Investing In The Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Analysis

Table of Contents

Decoding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

What is NAV and why is it important for ETF investors?

Net Asset Value (NAV) represents the underlying value of an ETF's assets per share. Simply put, it's the total value of all the assets the ETF holds, minus any liabilities, divided by the number of outstanding shares. Understanding NAV is vital because it reflects the true value of your investment, independent of market fluctuations. The market price of an ETF can deviate from its NAV, especially in actively traded ETFs. However, for a passively managed ETF tracking an index like the Amundi Dow Jones Industrial Average UCITS ETF (Dist), the market price should generally closely track the NAV. Analyzing the NAV allows you to:

- Assess the intrinsic value: Compare the NAV to the market price to identify potential buying or selling opportunities.

- Track performance: Monitor changes in NAV over time to gauge the ETF's performance.

- Make informed decisions: Use NAV data to support your investment strategy and timing.

Factors influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Dist). These include:

- Performance of the Dow Jones Industrial Average: As the ETF tracks the Dow Jones Industrial Average, its NAV directly reflects the performance of this index. Positive movements in the index generally lead to increased NAV, and vice versa.

- Currency fluctuations: If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate fluctuations can impact the NAV.

- Dividend distributions: When the underlying companies in the Dow Jones Industrial Average pay dividends, the ETF receives these dividends, which are then usually distributed to investors. This distribution will temporarily lower the NAV.

- Management fees: The ETF's management fees are deducted from the assets, thus slightly impacting the NAV over time.

Analyzing Historical NAV Data for the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Accessing historical NAV data

Reliable sources for obtaining historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) include:

- The Amundi website: The asset manager typically provides detailed information on their ETFs, including historical NAV data.

- Financial data providers: Reputable financial data providers like Bloomberg, Refinitiv, or Yahoo Finance often have comprehensive ETF data, including historical NAV.

Interpreting NAV charts and graphs requires understanding basic charting techniques. Look for trends, volatility, and significant price movements.

Identifying trends and patterns in historical NAV data

Analyzing historical NAV data can reveal valuable insights. Techniques like:

- Moving averages: Calculate moving averages (e.g., 50-day, 200-day) to smooth out short-term fluctuations and identify long-term trends.

- Trend lines: Draw trend lines to visualize the overall direction of the NAV.

can help identify potential investment opportunities. For example, a consistent upward trend might suggest a strong performing ETF.

Comparing NAV performance to benchmark indices

Compare the ETF's NAV performance to its benchmark, the Dow Jones Industrial Average. This relative performance analysis helps evaluate the ETF's effectiveness in tracking the index. A close correlation indicates the ETF is effectively mirroring the index's performance.

Using NAV Analysis to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Determining a suitable entry and exit strategy based on NAV

While not solely reliant on NAV, a basic strategy could involve buying when the NAV is relatively low and selling when it's relatively high, compared to recent historical data or the market price. However, always remember to consider:

- Market conditions: Broader market trends can significantly impact the NAV.

- Personal risk tolerance: Your investment strategy should align with your comfort level regarding risk.

Assessing the risk associated with investing in the ETF based on NAV analysis

NAV fluctuations reveal potential risks and rewards. High volatility in NAV indicates higher risk, while a stable NAV suggests lower risk. Diversification across different asset classes is crucial to mitigate risk.

Long-term vs. short-term investment strategies using NAV analysis

Long-term investors might focus on consistent, long-term NAV growth, while short-term investors might capitalize on short-term NAV fluctuations. Both strategies can utilize NAV analysis, but their application differs significantly based on the investment horizon.

Conclusion: Making the Most of Your Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV Analysis

Understanding Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV analysis is essential for successful ETF investing. By analyzing historical NAV data, identifying trends, and comparing performance to the benchmark index, you can make more informed decisions about when to buy, sell, and hold this ETF. Remember that NAV is just one factor to consider alongside broader market trends and your individual risk tolerance. Start your Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV analysis today! Learn more about effective Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV analysis strategies and maximize your investment potential.

