$3 Billion Crypto SPAC: Cantor, Tether, And SoftBank Explore Merger

Table of Contents

The Players Involved: A Deep Dive into Cantor, Tether, and SoftBank

This mega-merger hinges on the collaboration of three powerful entities, each bringing unique strengths and challenges to the table.

Cantor Fitzgerald: A Legacy Firm Entering the Crypto Space

Cantor Fitzgerald, a renowned financial services firm with a long history in trading and brokerage, is increasingly expanding its presence in fintech. Their experience in navigating complex financial transactions and regulatory landscapes makes them a significant player in this crypto SPAC. While not heavily involved in crypto previously, their foray into this space signals a major shift in institutional interest.

- Key Strengths: Deep financial expertise, established network, strong regulatory understanding.

- Potential Risks: Navigating the volatile crypto market, adapting to the fast-paced nature of blockchain technology.

- Strategic Objectives: Diversification into high-growth sectors, gaining a foothold in the burgeoning crypto market.

Tether: The Stablecoin Giant's Strategic Move

Tether, the leading stablecoin issuer, plays a crucial role in the cryptocurrency ecosystem. Its market capitalization significantly influences the overall crypto market. A SPAC merger could offer Tether enhanced legitimacy, boosting investor confidence and facilitating market expansion.

- Tether’s Market Share: Dominates the stablecoin market, impacting liquidity and trading volume.

- Regulatory Challenges: Faces ongoing scrutiny regarding its reserves and transparency.

- Financial Stability: Maintaining the 1:1 peg with the US dollar is paramount to its success.

SoftBank: The Tech Giant's Crypto Gamble

SoftBank, a multinational conglomerate with a history of significant investments in technology companies, is known for its bold, high-risk, high-reward investment strategy. Their potential involvement in this crypto SPAC signifies growing institutional acceptance of cryptocurrencies.

- SoftBank’s Investment Strategy: Focus on disruptive technologies and high-growth potential.

- Risk Appetite: Willingness to invest heavily in ventures with significant potential returns.

- Potential Return on Investment: The vast market potential of the cryptocurrency sector drives this investment interest.

The Potential Implications of the $3 Billion Crypto SPAC Merger

This proposed merger carries immense implications for the cryptocurrency market and the broader financial landscape.

Market Impact and Future of Crypto Investment

A successful merger could significantly impact the overall cryptocurrency market capitalization, potentially attracting increased institutional investment. This influx of capital could lead to greater price stability and potentially drive up the price of Tether and other cryptocurrencies.

- Potential Market Volatility: The merger itself could trigger short-term price fluctuations.

- Increased Investor Confidence: A successful union could attract more traditional investors.

- Regulatory Scrutiny: Increased attention from regulatory bodies is inevitable.

Regulatory Scrutiny and Legal Considerations

Navigating the regulatory landscape is crucial. Crypto mergers and acquisitions are subject to various regulations, potentially creating significant legal hurdles. Compliance with SEC regulations and other relevant laws will be paramount to the merger's success.

- SEC Regulations: Compliance with securities laws is essential.

- Compliance Requirements: Meeting rigorous KYC/AML standards is critical.

- Potential Legal Risks: The complexities of international regulations and jurisdictional differences pose challenges.

Alternative Scenarios and Potential Outcomes

While a successful merger is the primary scenario, several alternative outcomes are possible.

- Successful Merger: Leads to increased market capitalization, greater investor confidence, and more institutional participation.

- Failed Merger: Could result in negative market sentiment and impact the valuations of the involved companies.

- Regulatory Intervention: Regulatory hurdles could delay or prevent the merger.

- Alternative Investment Strategies: The involved parties might pursue alternative investment avenues if the merger fails.

Conclusion: The Future of $3 Billion Crypto SPACs

The potential $3 billion crypto SPAC merger involving Cantor Fitzgerald, Tether, and SoftBank represents a pivotal moment for the cryptocurrency market. Its success hinges on navigating regulatory challenges and achieving a balance between innovation and compliance. The implications for crypto investment, market capitalization, and regulatory scrutiny are profound. The outcome will be closely watched and will undoubtedly influence the future trajectory of crypto SPACs and the broader cryptocurrency landscape. Stay tuned for more analysis on this groundbreaking $3 billion crypto SPAC and other future developments in the cryptocurrency and SPAC markets. Stay informed about this developing story and continue following for updates on this significant $3 billion crypto SPAC merger.

