 28, 2025

Latest Posts

-

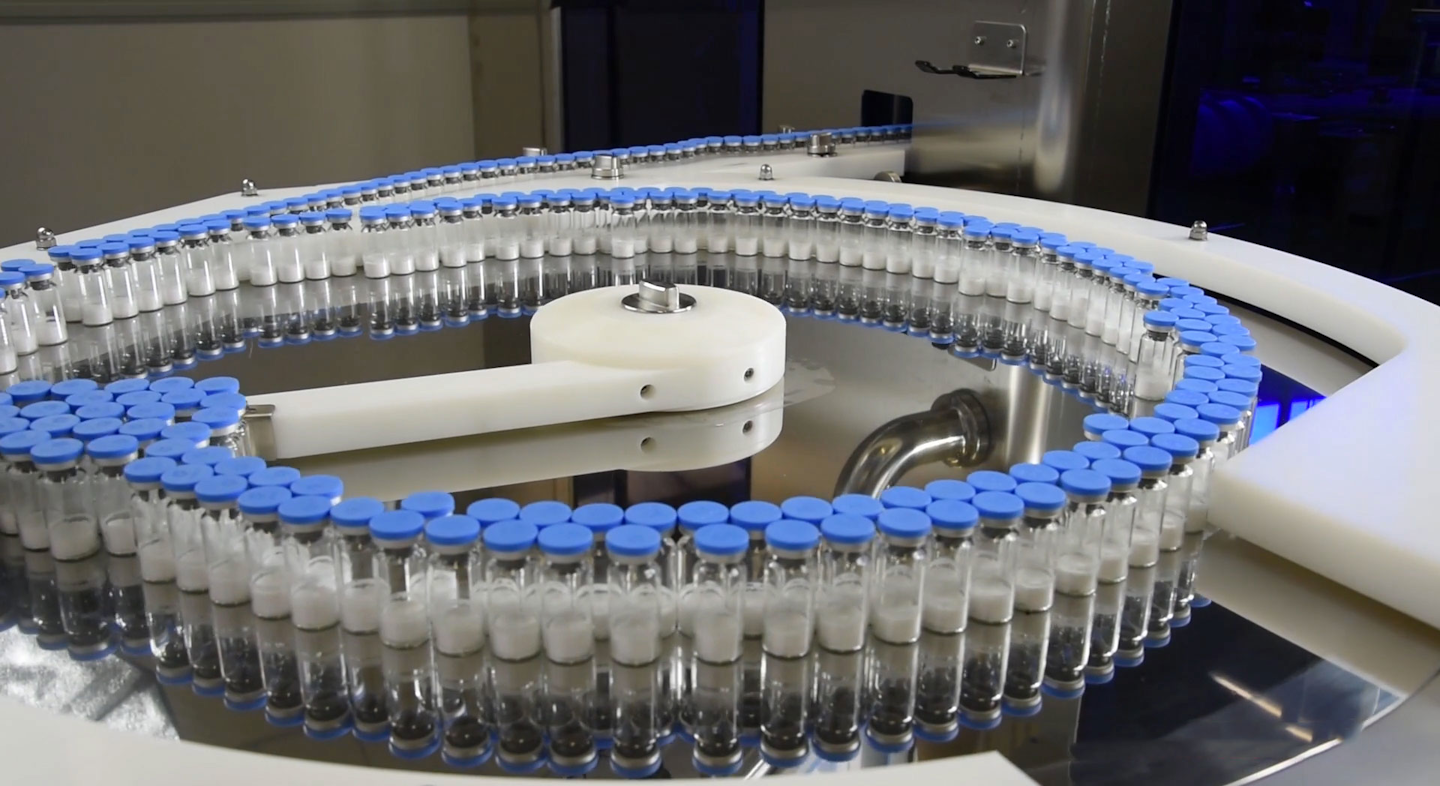

Strategies For Reliable Automated Visual Inspection Of Lyophilized Vials

May 12, 2025

Strategies For Reliable Automated Visual Inspection Of Lyophilized Vials

May 12, 2025 -

Enhanced Automated Visual Inspection Systems For Lyophilized Vials

May 12, 2025

Enhanced Automated Visual Inspection Systems For Lyophilized Vials

May 12, 2025 -

The Future Of Automated Visual Inspection For Lyophilized Vials Addressing Current Limitations

May 12, 2025

The Future Of Automated Visual Inspection For Lyophilized Vials Addressing Current Limitations

May 12, 2025 -

Efficient Automated Visual Inspection Of Lyophilized Vials Addressing Key Challenges

May 12, 2025

Efficient Automated Visual Inspection Of Lyophilized Vials Addressing Key Challenges

May 12, 2025 -

Challenges And Advancements In Automated Visual Inspection Of Lyophilized Drug Products

May 12, 2025

Challenges And Advancements In Automated Visual Inspection Of Lyophilized Drug Products

May 12, 2025