The Dependence: European Shipyards And The Viability Of Russia's Arctic Gas Trade

Table of Contents

H2: The Crucial Role of Ice-Class Vessels in Arctic Gas Extraction

The Arctic presents unique challenges for shipping. Extreme weather conditions, including unpredictable ice formations, make navigation incredibly difficult and dangerous. Traditional vessels are simply not equipped to handle these conditions. The successful extraction and transportation of Arctic gas, particularly liquefied natural gas (LNG), relies heavily on specialized ice-class vessels. These vessels are designed and built to withstand the immense pressure of thick ice and navigate through challenging Arctic waters.

- Extreme weather conditions and sea ice necessitate robust vessel design: Ice-class vessels require reinforced hulls, powerful engines, and advanced maneuvering systems to navigate through ice floes and withstand the crushing forces of ice.

- Specialized propulsion systems and hull designs are crucial for navigation: Unique hull designs, such as icebreaking bows and strengthened structures, are essential for breaking through ice and maintaining stability in treacherous conditions. Propulsion systems must be capable of generating substantial power for icebreaking and maintaining speed in challenging environments.

- Longer transit times and higher operational costs compared to traditional shipping routes: Arctic shipping routes are significantly longer and more challenging than traditional routes, leading to increased transit times and higher fuel consumption, impacting overall operational costs.

- Demand for larger, more efficient icebreakers and LNG carriers: As Arctic gas extraction expands, the demand for larger and more efficient icebreakers and LNG carriers capable of transporting substantial volumes of LNG will continue to grow.

H2: European Shipyards: The Dominant Players in Ice-Class Vessel Construction

European shipyards possess unparalleled expertise and technological capabilities in building ice-class vessels. Decades of experience operating in harsh northern climates and a strong research and development focus have given them a significant competitive advantage. Several key players dominate the market:

- Finland (e.g., Aker Arctic Technology, Meyer Turku): Finnish shipyards, particularly Aker Arctic Technology, are renowned for their expertise in icebreaker design and construction, having delivered numerous icebreakers for both commercial and governmental clients. Meyer Turku also contributes significantly to the construction of ice-capable LNG carriers.

- Norway (e.g., Vard Group): Norway's Vard Group has considerable experience in building specialized offshore vessels, including those capable of operating in Arctic conditions, contributing to the support infrastructure for Arctic gas extraction.

- Germany (e.g., various shipyards with experience in building specialized vessels): Several German shipyards contribute to the technological advancements in LNG carrier design and construction, incorporating innovative technologies to improve efficiency and reduce environmental impact.

- Technological advantages and experience in Arctic conditions: These shipyards possess a deep understanding of the unique challenges posed by Arctic environments, leading to superior vessel designs that optimize performance and safety in these demanding conditions.

H2: Geopolitical Implications and Sanctions: A Threat to the Partnership

The collaboration between European shipyards and Russia is significantly impacted by geopolitical tensions and Western sanctions. These sanctions create obstacles to the smooth flow of shipbuilding activities.

- Sanctions limiting technology transfer and access to crucial components: Sanctions restrict the transfer of advanced technologies and crucial components needed for the construction of advanced ice-class vessels, potentially delaying or hindering project timelines.

- Impact on financing and insurance for Arctic projects: Sanctions can affect the financing and insurance of Arctic gas projects, making it more difficult to secure the necessary funding for new vessel construction.

- Potential for alternative shipbuilding partnerships for Russia (e.g., China, South Korea): Faced with limitations imposed by sanctions, Russia is exploring alternative partnerships with countries like China and South Korea. However, these alternatives may lack the same level of experience and technological expertise in ice-class vessel construction as European shipyards.

- Increased uncertainty and risk for European shipyards involved in Russian projects: The geopolitical climate introduces significant uncertainty and risk for European shipyards involved in Russian Arctic projects, potentially impacting their investment decisions and long-term strategies.

H3: The Search for Alternatives: Russia's Shipbuilding Capacity

Russia is striving to develop its own shipbuilding capacity to reduce reliance on European yards. However, this path faces substantial hurdles.

- Assessment of current Russian shipbuilding capacity for ice-class vessels: While Russia has some shipbuilding capabilities, the capacity to build advanced ice-class vessels, particularly large LNG carriers, remains limited compared to European standards.

- Technological gaps and challenges in achieving self-sufficiency: Closing the technological gap with European shipyards requires significant investment in research, development, and technology transfer.

- The time and investment required to develop a fully independent shipbuilding industry: Developing a fully independent shipbuilding industry for ice-class vessels is a long-term undertaking requiring substantial investment and time.

- Potential impact on the timeline and costs of Arctic gas projects: The limitations in Russian shipbuilding capacity can significantly impact the timelines and costs of Arctic gas projects, potentially delaying their development and increasing their overall expenses.

H2: The Future of Arctic Gas Trade: A Dependent Ecosystem?

The long-term viability of Russia's Arctic gas ambitions is closely tied to its relationship with European shipyards. The dependence creates a vulnerable ecosystem.

- The potential for escalating tensions to disrupt the supply chain: Future geopolitical events could further disrupt the already strained supply chain, impacting Russia's ability to access the specialized vessels needed for Arctic gas extraction.

- Long-term strategies for Russia to mitigate its dependence: Russia needs to implement robust long-term strategies to reduce its dependence on European shipyards, including significant investment in its domestic shipbuilding industry and technology transfer partnerships.

- The role of international cooperation and regulation in Arctic shipping: International cooperation and the establishment of clear regulations for Arctic shipping are crucial to ensure the safety and efficiency of operations in this challenging environment.