Featured Posts

-

Israeli Beachs Shark Infestation Leads To Tragedy Swimmer Vanishes Body Discovered

Apr 24, 2025

Israeli Beachs Shark Infestation Leads To Tragedy Swimmer Vanishes Body Discovered

Apr 24, 2025 -

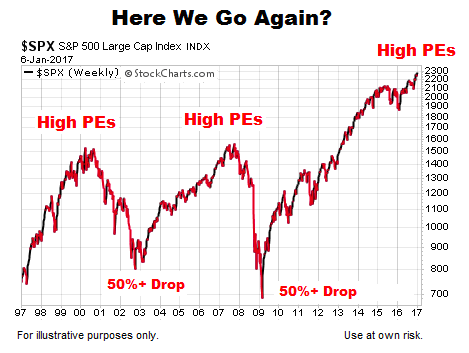

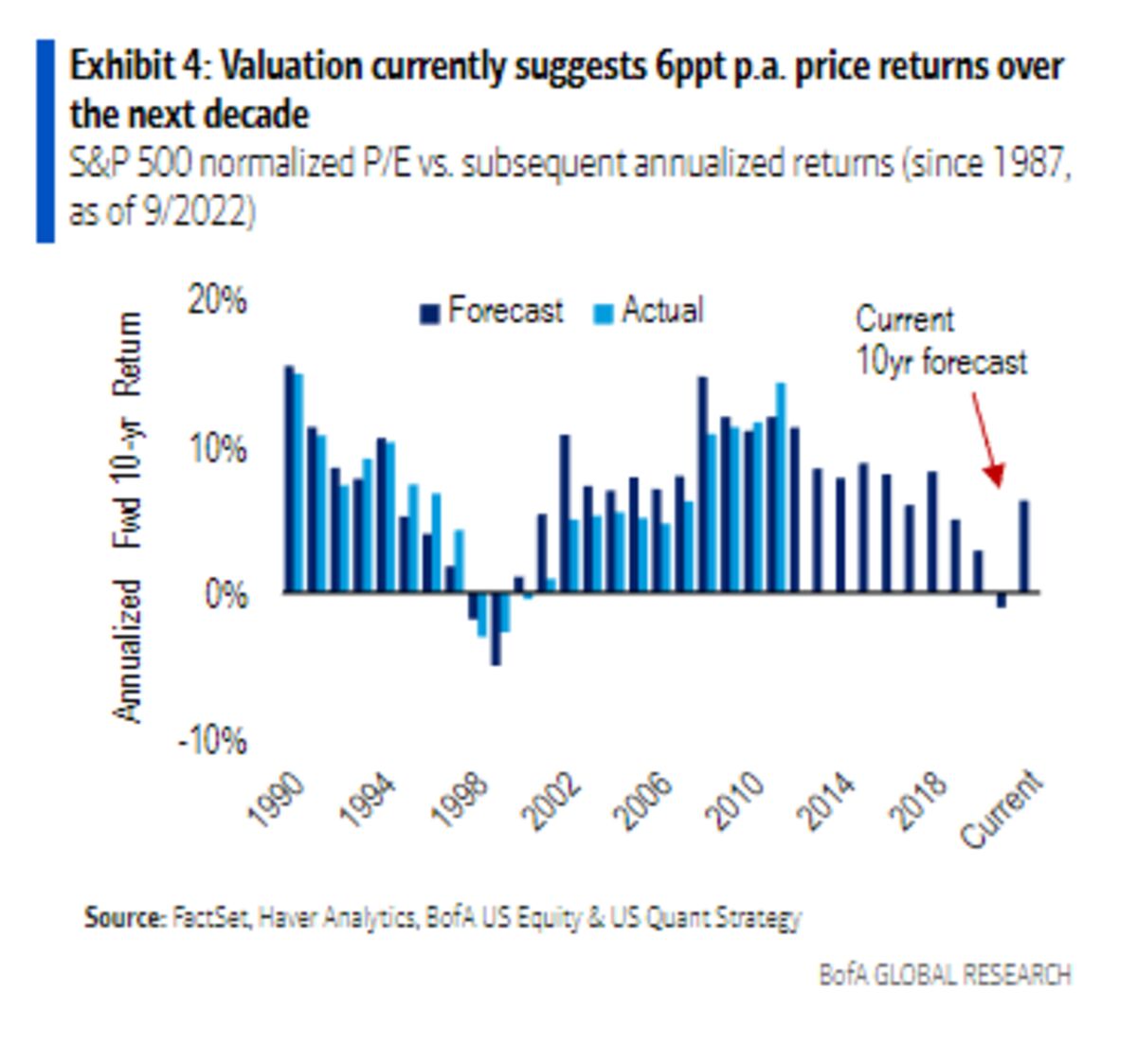

Why High Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

Apr 24, 2025

Why High Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

Apr 24, 2025 -

Chinese Buyout Firm To Sell Utac Chip Tester Industry Speculation Mounts

Apr 24, 2025

Chinese Buyout Firm To Sell Utac Chip Tester Industry Speculation Mounts