Featured Posts

-

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025 -

Kering Sales Figures And Demnas Gucci Designs A September Update

May 24, 2025

Kering Sales Figures And Demnas Gucci Designs A September Update

May 24, 2025 -

Czy Porsche Cayenne Gts Coupe Spelnia Oczekiwania Szczegolowa Recenzja

May 24, 2025

Czy Porsche Cayenne Gts Coupe Spelnia Oczekiwania Szczegolowa Recenzja

May 24, 2025 -

The Proposed M62 Relief Road Through Bury An Examination Of The Uncompleted Project

May 24, 2025

The Proposed M62 Relief Road Through Bury An Examination Of The Uncompleted Project

May 24, 2025 -

Mathieu Avanzi Depasser Les Cliches Le Francais Aujourd Hui

May 24, 2025

Mathieu Avanzi Depasser Les Cliches Le Francais Aujourd Hui

May 24, 2025

Latest Posts

-

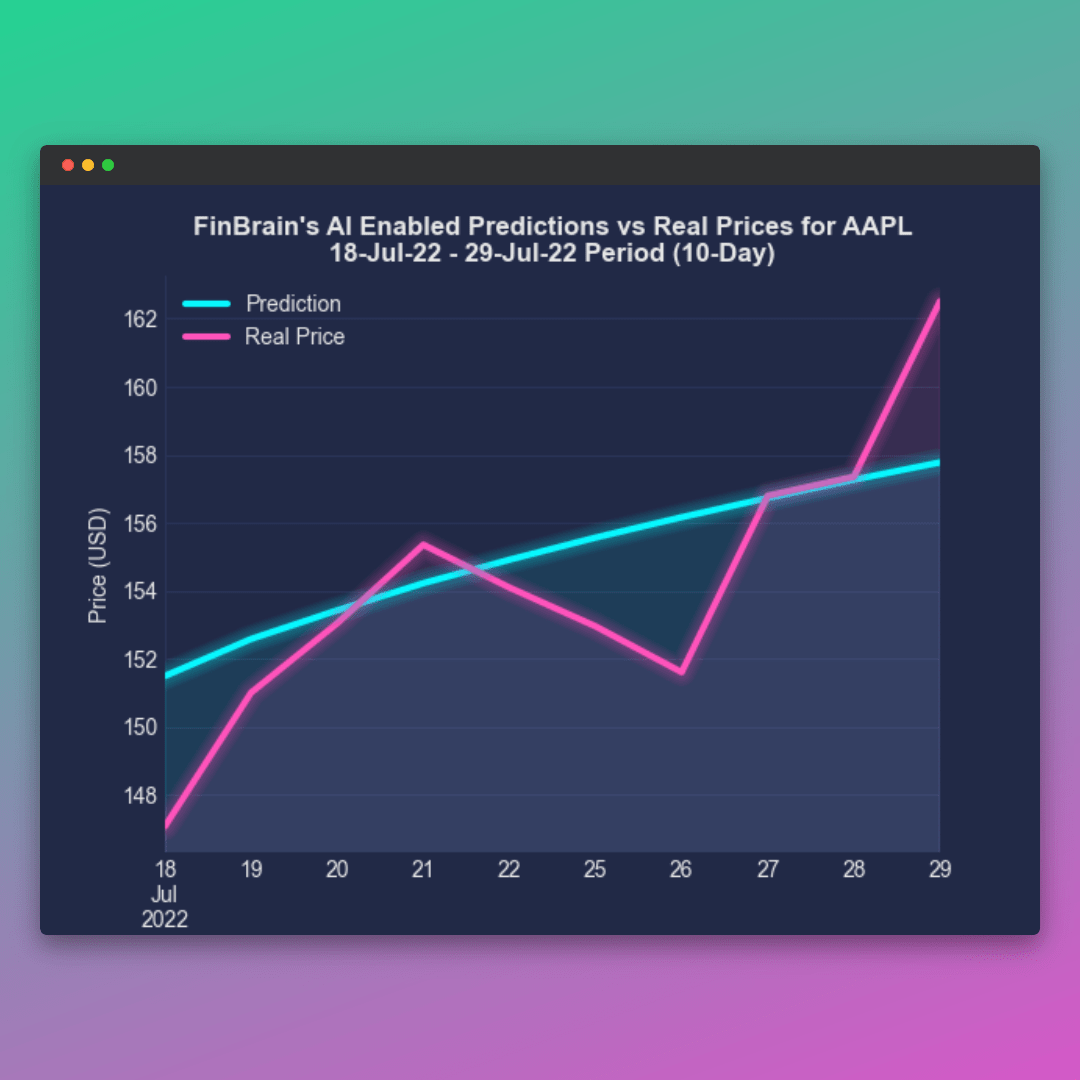

Aapl Stock Analysis Of Future Price Levels And Support Resistance

May 24, 2025

Aapl Stock Analysis Of Future Price Levels And Support Resistance

May 24, 2025 -

Apple Stock Aapl Key Price Levels To Watch In 2024

May 24, 2025

Apple Stock Aapl Key Price Levels To Watch In 2024

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Return To Collaboration Bangladeshs Renewed Focus On The European Market

May 24, 2025

Return To Collaboration Bangladeshs Renewed Focus On The European Market

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025