- The future of Arctic energy and its reliance on international collaboration: The future of Arctic energy will likely depend on increased international collaboration and a commitment to sustainable and responsible development practices.

3. Conclusion:

The viability of Russia's ambitious Arctic gas trade is inextricably linked to its dependence on European shipyards for the specialized ice-class vessels crucial for Arctic operations. Geopolitical factors and sanctions significantly impact this relationship, creating uncertainty and potential bottlenecks. While Russia seeks to enhance its domestic shipbuilding capabilities, overcoming technological hurdles and achieving self-sufficiency will require substantial investment and time. Understanding this intricate dependence is crucial for forecasting the future of Arctic energy and the geopolitical landscape of the region. To stay informed about the future of this vital energy sector, continue researching the intricate relationship between European shipyards and the viability of Russia's Arctic gas trade. Further research on the impact of sanctions on Arctic shipping and alternative shipbuilding partnerships for Russia is strongly encouraged.

Featured Posts

-

Price Gouging Allegations Against La Landlords Surface After Recent Fires

Apr 26, 2025

Price Gouging Allegations Against La Landlords Surface After Recent Fires

Apr 26, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 26, 2025

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

Apr 26, 2025 -

Nepo Babies And The Oscars A Discussion On Merit And Inherited Privilege

Apr 26, 2025

Nepo Babies And The Oscars A Discussion On Merit And Inherited Privilege

Apr 26, 2025 -

Benson Boone Clarifies Harry Styles Influence Allegations

Apr 26, 2025

Benson Boone Clarifies Harry Styles Influence Allegations

Apr 26, 2025 -

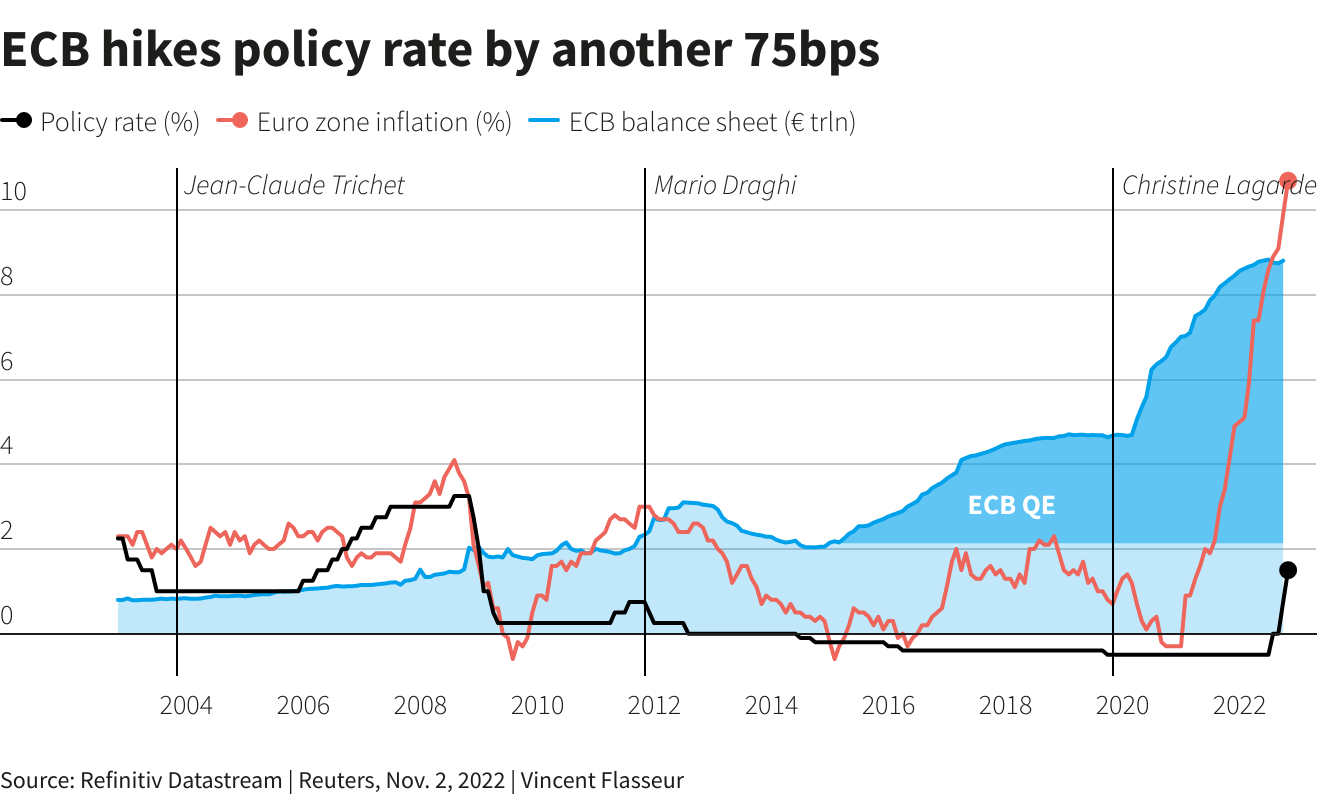

Impact Of Trump Tariffs On Inflation Ecbs Holzmanns View

Apr 26, 2025

Impact Of Trump Tariffs On Inflation Ecbs Holzmanns View

Apr 26, 2025

Latest Posts

-

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 10, 2025

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 10, 2025 -

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Many Billions Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025

2025 Hurun Report Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025 -

Hurun Global Rich List 2025 Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025

Hurun Global Rich List 2025 Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025 -

Fluctuations In Elon Musks Net Worth A Us Economic Perspective

May 10, 2025

Fluctuations In Elon Musks Net Worth A Us Economic Perspective

May 10, 2025