Apr 24, 2025 -

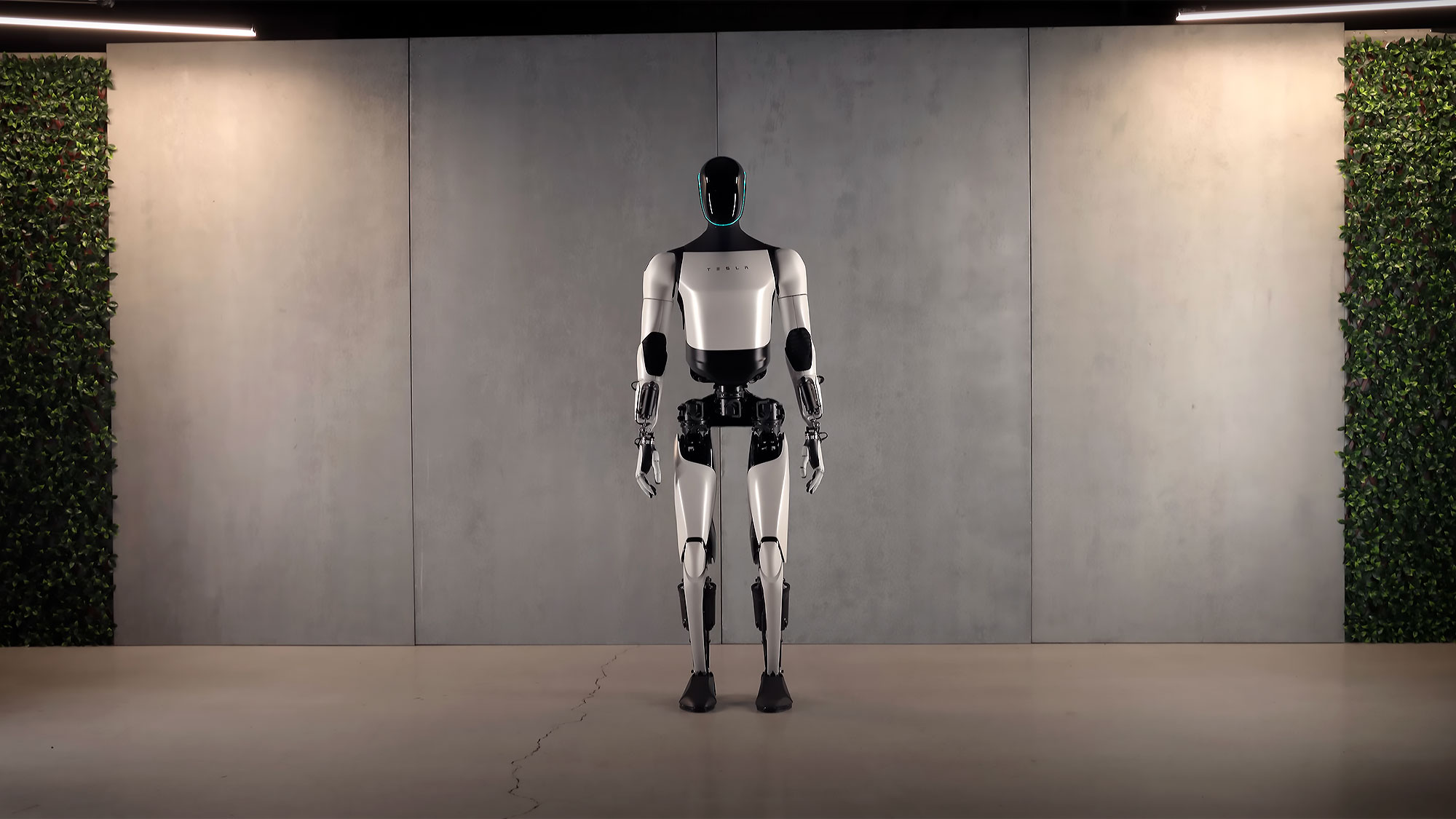

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Latest Posts

-

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025

Regulatory Changes Sought By Indian Insurers For Bond Forwards

May 10, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Answer

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Regulations

May 10, 2025 -

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025

Call For Regulatory Reform Indian Insurers And Bond Forwards

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025